Market snapshot: A guide to international student recruitment in Brazil

- Brazil is increasingly on the radar of English-language institutes and universities around the world

- Well over 100,000 Brazilians are currently studying abroad

- Research from BONARD, QS, BELTA, and ICEF provides valuable market insights about Brazilian students’ motivations, destination preferences, concerns, and enrolments

- The following article is a deep dive into the characteristics and potential of the Brazilian student market

FAST FACTS

Capital: Brasília

Population: 218 million (2024)

Youth population: 44% below the age of 30

Median age: 33

GDP: US$1.92 trillion (2022)

Currency: Brazilian real (BRL)

Language: Portuguese

Main language of instruction: Portuguese but English is now a compulsory subject in secondary school.

English proficiency: “Low” (#70 of 113 countries ranked on the EF English Proficiency Index, #15 of 20 Latin American countries).

Religion: Predominantly Catholic – Brazil has more Roman Catholics than any other country in the world.

Geography: Brazil occupies almost half of South America and borders the Atlantic Ocean. Its border countries are Argentina, Bolivia, Colombia, French Guiana, Guyana, Paraguay, Peru, Suriname, Uruguay, and Venezuela.

Key student cities: São Paulo, Rio de Janeiro, Brasília, Salvador, Campinas, and Curitiba.

Outbound students: The latest UNESCO count of Brazilians abroad for higher education was 89,150. However, that number will primarily reflect those that go abroad for higher education. And, as you’ll read in this article, our own research shows more than 110,000 Brazilian students abroad at various levels – and including English-language study – in 2023/24.

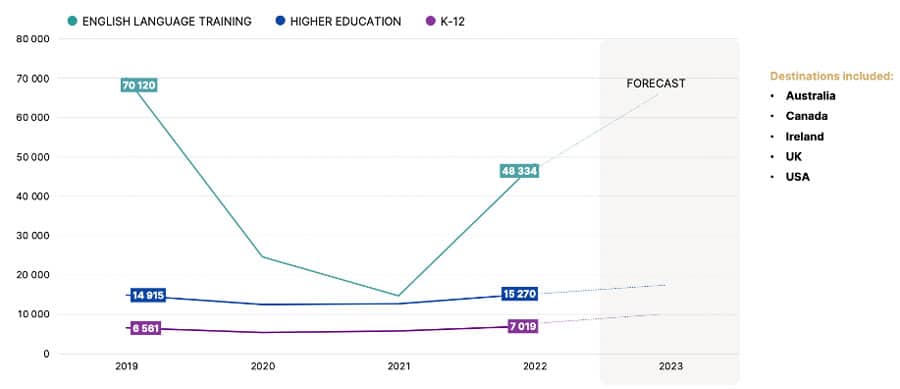

Top levels of study for Brazilian students looking at study abroad: Most of Brazil’s outbound students are pursuing English-language courses, but there are also significant numbers opting for higher education.

Brazil is quite simply one of the most promising markets for international recruiters in 2024.

A massive economy with unmet potential

Brazil is one of the world’s most important economies. It is usually counted in the top ten or just outside that tier, and it is a founding member of the powerful BRICS+ trading bloc. Even before the expansion of this bloc in January 2024, the initial five nations of BRICS – Brazil, Russia, India, China, and South Africa – contributed 26% of the world’s GDP. Now, with the addition of Egypt, Ethiopia, Iran, and the United Arab Emirates, the BRICS+ accounts for 37.5% of global GDP. This is higher than that of the EU, and the GDP of BRICS+ is forecasted to exceed that of the G7 nations within the next two decades.

Within the BRICS+, Brazil contributes the third-largest proportion of GDP after China and India, but some of its market fundamentals are weaker than those in China and India. For example:

- Brazil’s population is aging quickly: between 2010–2022, the median age of Brazilians increased from 29 years to 35 years.

- Despite abundant natural resources, Brazil has fared poorly in studies measuring productivity and competitiveness, including digital competitiveness (#57 out of 64 countries assessed by IMD).

- Average income is low – about US$600 a month in February 2024.

- Youth unemployment is high, as are drop-out rates of secondary students. Many young Brazilians simply give up on the idea of looking for a job. Brazil had the dubious position in 2020 of placing 3rd among OECD countries in terms of the percentage of youth who were not studying or working.

- Government funding for education has declined dramatically in recent years.

At the root of many of these problems, say experts, is an education system which, while very large, offers only a fraction of Brazilian youth the kind of credentials that lead to well-paying jobs. Brazil is one of the most unequal societies in the world in terms of opportunities and income distribution. It is in this context that we can understand that obtaining an undergraduate degree is a highly coveted way for Brazilians to obtain social mobility.

There has been a notable expansion of access and enrolments in the Brazilian education system thanks to recent reforms, but in 2018, only just over 18% of the Brazilian workforce had an undergraduate degree. Less than 1% of Brazilians hold a master’s degree or a PhD.

