New Zealand’s international enrolment up 13% in 2014; growth continuing this year

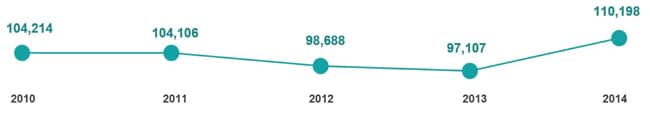

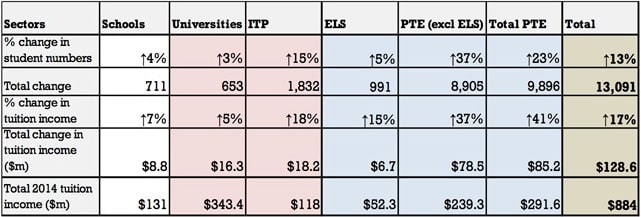

New data from Education New Zealand provides the final word on a strong 2014 for the country’s international education sector. International student numbers were up 13% over 2013 (an increase of 13,091 students) to reach a total of 110,198 for the year. This led in turn to a 17% increase in tuition revenues for 2014, sharply reversing the previous two-year trend of declining enrolment and marking the highest international enrolment levels in New Zealand in more than a decade.

This is particularly true of the strong growth in Indian student numbers foreshadowed in the previously released student visa data.

India and China accounted for the bulk of 2014’s enrolment growth but India alone sent 8,135 more students during the year (67% growth over 2013 and a volume equivalent to 62% of the total increase for 2014). China, meanwhile, was up 12% and accounted for roughly a quarter of the overall enrolment growth for the year.

"There has [also] been significant growth from a number of emerging markets," adds Education New Zealand. "Colombia, France, Chile and the Philippines are a few of the emerging markets that have experienced record level enrolments."

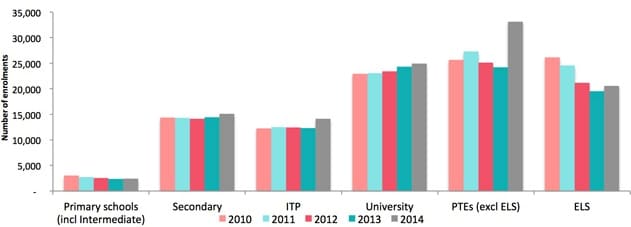

Picking up on another important trend that was apparent in the earlier visa tracking data, much of the enrolment growth for the year was focused in the Institutes of Technology and Polytechnics (ITP) and Private Training Establishments (PTE) sectors, which grew 15% and 37% respectively.

As the following table reflects, all other segments of international education - schools, universities, and English language programmes - grew more modestly, in the range of 3-5%.

The latest on 2015

Education New Zealand has also recently released new visa tracking data for the first two quarters of 2015, and here again we see important indicators of continuing growth this year. Year-to-date through June 2015, both the total number of student visas issued and the total number of new student visas issued increased by 10%.

Month-by-month visa volumes in both categories have consistently tracked above those of 2014 throughout the first half of 2015, suggesting that New Zealand is on course for another year of strong enrolment growth.

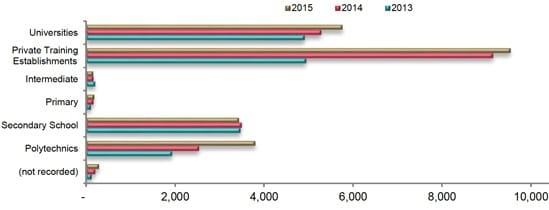

As was the case throughout 2014, much of that growth is again being driven by China and India. Student visas issued to Indian students are up 22% YTD June 2015. Interestingly, however, the dramatic growth in PTE enrolment recorded for 2014 seems to be moderating in the first half of 2015, with Indian enrolments in particular shifting to the ITP segment to a greater extent.

This shift is reflected in overall volumes of first-time visas (that is, visas issued to new students) by educational segment. As the following chart reflects, the ITP segment is showing stronger growth this year, PTE growth is moderating somewhat, and university enrolment is tracking higher YTD as well.

Turning the corner

Education New Zealand points back to 2013 as the turning point for enrolment growth in the country. That was the year that New Zealand introduced new work rights for international students. Some months later, it also introduced improvements to visa processing and launched an extensive and highly effective "Think New" branding campaign. As we commented at the time, "Notable (and laudable) about both New Zealand’s Think New marketing campaign and its immigration initiatives is the degree of coordination among various stakeholders in the country’s international education sector. Industry groups, education providers, and foreign-based agents have all been consulted in the design and deployment of the initiatives. Moreover, their expertise and particular roles in international recruitment are being actively leveraged in the execution of the campaigns and new visa processing systems." As the latest visa data indicates, the results of this close coordination between policy and market development continue to reflect in the impressive growth that New Zealand’s international education sector has seen over 2014 and 2015.