Chinese economy shifting but demand for study abroad expected to remain strong

It has been a tumultuous summer for the Chinese economy.

The roller coaster ride started when the Chinese stock market crashed in late June. Stock values fell off by as much as 30% at one point and the government was forced to intervene to try and halt the slide. This led, among other measures, to the suspension of trading of roughly half of the stocks on the country’s two main exchanges in Shanghai and Shenzhen as well as the introduction of new trading controls for large investors.

More recently, Chinese monetary policy has taken a sharp turn as well. The value of the yuan (officially, renminbi or RMB) is closely controlled by China’s central bank and so the world took notice when on 11 August, the People’s Bank of China suddenly devalued the currency by 2%. This was the largest single-day drop for the yuan since 1994. The bank then followed this move with further devaluations, another 1.6% on 12 August and then a 1.1% drop on 13 August.

The sliding stock market and suddenly falling yuan have triggered a wave of anxiety around the world. Much of the worry and speculation for investors and companies trading with China amounts to this: is the Chinese economy, the world’s second-largest and an important driver of global growth for years, faltering at last?

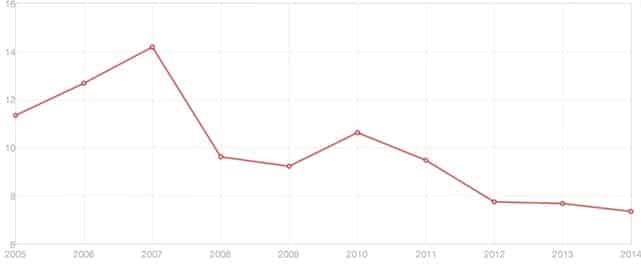

The Chinese economy has indeed been cooling over the last five years, and is expected to grow by only 7% this year. Such a forecast would never normally have the word "only" attached to it, but this is China and the world is used to a Chinese economy that moves along at a faster clip. From a recent high of 10.6% growth in 2010, the economy has slowed in the years since.

Sliding or shifting?

There is another view emerging as well, one that suggests that the recent declines in stocks and currency reflects some broader structural shifts at work in the Chinese economy. On the one hand, growth is certainly slowing, but this is not a shocking development in itself. No economy can sustain sky-high growth rates for the long term and economies naturally shift and moderate as they develop. On the other, the make-up of the Chinese economy is shifting, particularly in terms of the proportion of economic activity accounted for by manufacturing and resource sectors – the traditional drivers of China’s industrial expansion – as opposed to the service and knowledge industries that are such an important feature of modern economies around the world. "China has long sought to jack up its services sector, in hopes of fashioning itself after more developed countries," says The Globe & Mail. "Now it’s happening." "This year, for the first time, China is likely to see services represent more than half its economy – a remarkable change from 2012, when services, at 44.6%, still lagged industry… In the first half of 2015, the GDP among services rose 8.4%, some two and a half times the growth rate [of manufacturing and resource sectors]… and they’re pulling the rest of the country with them. If China continues at its current pace, its service sector will help create a third more jobs this year than in the heyday of big industrial expansion."

Cheaper but also more expensive

For the moment, the immediate impact of a depreciated yuan is to make Chinese exports cheaper. The high valuation for the currency was a factor in driving up the costs of Chinese products in recent years, and export levels have been slumping as a result. The flipside of this is that a lower currency also makes it more expensive to import products and services to China. The devaluation could therefore potentially suppress demand for foreign goods, perhaps especially luxury goods, and this has given rise to some speculation that it will also dampen Chinese tourism and demand for study abroad as well.

Demand trumps currency movement

Most recently, any such concerns have been moderated by the view that, just as we observed in 2013, China’s demand for education is simply too strong to be offset by short-term economic moves. Rahul Choudaha, Chief Knowledge Officer & Senior Director of Strategic Development at World Education Services (WES) said recently to the Vancouver Sun, "The base with which we are working from, just the sheer numbers of people who have both the willingness to go abroad and the resources to go, the numbers are quite huge… the demand-side of Chinese students is so huge that these economic upheavals will not make any difference." Along the same line, HSBC Chief Economist Paul Bloxham told The Australian this week that the bank doesn’t expect to see much in the way of further depreciation of the yuan, and that China’s burgeoning middle class would continue to drive demand for study abroad. "[The growth of the middle class] is a medium-term structural trend," he said. "It doesn’t really get thrown off by what we’ve seen in the last couple of weeks or even the short-term cyclical weakness we’re seeing in China. Middle-class incomes are rising. They’re travelling abroad in big numbers and there are increasing numbers of people from China looking to get education offshore." Phil Honeywood, Chief Executive of the International Education Association of Australia (IEAA), agrees, adding, "These decisions to invest a family’s money are made some years in advance and fluctuations in the current moment tend not to have a major impact. If (the Chinese currency) does continue to devalue, then it will have a far more challenging effect on student numbers, but at this stage it is not a game changer, notwithstanding all the hype around it."