There are more international students in the US than ever in 2025, but commencements are declining

- There are more international students in the US than ever, but US higher education institutions are seeing fewer new international students in the 2024/25 academic year

- The decline in new international students is especially pronounced at the graduate level (-15%)

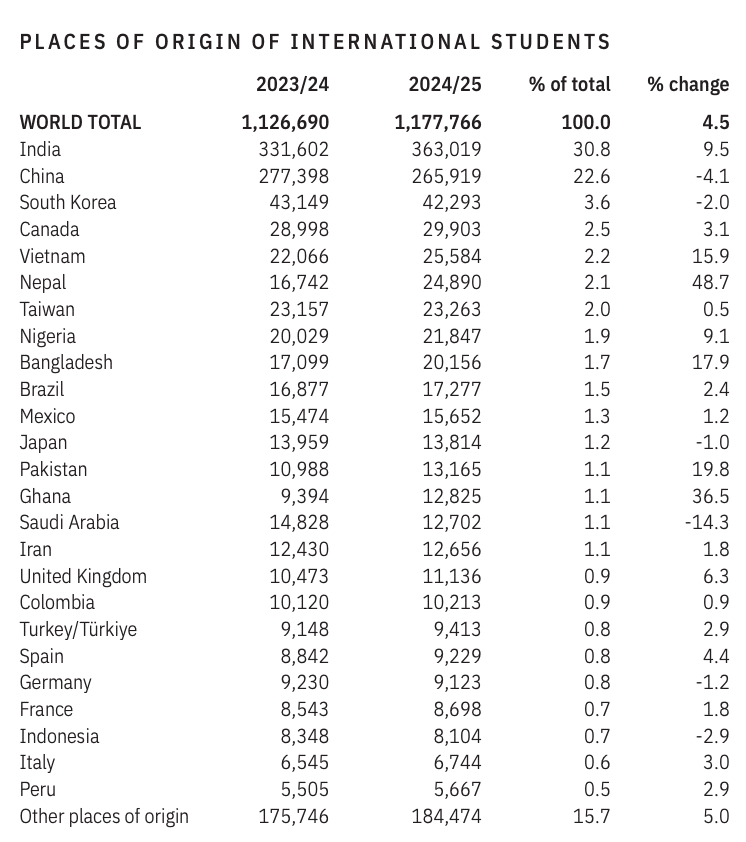

- For the second consecutive year, India is the top market, followed by China, South Korea, Canada, and Vietnam

- Growth has been especially strong from Vietnam, Nepal, Pakistan, and Ghana

- The IIE’s Fall 2025 Snapshot survey highlights a -17% drop in commencements as reported by responding institutions. More than half (57%) enrolled fewer international students than in 2024, compared with 29% registering an increase and 14% reporting stable numbers

The IIE’s 2025 Open Doors Report on International Educational Exchange shows that the number of international students in US colleges and universities (as well as Optional Practical Training) grew again in 2024/25 over the previous year. The total number was 1,177,766, up from 1,126,690 in 2023/24. This represents a record number, a +5% y-o-y increase, and an increase that follows on +7% growth the year before.

The growth was distributed variously across sectors and levels, with one level recording a decline. There was a -3% decrease in those pursuing master’s or doctorate degrees (488,481) following three years of growth, but the number of undergraduate students increased by +4% to 357,231 – the first notable growth at that level since the COVID-19 pandemic.

Meanwhile, the number of students in Optional Practical Training (OPT) – the work stream available to international graduates of US institutions – grew significantly, up +21% to 294,253 students. Optional Practical Training participants are still counted among international student numbers in the US and that OPT programme growth accounts for most of the 5% total increase in international enrolments. It also reflects the large cohort of international students graduating from US universities last year.

Community colleges experienced the fastest rate of growth (+8%) among institutions.

Commencements fell in 2024/25 but not as much as feared

There was a significant falloff in international student commencements (that is, new student enrolments) in 2024/25. Commencements fell by -7% to 277,118 students despite a +5% increase at the undergraduate level. Propelling the overall decline was a -15% decline in new graduate students.

The decline in new international students was expected, but it was forecast to be much more severe earlier this year.

India remains the #1 market

For the second consecutive year, India is the top international market for US higher education institutions, contributing 363,019 students in 2024/2025, up +10% and following growth of 23% in 2023/24.

China is in second place with 265,919 students, a -4% decline compared with last year that follows a -4% drop in 2023/24.

Of the 25 countries contributing international students to the US, 12 sent more students than ever: Bangladesh, Canada, Colombia, Ghana, India, Italy, Nepal, Nigeria, Pakistan, Peru, Spain, and Vietnam. The largest gains were from and Nepal (+49%), Ghana (+36.5%). Vietnam (+26%), and Pakistan (+20%).

The top 10 markets in 2024/25 looks notably different from 2023/25 in some respects. The top four countries remain the same (India, China, South Korea, and Canada). But Vietnam has moved into the #5 spot from the #6 spot, and Nepal has jumped from #10 to #6. Taiwan fell to #7 from #5 the previous year.

Leading countries of origin for foreign students at US higher education institutions in 2024/25. Source: IIE’s 2025 Open Doors Report

Fall 2025 survey finds a -17% decline in commencements

As it has for 20 years, IIE has complemented its comprehensive Open Doors report of 2024/25 data with a Fall Snapshot survey outlining more recent enrolment trends. The 2025 Fall Snapshot presents the responses of over 825 US higher education institutions on their international student enrolments for the 2025/26 academic year. These provide an indication of what the current year is looking like for US educators.

The Fall 2025 Snapshot reveals:

• A -1% decline in the total number of international students, including those enrolled in study programmes and in Optional Practical Training (OPT);

• An increase in undergraduates (+2%) and a decline in graduate (-12%) students;

• A -17% decline in overall commencements.

Growth in OPT enrolments continues (+14%) as a result of the strong growth in graduate enrolments between 2021 and 2024.

Of the participating institutions in the survey, 57% reported a decrease in new international enrolments, 14% reported stable numbers, and 29% registered an increase.

Partly in response to current uncertainty in international markets about the wisdom of pursuing higher education in the US under President Trump, 72% of responding institutions have offered international student deferrals to spring 2026, and 56% are providing deferrals to fall 2026. This strategy keeps prospects in the enrolment funnel. Eventually, some students will progress to enrolment and some will not.

Changes in student interest take time to show

The contrasting trends we see over 2024 and 2025 – enrolments up but commencements down – reflects the fact that enrolment volumes do not significantly relate to current international student demand for a destination. Specifically, students enrolled in years two, three, four, or even OPT today could have been prospects for a year or more before their start date. This means that policy changes or other market developments in 2025 would have had less influence on the decision to study in the US for many of those students.

Commencement trends, meanwhile, bear a closer relationship to international student demand because they capture instances of students being approved for study in the US in 2024/25 but choosing to defer or to choose another destination. They also relate to levels of visa refusals – students who wanted to study in the US and were extended offers of admission – but who were not approved for visas by US immigration officials.

The decline in commencements almost certainly relates to the fact that:

- Department of State data show that the number of F-1 visas issued to international students dropped by more than -14%, year-over-year, in the period January–May 2025;

- There was a 3–4 week pause in visa appointment scheduling during the key May to August period in which the lion's share of F-1 visas are typically issued each year.

The substantial decrease of new international students at the graduate level (-15% in 2025 versus 2024) may also be associated with President Trump’s acrimonious disputes with world-leading American universities such as Harvard as well as his research funding cuts and withdrawal from international research collaborations and organisations, especially in the areas of climate change and infectious diseases. Such developments are making some international graduate students less confident to make a decision to study in the US and more likely to choose another destination.

But many experts believe that the impact of President Trump’s policies on international students will take a year or more to reflect in enrolment data, since student demand for US higher education had been so high in the years leading up to the second Trump administration. It is that interest we see captured in the record-high international student enrolments registered in this year’s Open Doors report.

Dr Fanta Aw, NAFSA executive director and CEO, adds:

“A close read of enrolment figures from last year and this fall shows that the pipeline of global talent in the United States is in a precarious position.

If you exclude those international students who were engaged in post-graduation Optional Practical Training last year – which, at 25%, is the largest share of total enrolment ever – and this fall, there are alarming declines that we ignore at our own peril.

Other countries are creating effective incentives to capitalise on our mistakes. The United States must adopt more proactive policies to attract and retain the world’s best and brightest and recognize that post-study work opportunities are essential to our standing as the top destination for global talent. Otherwise, international students will increasingly choose to go elsewhere – to the detriment of our economy, excellence in research and innovation, and global competitiveness and engagement.”

A longer-term analysis paints a troubling picture

Chris Glass, who leads the Executive Doctor of Education (Ed.D.) in Higher Education program at Boston College, argues that it is far more instructive to look at long-term patterns in enrolments than to consider year-over-year changes. When reflecting on the past decade of international education in the US, he notes:

“Ten years that could have created a resilient talent strategy instead produced a system dependent on volatile elements: one country (India), one field (STEM), one degree level (graduate programs), one policy (OPT).”

Mr Glass points to US’s lack of an internationalisation strategy or cohesive plan to attract talent as a major obstacle for US institutions, international students, and national innovation. He compares this to other countries (e.g., Japan, Australia, China, and India) that have coordinated programmes geared at attracting and retaining top international talent. The US’s failure in this regard, says Mr Glass, results in:

“Maximum uncertainty for students (OPT to H-1B lottery to decade-long green card backlogs) and maximum vulnerability for institutions (dependence on volatile enrollment streams). A system optimized for neither talent development nor political sustainability: just institutional revenue and temporary labor supply.”

Mr Glass makes two crucial points about sub-trends in international enrolments in the US:

- "Optional Practical Training (OPT) students now comprise 25% of the 1.2 million total international students: up from 16% ten years ago.

- "OPT has doubled in 10 years. 1 in 4 “international students” are not enrolled in a university. Growth in OPT has masked real enrollment declines for the last decade."

Economic value of international students in the US

In 2024/25, international students contributed US$42.9 billion to the US economy and supported more than 355,000 jobs. This huge contribution is down -2% from 2023/24, and 2024/25 is the first year in which a decline has been recorded since the COVID-19 pandemic.

A related analysis from NAFSA, also released today, estimates that the economic impact of international students in the US fell by US$1.1 billion in fall 2025, a decline that cost the US economy an estimated 23,000 jobs.

For additional background, please see: