Seventh annual Agent Barometer provides agents’ view of marketplace

The results are in from the seventh annual edition of the ICEF i-graduate Agent Barometer, a comprehensive survey that delivers insight into the profile of education agents, as well as their perspectives and preferences.

This year’s survey ran for six weeks in September and October 2013 and drew the most agent respondents ever in the study’s seven-year history with responses from 1,194 agents representing 117 nationalities and responsible for the placements of nearly 330,000 students in institutions around the world.

Last year’s Agent Barometer results highlighted the turbulence in leading higher education markets during 2012, perhaps most graphically represented in Canada’s remarkable leap up the roster of “most attractive destination countries” as the nation worked hard to expand its marketing and strengthen its visa policies and processing.

This year the changes in destination countries’ attractiveness are less dramatic. Instead, the 2013 survey paints an illuminating picture of popular programmes, areas of interest, and content delivery methods, and it also underlines how affecting a country’s visa climate can be on the choices of agents and the students they represent.

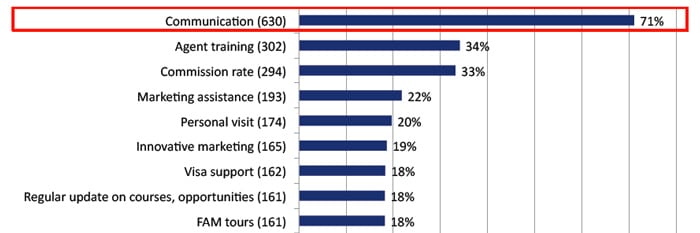

The 2013 Agent Barometer illustrates again the great premium placed on effective communications between institutions and agents: 71% of respondents cited “communication” as the main ingredient in successful educator-agent partnerships - by far the most common response in this category.

Response profiles: most are from small agencies representing less than 20 institutions

Of the 1,194 respondents, 82% were executive level: managers, directors, or owners of their agencies. In terms of location, the largest proportions of agents hailed from India (11%), Brazil (11%), and Russia (6%); the rest were spread out among the other 114 nations represented. The largest proportions of agents said they place between 51 and 200 students annually: 20% place between 51 and 100 students, while 19% place between 101 and 200. In combination, participating agents placed nearly 330,000 students in 2013; these students came from a total of 194 countries. Seven in ten (71%) agents work in agencies with fewer than 10 employees. Most responding agents represent less than 20 education institutions.

Placement categories

Language schools account for the largest proportion of placements (58% of responding agents said they primarily place students in language programmes), with public and private colleges right behind (56% and 51%, respectively). 37% of respondents indicated they primarily place students in pathway programmes, and summer school is also an important placement category (27%). In terms of programme placements, language courses are the most popular (71% recruit students for these courses), followed by undergrad university (67%) and graduate programmes (64%). Rounding out the list of programme placements are MBAs (50%), university foundation programmes (47%), secondary/high school (39%), vocational/continuing education (36%), work and study programmes (26%), work and travel programmes (18%), and distance/online learning (7.5%). The 2013 survey included a new section on the recruitment of professionals and found that nearly 70% of respondents are interested in recruiting professionals for work opportunities abroad. Respondents felt that the hospitality (52%) and tourism (40%) are the sectors with the greatest potential with respect to professional recruitment.

Optimism for next year

For virtually all countries, the number of agents expecting to place more students in the next year outpaced the number expecting to place the same number. The countries eliciting the highest responses of “more placements” were the US (81%), the UK (76%), Canada (73%), and Australia (71%). This optimism extended to the various programme areas, with by far the greatest proportions expecting to place “more” students into all programmes listed.

Most attractive study destinations: Canada moves into second place, by a hair

The US continues to lead the pack as the most attractive study destination in the world according to agents. The top five, according to “very attractive” mentions are:

- US: 73% (stable since last year)

- Canada: 64% (stable since last year, now in second place)

- UK: 63% (-1% since last year, dropping it marginally into third place)

- Australia: 53% (+5% since last year, continuing a rebound from a low in 2010 of 40%)

- New Zealand: 33% (+1 since last year)

So the story here, really, is one of general stability and gradually improving prospects for Australia (see here for a recent ICEF Monitor article on Australia’s recovery).

Attractive is one thing, but what’s the best?

Agents’ ideas about what the “best” destination for various programmes are stable in relation to 2012’s survey results and can be summarised like this:

- The US is perceived to be the best in terms of undergraduate, graduate, MBA, and work and travel programmes.

- The UK is perceived to be the best in terms of language courses, secondary/high school, and foundation courses.

- Australia is perceived to be the best in terms of vocational education.

Visas emerge as main area of concern for students and parents

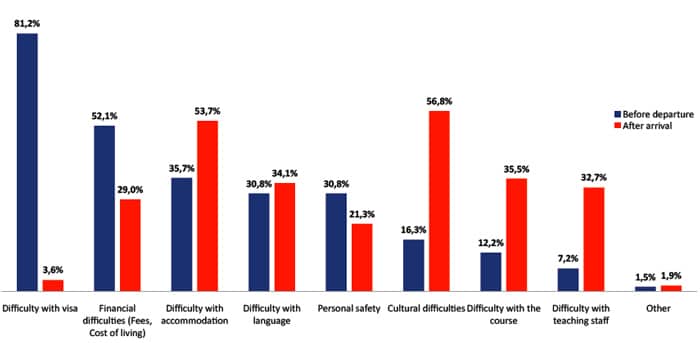

Agents said that before departure, families’ top two greatest concerns are visa difficulties (81%) and financial difficulties (52%). After the student arrives in the destination country, the top concerns change to cultural difficulties (57%) and difficulties with accommodation (54%).

The linkage between visas and attractiveness

Not much has changed in the leading destination markets’ popularity among agents and the students they represent. Perhaps this is due to the fact that some of the leading markets whose visa policies have been problematic for agents and students have tried to change course over the past year, for example:

- Canada’s public sector workers’ strike was alarming but temporary and occurred against a backdrop of broader systemic improvements in Canadian visa processing.

- The UK has been trying for most of this year to assure genuine international students they are most welcome and that stricter visa policies aren’t meant for them.

- Australia’s new government is showing signs of wanting to reverse damage to the international education sector.

That said, were a leading destination country to adopt really progressive and streamlined visa policies for international students in the next year, we might see it separate itself from the pack and change up the “most attractive” rankings more dramatically. What may also become more and more of a factor in where agents will be sending students is the increasing number of Asian institutions moving up the world university rankings. Not much changed this year in terms of emerging markets’ popularity, but we have certainly seen many indications this year that Asian education hubs are working hard to become must-consider destinations for international students, particularly within their own populous geographic region. For more information about the ICEF i-graduate Agent Barometer, please visit the i-graduate website or contact Project Manager Saskia Jensen.