British ELT stable in 2018 but performance is uneven across private and public centres

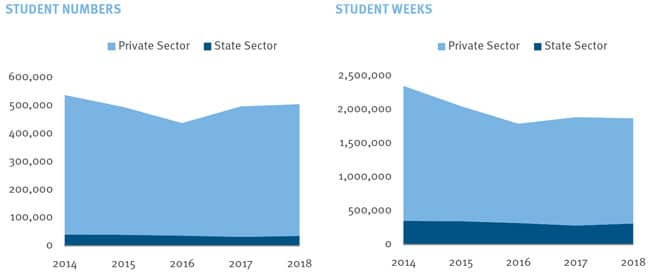

After rebounding strongly in 2017 after three years of decline, the UK’s English Language Teaching (ELT) sector held onto – but did not further increase – its gains with a relatively stable performance overall in 2018. Student numbers were up by nearly 2% overall and student weeks decreased by 1%, according to new data from English UK, which represents 360 private and 59 state (i.e., public university and college) language centres. Some lack of growth in the sector can be explained by membership in English UK declining by 15 centres in 2018.

There were mixed results across the member base, however, with student weeks falling 3% among private sector providers but increasing by 11% among college and university members. Even among state centres, there were varying levels of performance: 60% recorded increases in student weeks while the rest reported declines.

As for student numbers, centres in colleges and universities increased their enrolments by 10.5% while private centres increased by 1%.

Student weeks singled out

The UK is not alone in terms of challenges maintaining student weeks in recent years. Malta’s student weeks fell by 12% in 2018, and in the US weeks fell by 20% in 2017. By contrast, Ireland’s weeks grew by more than 5% in 2018, South Africa’s weeks grew by nearly 5% in 2018, and Canada’s were up by 7% in 2017. Sarah Cooper, chief executive of English UK, said that the 2018 data “gives us much to reflect on in the student weeks trend – we will be looking at this carefully and encouraging members to consider this as part of their business development." Samuel Vetrak, CEO of Bonard, the research firm that prepared the statistical report for English UK, added that “"The downward trend in length of stay seems to be a challenge globally: the UK is not alone in facing it. Tackling this issue might be essential for language schools worldwide going forward." Still, Ms Cooper emphasised, “It's pleasing to see the strength and resilience of our industry in what has been a challenging period, with the continuing uncertainty over the UK's relationship with the EU.”

Student mix

Juniors make up half (54%) of ELT students in private ELT centres in the UK, but their numbers dipped by 2% in 2018, compared with 27% growth the previous year. In contrast there was 5% growth across the ELT sector in the number of adult students. Non-EU countries continue to be vital to the sector, with students from outside the EU composing 43% of all students and responsible for 63% of all student weeks.

Top source countries

The nationalities accounting for the greatest proportions of student weeks differ according to whether member schools are private – by far the bulk of English-UK’s membership (360 centres) – or based in universities and colleges (59 centres). It’s important to note that private centres enrol vastly more junior students (54% of enrolments) than state-run centres do (13% of enrolments), and that juniors spend markedly shorter times in ELT studies and are more likely to be from the EU than adult students. For private centres, the top 5 source countries for student weeks are:

- Italy (responsible for 16% of total weeks but down 5% over 2017)

- Saudi Arabia (responsible for 9.5% of total weeks and up 12%)

- Spain (responsible for 7% of total weeks but down -2%)

- China (responsible for 6% of total weeks but down 1%,)

- France (responsible for 5% of total weeks and no change since 2017)

The most growth in student weeks for the private sector came from Saudi Arabia, Argentina, and Chile while significant decreases came from Italy (the major source market for the private sector), Turkey, and South Korea. Interestingly, Malta also saw Italian student weeks fall sharply, by 12% in 2018 compared to 2017. For state centres, the top source countries for student weeks are:

- China (responsible for 43% of total student weeks and up +20% over 2017)

- Poland (responsible for 8% of total student weeks and up +13%)

- Japan (responsible for 7% of total weeks and up +2%)

- Saudi Arabia (responsible for 7% of total weeks and up +3%)

- Spain (responsible for 4% of total weeks but down -3%)

The most growth in student weeks for the state sector came from China (the top source market by far), Romania, and Poland, while decreases came from Taiwan, Panama, and Kazakhstan. Ms Cooper commented that, “The data repays very careful reading, with rich and detailed insights which member centres can use to target their marketing and identify regions and countries where there is growth.” Mr Vetrak agreed and added that it would be important for British ELT sector to monitor growth trends in sending markets and strategise accordingly. Growth in 2018 was contributed by “well under half of the 114 sending markets – 39 in the state sector and 42 in the private sector…This underlines the need for UK ELT centres to be (or become) strategic and highly effective in their international student recruitment activities.” For additional background, please see: