UK ELT reports declining enrolments for first half of 2025

- Quarterly data releases for the English language training sector in the UK report declining ELT volumes through the first two quarters of this year

- The softening numbers for the first half of 2025 are attributed to continuing policy uncertainty and economic headwinds in key sending markets

Extending the global pattern reported for 2024 of declining English language learning enrolments, English UK's quarterly reporting for the first half of 2025 describes a "slower than usual" build up to the key summer season.

Also reflecting the global trends from 2024, Ivana Bartosik, International Education Director at English UK's research partner BONARD, notes that, "Across all major ELT destinations, Q2 2025 has seen a decline in student numbers." She attributes the softer numbers in the first half of the year to continuing "policy uncertainty including enrolment caps, visa restrictions, and changes in government administration and an economic downturn in key source markets."

Quarter by quarter

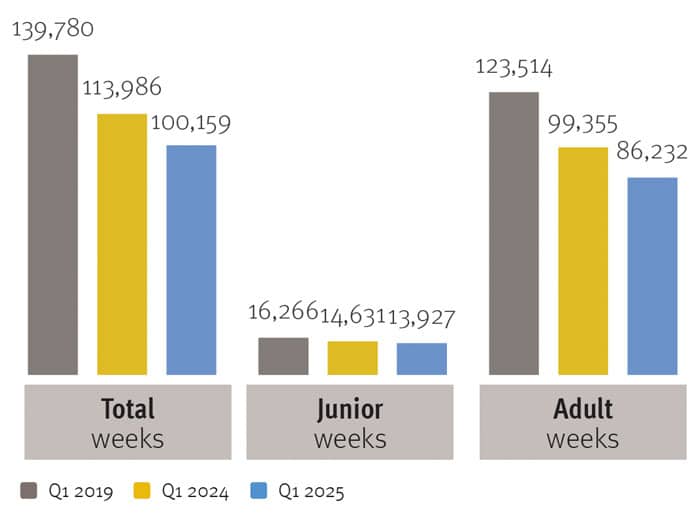

In a like-for-like comparison of schools that were operating across all of the survey periods, English UK says that reporting centres saw a -12% decline in students weeks from Q1 2024 to Q1 2025. As we see in the charts below, that decline is tied to softer adult learner numbers for the quarter.

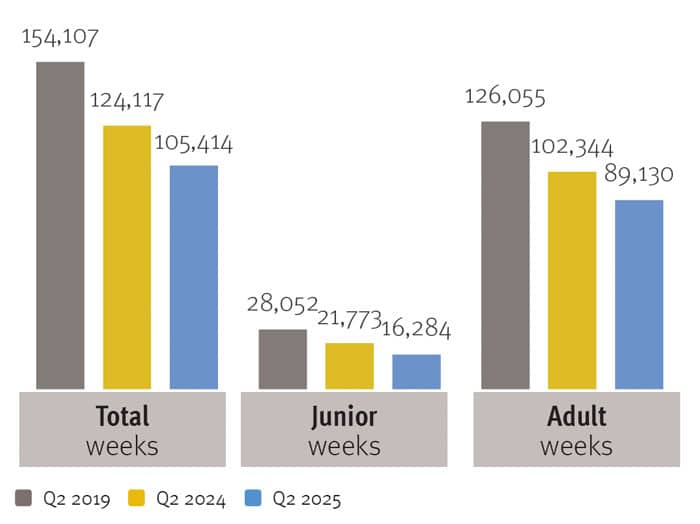

The additional charts below for Q2 2025 show a similar pattern, albeit with a decline in junior numbers as well. Student weeks for the quarter only marginally increased from Q1 (3%), but a similar like-for-like comparison finds that student weeks for the quarter, for that group of reporting centres, declined by -15%.

"Asian markets have been impacted by the trade war," adds English UK. "Volatile exchange rates, economic slowdown, and uncertainty have also affected source markets, reducing outbound student mobility [thus far this year]."

Overall, the volume of student weeks for the quarter fell in relation to pre-pandemic benchmarks, representing 68% of Q2 2019 volume. This compares to the 72% recovery with respect to pre-pandemic levels reported for Q4 2024.

Key sending markets

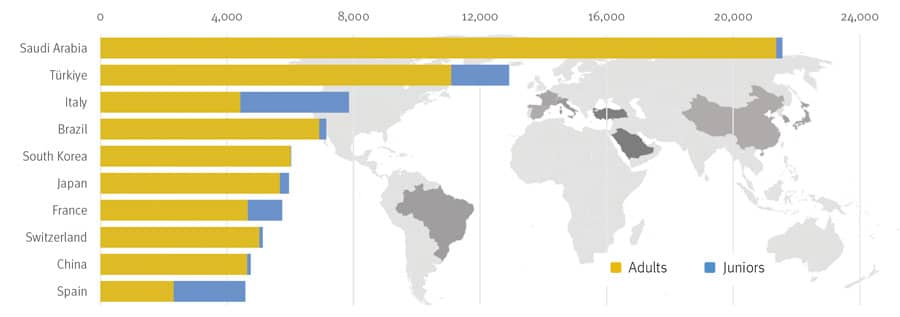

In Q2 2025, the top 20 sending markets for UK ELT accounted for 89% of all student weeks. As it has been for some time, Saudi Arabia remains the top sender, albeit with a decrease of nearly 3,000 student weeks compared to the same quarter last year. More broadly, markets in the Middle East accounted for just over a third (34%) of all student weeks for the quarter.

Türkiye also held its spot as the second-ranked sending market, but also showed the strongest growth among top source markets, gaining just under 2,000 student weeks from the same quarter in 2024.

For additional background, please see: