UK: Reduced demand from India, Nigeria, and Bangladesh drive a 14% decline in sponsored study visas in 2024

- Sponsored study visa issuances for international students coming to the UK fell by 14% in 2024 compared with 2023

- The largest drops were from India, Nigeria, and Bangladesh

- China declined, but not nearly as much as other top markets, and it has returned to its position as the top source country for UK educators

- The rise of alternative destinations in Asia and the Middle East may be drawing some students away from the UK, but it is the so-called dependants ban that was the main drag on demand

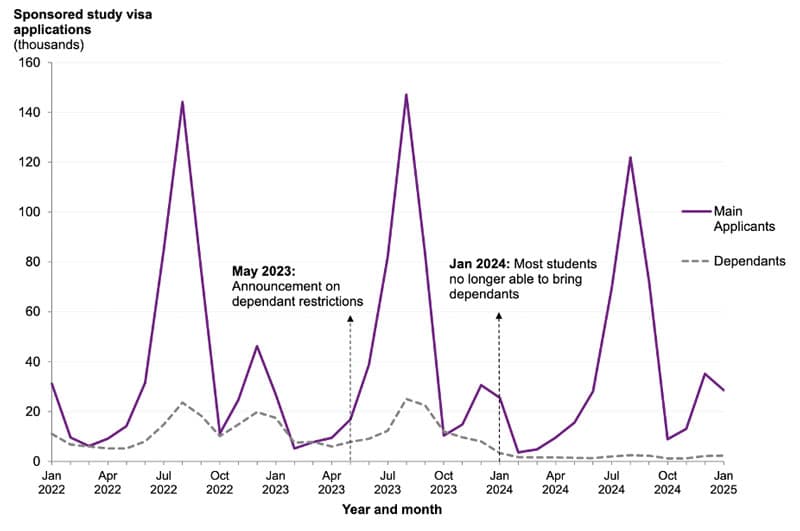

Last week we reported on data indicating that international students' visa applications and grants to study in the UK increased at the end of 2024 and into the first quarter of this year – welcome news given many UK universities' ongoing financial struggles due to declining foreign enrolments. The recent uptick contrasts with newly released full-year data from the UK’s Home Office detailing the decline in sponsored visas issued to international students in 2024 versus 2023. This data confirms that the so-called dependants ban that went into effect in January 2024 has had a significant impact on student demand for the UK in top markets such as Nigeria, India, and Bangladesh.

Since January 2024, most international students have not been allowed to bring their family with them while they study in the UK. The only exceptions are for students in research-oriented postgraduate programmes and those on government-sponsored scholarships.

Prior to the ban, students in taught master’s programmes had been permitted to bring family with them, which was a key reason these programmes were so popular in emerging markets. That popularity has waned since the launch of the dependants ban. As reported in Times Higher Education, the share of study visas for master’s programmes fell from 66% in 2023 to 61% in 2024. The countries accounting for the most master’s visas are now, in order, India, China, and Pakistan.

As shown in the chart below, there was an 84% decrease in dependant applications for the year ending January 2025.

A 14% drop in sponsored study visas

A total of 393,125 sponsored study visas were issued to main applicants (i.e., students) in 2024, a 14% drop compared with 2023. This percentage drop is very close to the 15% decline we predicted last year in an ICEF Insights article on dependants, which also noted that:

“The largest losses [if partial-year data trends were to hold] would be from non-EU countries, including Nigeria and India … [except that] the impact on Chinese students would be minimal if we go by ‘dependant-to-main-applicant ratio’ trends. That ratio was 1.16 for Nigerian students compared to less than 0.01 for Chinese students.”

Sure enough, visas issued to Nigerian and Indian students declined by -55% and -26%, respectively, in 2024 versus 2023. Issuances for Chinese students, by contrast, fell by only -6%.

The far gentler softening of the Chinese market saw China regain its position as the top international student source country for UK educators, reversing a two-year trend in 2022 and 2023 where India had held that spot. India is now second, with 88,860 visa issuances compared with China’s 102,940 in 2024.

Visas for Indian students fell at both the master’s and undergraduate levels. Nicholas Dillon, Director of Nous Group, commented on LinkedIn about the Indian undergraduate trend: “Interesting to see such a fall in a market for a cohort that’s not directly affected by the dependent visa changes (and interesting that it happened notwithstanding Canada’s clamp-down).” It seems clear that Indian students are considering a much wider range of options for study abroad than in the past.

Nigeria and Pakistan switch spots, and Nepali demand remains strong

The drastic -55% drop-off from Nigeria – paired with a somewhat surprising 13% increase from Pakistan – means that Pakistan is now the UK’s number three student market, with Nigeria bumped to fourth.

Pakistan’s overall surge happened even with an 85% decline in visas issued to Pakistani dependants, highlighting exceptionally strong demand from Pakistan for UK education. The dependant-to-main-applicant ratio for Pakistan had actually been slightly higher than for India before 2024 (0.37 versus 0.31, respectively) – so the dependants ban seems to have been considerably less influential on study abroad decision-making in Pakistan than in India. Visa issuances to Pakistani students increased at both the undergraduate and postgraduate level.

As with Pakistan, demand from Nepal remains strong, with 44% more visa issuances in 2024 than 2023 and growth at both the undergraduate and postgraduate levels. Nepal now represents the third largest undergraduate market for the UK and the sixth largest overall.

Other non-EU markets weaken, for various reasons

Some other important student markets for the UK weakened. Within the Top 10, the largest drops in study visa issuances were for Malaysia (-12%), Hong Kong (-15%), Saudi Arabia (-16%), and especially Bangladesh (-31%).

The fall-off from Bangladesh is likely tied to the dependants ban, given a very high dependant-to-main-applicant ratio over the past couple of years (1.01%).

Declines from Malaysia and Hong Kong may have more to do with the rise of alternative destinations in Asia, including Malaysia’s and Hong Kong’s ambitions to become regional education hubs. Universities UK points out that Malaysian demand has been dropping in recent years both for study in the UK and for study in Malaysia via UK transnational education arrangements. At the same time, Malaysia has a goal of attracting 250,000 foreign students by 2025.

Hong Kong has also set its sights on recruiting more international students. In 2019/20 there were 12,350 undergraduate international students in Hong Kong universities, and this rose by 20% to 14,760 in 2024. Most of those students are from China, but India is a growing priority. Hong Kong’s eight public universities joined together last year to recruit Indian students, especially those who are strong in STEM.

Meanwhile in the Middle East, both the UAE and Saudi Arabia are increasing foreign partnerships and branch campuses to attract more foreign students.

Top 10 markets for the UK according to study visa issuances, 2024

China:102,940

India: 88,860

Pakistan: 35,045

Nigeria: 18,900

US: 15,275

Nepal: 12,235

Bangladesh: 6,400

Malaysia: 5,420

Hong Kong: 5,180

Saudi Arabia: 4,875

For additional background, please see: