Global study highlights a jump in online bookings for under-30 travellers

Every five years, the WYSE Travel Confederation puts its New Horizons Survey in the field to monitor key trends in the under-30 travel market. The latest findings – drawing on 57,000 survey responses from young travellers around the world – were published earlier this month in New Horizons IV: A global study of the youth and student traveller.

As always, the report is wide ranging and comprehensive, and this year’s edition updates and expands on a number of important findings from earlier years. One area of note is the increasing role of online booking services for millennial and Generation Z travellers.

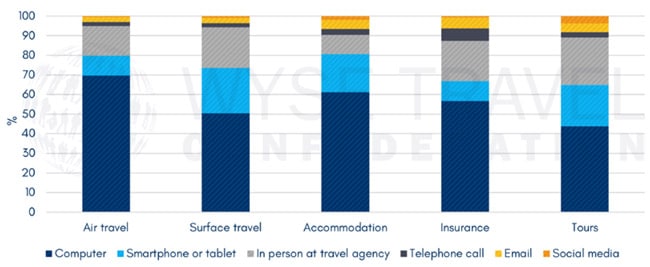

The report’s overall observation in this respect is that travel is being made more accessible by the incredible volume of travel information now available online, and by the growing range of online booking options as well. As of 2007, around 50% of millennial travel bookings were made online, and most often via a desktop computer. In the 2017 survey, respondents reported that 80% of their travel bookings were made online. And, as the following chart illustrates, an increasing share of these transactions are being carried out on mobile devices.

Travel for study and work

The report carries some important implications for destination marketers and recruiters alike, especially so given both the scale of the youth travel segment and its natural overlaps with study abroad markets. The UN World Tourism Organization estimates that youth travel accounted for 23% of all international arrivals in 2017, or just over 300 million trips, with the value of the youth travel market estimated at more than US$280 billion. Although nearly four in ten (38%) of all youth bookings are still for holiday travel, WYSE is tracking an increasing proportion of what might be classed as “purposeful travel” within the youth segment, from 53% of all trips in 2012 to 62% in 2017. And study figures prominently within that field of the 60%+ of youth bookings for purposeful travel, with 23% indicating that they travelled abroad for language study, another 14% reporting non-language study as the purpose of their trip, and 13% indicating that they went abroad for international work experience. For additional background, please see:

- “Global tourism report highlights key travel trends”

- “Let them talk: The power of student reviews”

- “Destination marketing organisations adding new partnerships and resources for international student recruitment”

- “Cultural experience the big driver of study abroad for Generation Z”

- “The millennial shift to simple, authentic, and inspiring”

Most Recent

-

Australia introduces new rules restricting agent commissions for onshore student transfers Read More

-

ICEF Podcast: Stop losing applicants: How qualification recognition drives seamless international enrolment Read More

-

UK’s new international education strategy seeks to build education exports to £40 billion by 2030 Read More