Malaysia’s growing appeal as a study destination

- Malaysia is steadily increasing its volume of international students, backed by careful government strategies

- East Asian students are particularly attracted to Malaysia, and the number of Chinese students is increasing rapidly

- Malaysia’s investment in education and international student recruitment contrasts with trends in several top Western destinations for study abroad

Malaysia has always been a favoured Asian study abroad destination. Its appeal among international students is based on factors such as:

- Highly ranked universities, including eight in the top 500 QS World University Rankings (2025).

- Relatively low cost of living compared to other top destinations. For example, Malaysia has been estimated to be two-thirds less expensive to live in than the US and half as expensive as Canada and Ireland.

- Affordable tuition fees. Annual tuition for an undergraduate degree is on average US$6,000.

- Cultural and religious factors. Malaysia is a Muslim-majority nation, which is attractive to many aspiring Muslim students in top markets such as Bangladesh, Indonesia, Nigeria, Pakistan, and Egypt. In addition, it has many Chinese-speaking communities, which appeals to Chinese families, who became much more likely during the pandemic to prioritise safety, comfort, and proximity when looking at study abroad options.

The Malaysian government rarely releases tertiary enrolment data. However, it does publish information on foreign students’ applications to Malaysian institutions through its international education arm, Education Malaysia Global Services (EMGS). While the volume of applications will not exactly match the number of enrolments, it is a good indicator of enrolment trends given that the visa approval rates are relatively high in Malaysia. One source has it that the visa approval rate is about 90%.

Applications volumes are trending upward, in line with Malaysia’s official goal of attracting 250,000 international students by 2025.

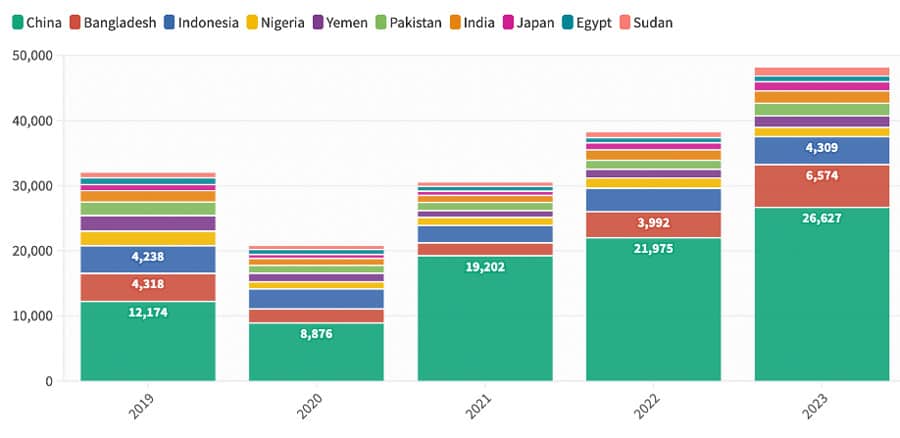

Asian and African countries dominate Top 10 sending markets

In 2023, all of Malaysia’s Top 10 markets were in Asia and Africa. Chinese students sent in the most applications by far: nearly 27,000 – and up from about 12,000 in 2019. Bangladesh was the fastest-growing source of students.

(1) China: 26,630 (+21% compared with 2022)

(2) Bangladesh: 6,570 (+94%)

(3) Indonesia: 4,310 (+19%)

(4) Pakistan: 1,940 (+42%)

(5) India: 1,900 (+18%)

(6) Yemen: 1,770 (+32%)

(7) Nigeria: 1,420 (-10%)

(8) Japan: 1,400 (+29%)

(9) Sudan: 1,310 (+60%)

(10)Egypt: 880 (+12%)

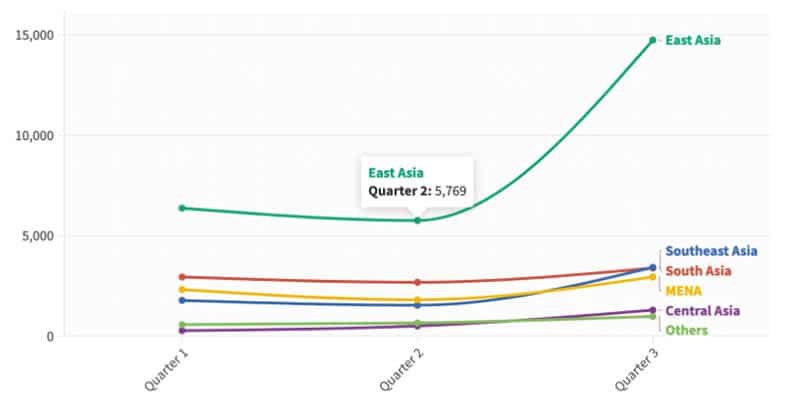

EMGS has also released data on applications by region for the first three quarters of 2024. As you can see in the chart below, demand from East Asia is only getting stronger. Between Q2 and Q3 2024, the number of applications from East Asian students almost tripled, driven by interest from China.

Post-study work rights for students from certain countries

The Malaysian government has been selective in its post-study work policies for international students. Last year, students from 23 countries became eligible for the 12-month Graduate Pass. Those countries include Australia, the US, the UK, Germany, Japan, Singapore, Saudi Arabia, UAE, the UK, Germany, Switzerland, and Finland. These are not main senders of students to Malaysia but were selected based on the Malaysian government’s intention to pursue two-way internationalisation with the countries and institutions hosting the most Malaysian students.

In 2024, some Indian and Chinese students were also offered the Graduate Pass subject to certain conditions. This policy was intended to last only until the end of 2024, but it has since been extended to the end of 2026.

The Graduate Pass appears to be attracting attention in target markets. Times Higher Education reports that “Malaysia’s share of global page views [on search platform Studyportals] has risen by about one-quarter this year, with particularly strong increases from the US, Saudi Arabia, and the UAE.” We can also imagine that the Graduate Pass opportunity for Chinese students has factored into the sharp rise in applications from China in the past year.

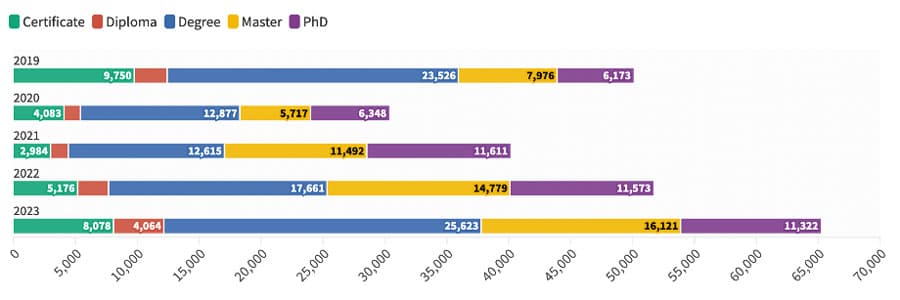

Degree programmes dominate

International students tend to come to Malaysia to obtain degrees. Undergraduate degrees remain the most popular, but since 2019, there has been much more growth at the master’s and postgraduate levels, as shown below.

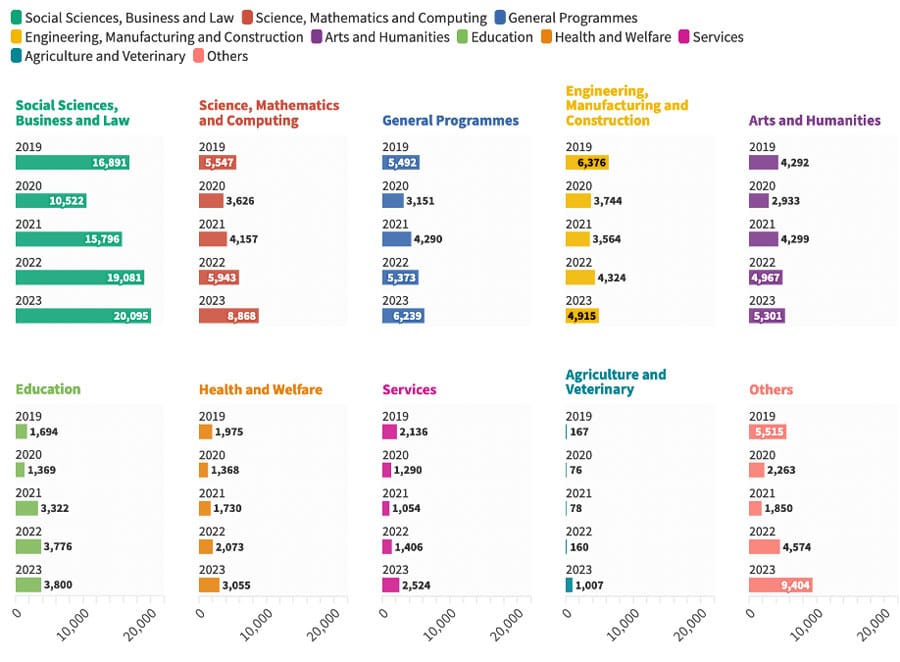

As shown below, the fields of social sciences, business, and law attract the most international students

Competitive opportunities

In 2024 it became crystal clear that many universities in the West (e.g., Australia, Canada, the UK, and the US) are ill prepared to cope with regulatory changes that challenge their ability to recruit international students.

In Canada, for example, international student tuition has been essential for tertiary institutions’ operations given chronic government underfunding, but the Canadian government is now actively working to curb international student numbers. Without additional funding, it is likely that many institutions – especially colleges, which are more affected by new immigration regulations – will struggle or even close in 2025.

By contrast, Asian destinations are picking up steam and investing more in both education and international student recruitment. Reporter Benjamin Laker, writing recently in Forbes, observes:

“As institutions in parts of the West continue to face [funding] challenges, higher education institutions across Asia are seizing opportunities to strengthen their competitiveness—a process that can be understood through the lens of economic theory, particularly competitive leapfrogging. This concept describes how organizations or nations strategically capitalize on gaps left by established leaders, not just to catch up but to surpass them by leveraging innovation, investment, and alignment with future trends.”

Asian institutions are ever more present in world university rankings, and Malaysia stands out as the country rising the fastest in the rankings. In the QS 2025 world rankings, 65% of Malaysia’s universities improved their position. Malaysian Prime Minister Anwar Ibrahim told Mr Laker that there is a strategy underpinning this success:

“Our goal is to create a pipeline of talent that meets industry demands while maintaining academic excellence. Investing in innovation is not just about economic gains—it is about positioning Malaysia as a hub for technological and intellectual leadership.”

Malaysia’s astute recognition of “academic power”

In his Forbes article, Mr Laker concludes:

“By adopting forward-looking strategies, [Malaysian institutions] are effectively ‘leapfrogging’ traditional limitations and reshaping the balance of academic power. The implications of this shift are profound, with potential impacts on global talent flows, research funding, and the distribution of academic influence for years to come.”

For readers interested in a comprehensive outline of visa processes, fees, cost-of-living, and more in Malaysia, this article – targeted mainly at Indian students and published in 2023 – is quite helpful.

For additional background, please see: