Summing up international student mobility in 2014

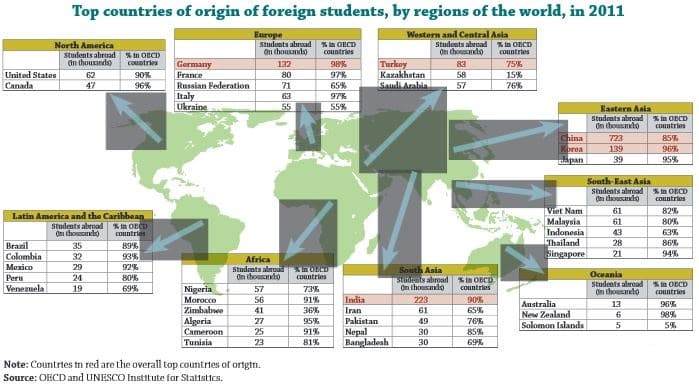

published a special issue on international student mobility last week and it got us thinking about what we really know about global student mobility as of 2014. The short answer: not as much as we would like. The slightly longer answer: many current reports on mobility trends are based on 2011 Organisation for Economic Cooperation and Development (OECD) data. That is the most recent year for which data is available from one of the most often-cited data sources. As always, there are questions about the completeness and currency of any such data set. Dr Daniel Guhr (Managing Director of the Illuminate Consulting Group) and Nelson Furtado (an ICG analyst) had an interesting item last week about this as well; pointing out there is no systemic, central data collection mechanism in place and that the ways in which internationally mobile students are counted vary considerably from country to country and from statistics agency to statistics agency. With that necessary caveat firmly in place, the top-level trends found in the OECD data are compelling to say the least:

- The movement of students between countries is now a mass movement. The global population of internationally mobile students more than doubled from 2.1 million in 2000 to nearly 4.5 million in 2011. Given that growth trajectory, that total number is likely nudging closer to 5 million in 2014.

- Asia is the key. China, India, and South Korea are the world’s leading sources of international students. One out of six internationally mobile students is from China, and together these three top countries account for more than a quarter of all students studying outside their home countries. All told, Asian students account for 53% of all students studying abroad.

- The pattern of global mobility is changing. The US is still the world’s leading destination. In fact, it is expected to enroll a record number of students again this year. But America’s market share is falling (from about 23% of all internationally mobile students in 2000 to 17% in 2011). This is partly due to the increasing share of other English-speaking destinations, such as the UK, Australia, and Canada. But it also reflects a growing trend to intra-regional mobility - that is, to a growing number of students who study outside their home country but within their home region.

Here is a quick round-up of trends and recent coverage from ICEF Monitor and other sources - on student mobility for major source and destination countries.

United States

The global market share of the US may indeed be falling but it is still on pace to enroll an estimated 900,000 foreign students in higher education programmes this year - a projected increase of more than 40% compared to enrolments of only a decade ago. China is driving much of that enrolment growth in the US. After a period of dramatic growth, graduate enrolments are flattening in recent years and the country mix for graduate students in the US is shifting too.

Other major English-speaking destinations

With the introduction of more restrictive visa policies, UK enrolments are beginning to flatten out as well. Conversely, Australia is seeing signs of growth in international enrolments after years of decline. After nearly doubling its international student enrolment over the past decade, Canada is aiming to double its enrolment base again by 2022.

Europe

Europeans account for nearly a quarter of all internationally mobile students and mobility in Europe, and the number of international students in Europe increased by 114% from 2000 to 2010. Mobility within the Eurozone also got a big boost last year with the EU’s approval of a major expansion of the Erasmus progamme (now Erasmus+).

Asia

As we noted earlier, Asia is the engine that continues to power much of the global growth in international education. A just-released report from UNESCO’s Asia and Pacific Regional Bureau for Education underscores many of the key mobility trends that have been observed in the region in recent years, particularly increased movement within the region. Our recent post on mobility within the ASEAN states picks up on some of these same trends for the fast-growing markets in Southeast Asia.

Africa

Much of the world’s projected population growth through 2050 will be in Africa and the continent is emerging as an increasingly important source of international students. Reflecting the larger global patterns, part of that growth will be reflected in students moving outside of Africa to pursue their studies and part will be in the form of intra-Africa mobility. Nigeria is gaining profile as a booming market but also as a strategic gateway to Africa.

Latin America

The OCED reports that Brazil, Colombia, and Mexico are the largest source of international students in Latin America, with between 30,000–35,000 students from each enrolled abroad in 2011. We have written recently about shifting patterns and choices for study abroad among Brazilian students, and how access to higher education in the country relates to both inbound and outbound student mobility. Other recent posts highlight changes afoot in higher education in both Colombia and Mexico.

Most Recent

-

Studies show countries “at forefront of research” prioritise international collaborations and mobility Read More

-

Australia introduces new rules restricting agent commissions for onshore student transfers Read More

-

ICEF Podcast: Stop losing applicants: How qualification recognition drives seamless international enrolment Read More