Survey finds US institutions expanding agency engagement and focusing on new student markets

- US institutions are concerned about challenges around student visa processing but otherwise sharpening their focus on developing new student markets

- Most incorporate digital marketing channels into that recruitment effort, but a strong majority are now actively engaged with education agents as well

AIRC (The Association of International Enrollment Management) and BONARD have just released a second edition of the State of the International Student Recruitment and Enrollment Field Survey that they inaugurated in 2023.

Building on those earlier findings, the 2025 survey gathers responses from 155 US universities and 64 education agents in order to provide an updated view on the motivations, methods, opportunities and challenges facing US educators and their partners in international recruitment for the United States.

How and why?

For a strong majority of responding institutions (82%), international student recruitment is carried out by staff in the admissions office (44%), as part of a global education unit (26%), or via a stand-alone department (12%). Only 14% indicated that recruitment is distributed across multiple offices throughout the university.

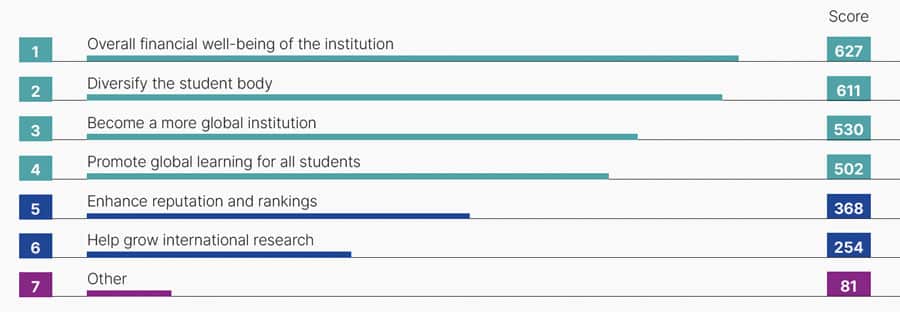

In terms of motivation for building international enrolment, and in contrast to the 2023 survey findings, "Overall financial well-being of the institution" was the most-cited factor this year. While hardly unique to the US, this may reflect a growing concern around the financial stability of higher education institutions in the United States.

"This is a major shift compared to two years ago, when financial reasons were only the fourth most important reason," notes the report. "Although diversifying the student body dropped from the first place to second, it remains an important aspect of student recruitment and experience."

Channels to market

Nearly nine out of ten responding universities (87%) said that they use digital marketing channels to reach international students. In broad terms, this makes digital the most widely used recruitment channel among respondents.

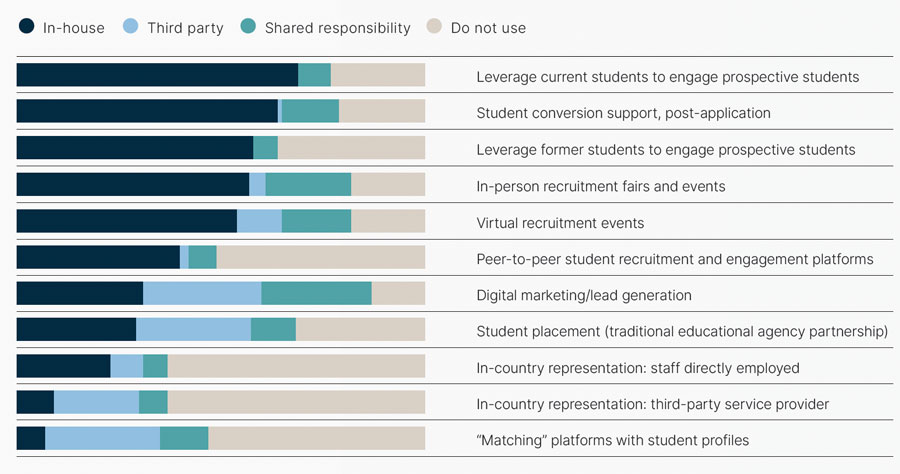

The following chart provides a more detailed breakdown of other key channels, with a further breakdown in each case to indicate the extent to which responding institutions reported managing each channel in-house, via a third party, or a combination of the two.

"In-person and virtual recruitment events are gaining traction, with 82% of institutions confirming their investment in these channels," adds the report. "Post-application student conversion support has become [another] important recruitment channel, with 80% of institutions dedicating resources to this approach."

Most are working with agents

The 2025 survey makes to clear as well that the US universities' engagement with education agents has expanded considerably over the past decade, with three out of four American institutions now actively working with agents.

The report explains: "Partnering with education agencies is increasingly popular among institutions. A 2016 study by BONARD revealed that 37% of US institutions engaged with education agencies. This figure rose to 63% in 2022 and has now reached 75% in 2024, proving the increasing importance of this recruitment channel in higher education." Further, nearly half of responding universities (47%) report working with 20 or more agencies.

The major factors cited by institutions when selecting or evaluating an agency partner include the agent's country of operation, positive references from other universities, the quality of referred students, agency certification/accreditation, the number of students placed in the US, and the number of existing partners in the United States.

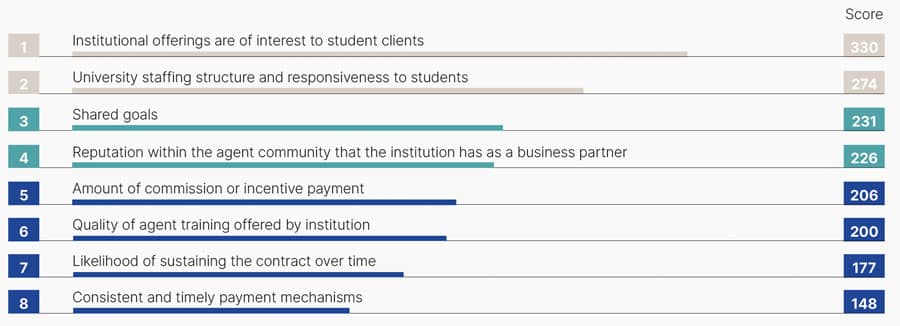

For their part, responding agencies put the emphasis on academic programme offerings, tuition and fees, institutional rankings, and responsiveness when vetting an institutional partner in the US. Agents also highlighted the factors outlined in the chart below – notably stability and commitment of the partner institution – as key aspects of an effective, long-term working relationship with a US institution.

The survey report confirms that, "More than half of educational agencies use a traditional, face-to-face model [for recruitment]; they provide a wide range of support services to students and to institutions; cost and visa issuance remain one of the most significant challenges to agencies [in recruiting to the US]; they focus on what they believe is best for students, including academic offerings, cost and institution rankings; and agencies and institutions differ in compensation model preferences."

A more diverse recruitment

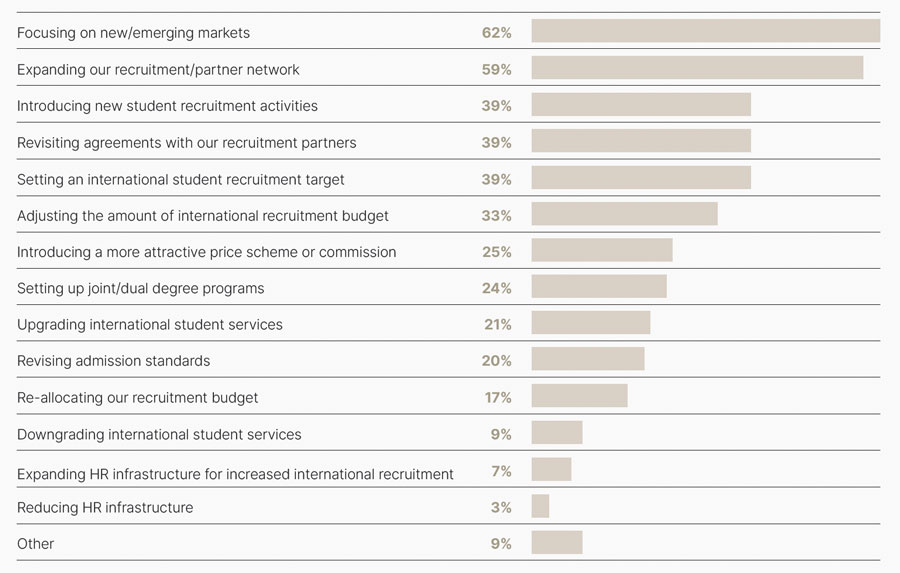

With enrolments slowing from traditionally strong sending markets, notably China, South Korea, and Saudi Arabia, responding universities say that they are increasingly focused on developing new or emerging student markets. "Sixty-two percent of institutions are targeting emerging markets such as Bangladesh, Pakistan, and Ghana," highlights the report. "Additionally, 59% are expanding their recruitment and partnership networks to diversify their global outreach."

Institutions noted "visa difficulties" (referring both to processing delays and rising rejection rates) as their most significant recruitment challenge, followed by "access to additional budget", and "cost of education in the US."

For additional background, please see: