New Zealand’s international enrolment grew by 13% in 2015

Education New Zealand has released its official enrolment report for 2015. It finds that international student numbers were up 13% last year to reach a total enrolment of 125,011. This marks a second consecutive year of double-digit growth for New Zealand, and the sharp reversal of a previous trend of declining enrolment from 2011 through 2013. Tertiary Education, Skills and Employment Minister Steven Joyce said that the increasing enrolment reflected, "the great work being done by the education community across New Zealand," and added that, "New Zealand is increasingly being recognised for the excellent education and study experiences it delivers to both local and international students." International tuition revenues also climbed by 17% in 2015, surpassing the NZ$1 billion threshold for the first time (US$725 million), and following a previous 17% increase in direct export revenues for the sector from 2013 to 2014. "But of course the story is broader than that," said Education New Zealand Chief Executive Grant McPherson. "This year, we are working on a reassessment of the economic value international education brings, and we know it is greater than the current valuation of NZ$3 billion and the 30,000 jobs it provides to New Zealanders."

Concentrated growth

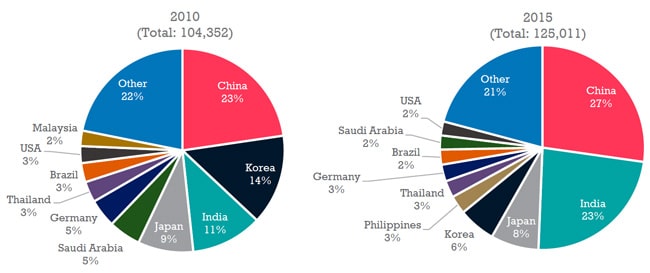

That 13% enrolment growth translated into 14,748 more foreign students in New Zealand in 2015. But nearly all of that growth is accounted for by three fast-growing sending markets: India (+9,013 students in 2015), China (+3,881), and the Philippines (+1,648).

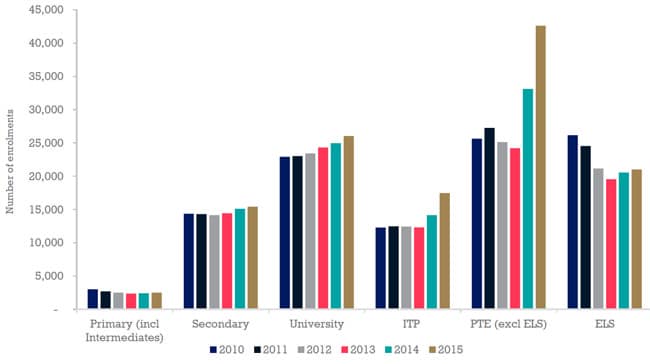

And, looking back over the last two years, most of the overall growth in foreign enrolment has been concentrated in two sectors - Institutes of Technology and Polytechnics (ITPs) and Private Training Establishments (PTEs) - and it has been largely driven in both sectors by increasing numbers of Indian students.

ITP enrolment climbed by nearly 42% over the two years, and by 23% between 2014 and 2015 alone. The PTE sector includes language schools and, while English Language Teaching (ELT) enrolment has been essentially flat over the last two years (+2% between 2014 and 2015), overall PTE numbers are up by more than 45% (including nearly 19% between 2014 and 2015).

Increases in Indian enrolment accounted for just over 80% of overall ITP growth last year and about 60% of PTE gains.

A looming diversification challenge

As the following chart reflects, foreign enrolment in New Zealand has become more concentrated over the past several years, and this in spite of coordinated attempts to open new sending markets.

This is in part a feature of the significant Indian growth noted above. But it also reflects a decline in a number of established source markets over the same period, including South Korea, Saudi Arabia, Thailand, Japan, and Germany.