South Africa: ELT student weeks up again in 2018

Newly released data indicates that South Africa’s English Language Teaching (ELT) sector booked a third consecutive year of growth in 2018. Student numbers were down slightly from 2017, but, on average, students stayed longer, and this helped to drive total student-weeks for the year to an all-time high. These are among the findings in the latest data release from Education South Africa (EduSA), the country’s peak body for ELT. EduSA reports a total enrolment of 9,512 among its member schools in 2018, down 5% from 10,042 students the year before. Student weeks, however, rose nearly 5% to reach a new high point of 64,102 for 2018. This important shift in the composition of ELT enrolments in South Africa can be traced back to a November 2016 out-of-court settlement between EduSA and the South African government. That settlement ended two years of legal limbo where the country’s ELT providers were effectively kept outside of the student visa system. With the settlement, study visas could once again be issued for students enrolled with recognised ELT providers. “The main reason why students are staying longer is due to our recent accreditation with the Department of Higher Education and Training in South Africa,” agrees EduSA CEO Ryan Peters. “The ELT industry now benefits from the collaboration with our government in a manner that opens the door for more long-term study visas.”

Brazil still number one

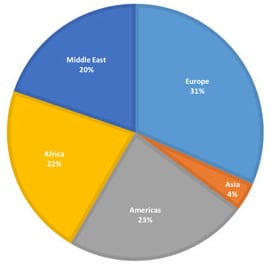

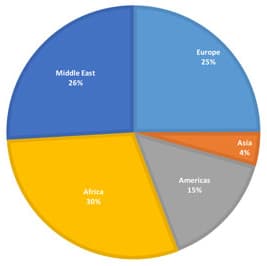

As the following charts reflect, South Africa has a fairly broadly based enrolment with strong representation from most global regions, with the exception of Asia.

Europe sent nearly a third of all students in 2018, but accounted for only 25% of student weeks. African students, in contrast, represented 22% of all ELT enrolments in the country but those bookings also made up 30% of all student weeks.