WENR has reported that most Brazilian students hoping to proceed to higher education sit for the ENEM exam, which “is said to be the biggest nationwide test in the world after China’s massive Gaokao examination—5.5 million students registered to sit for the ENEM in 2018.”

However, WENR notes:

“Competition for the limited number of open seats at public institutions is fierce. Not only do public universities provide tuition-free undergraduate education and offer a much broader variety of programs, they are also consistently ranked highest in terms of quality, according to the General Index of Courses (Índice Geral de Cursos, IGC), an education quality indicator established by the MOE.”

No more Science Without Borders, but other scholarships help to fill some of the gap

Brazil has a wealth of potential, but it clearly needs more of its youth to be educated to draw nearer to the pace of growth and competitiveness underway in China and India – and it needs this to happen rapidly.

The former government of President Dilma Rousseff recognised this urgency to such a great extent that she launched the Science Without Borders scholarship programme with an initial investment of US$1.2 billion. More than 100,000 Brazilian youth studied abroad under the programme, but Science Without Borders was wound up in 2017 after struggling administratively and logistically (and following the impeachment of Rousseff).

Many Brazilian students continue to study via scholarships provided by the Brazilian national government, state governments, host destinations (such as Canada’s Emerging Leaders in the Americas Program), and foreign institutions (such as the University of West Florida’s Latin American Caribbean Scholarship). There is also the 100,000 Strong in the Americas Initiative launched by former US President Barack Obama, which is focused on increasing educational exchange in the Americas, and which has included Brazil-only rounds of submission. QS features a range of other important scholarships for Brazilian students.

We expect to see more scholarships offered to Brazilian students given the intensity of competition that now exists in this fast-growing source market.

Low English-language proficiency

A major problem limiting the potential of Science Without Borders was that many Brazilian students did not have the English-language proficiency to succeed in Western university programmes, and many of the receiving Western universities did not have supports in place to help to rectify this gap. Institutions recruiting Brazilian students today must be aware that English proficiency is still very low in Brazil and that language supports are crucial for many Brazilians entering undergraduate or graduate programmes.

High demand for English-language programmes

Thousands of Brazilian students go abroad every year to improve their English – and many of them have a further plan to study abroad in higher education.

A recent webinar from the research firm BONARD on recruiting students in Brazil featured Alexandre Argenta (Brazilian Educational & Language Travel Association, BELTA), Maura Leão (YET Education & Travel), André Simonetti (CI - Central de Intercâmbio Viagens) and Ivana Bartosik (BONARD). The panelists noted a “shift from General English to English Plus programs, especially among juniors, who are increasingly academically focused, seeking broader educational content alongside language learning.” As you can see in the chart below, language studies are by far the most common type of programme Brazilian students pursue abroad, and enrolment growth in this sector is much higher than for K-12 or higher education.

Select verbatims from the webinar underline the promise of the Brazilian market:

- André Simonetti: "Demand is really increasing [in 2024] and will keep on growing."

- Maura Leão: "Brazilians need a visa to go to certain countries so the trends move a little bit according to how [easily] they can get a visa. Brazil has more than 200 million people, and we have 44% between 5 and 34 years old. So it's a very young country and it's a country with a lot of potential."

- Alexandre Argenta: "We have already forgotten the pandemic in Brazil. Since 2022, we see larger [outbound numbers] than in 2020, and we expect at least stability in 2023 and 2024.”

Highlights from an April 2024 Brazilian Educational & Language Travel Association (BELTA) survey of 569 agencies include:

- The top three age ranges for Brazilian language students are (in order) 25-29, 18-24, 15-17;

- The most preferred study durations are (in order) up to one month (34%), 4-6 months (18%), and 7-11 months (11%);

- The main influences on study abroad choices are (in order) friends (25%), information on websites specialising in language programmes (20%), social media (20%), parents (19%), student fairs devoted to study, work, and travel programmes (15%);

- The most preferred study destinations are (in order) Canada, UK, US, Ireland, Australia, Malta, South Africa, Spain, New Zealand, and France.

- The top factors influencing destination choice are recommendations from family and friends (18%), location (14%), and natural beauty and tourist attractions (14%).

Higher education trends

QS’s recent survey report “On your radar: Latin America and the Caribbean” (drawn from a sample of over 3,000 students mostly researching higher education options in 2023) found that students from the region are most concerned with the cost of living when looking at study abroad destinations (79%) and look closely for available scholarships (69%).

In addition:

- 30% wanted to receive information on the outcome of their application within three days;

- 57% expected full and personalised responses to enquiries within three days;

- 51% said their top priority was for a destination to be safe and welcoming to international students;

- 64% said their top motivation for choosing a university was the availability of scholarships;

- 36% researched the sustainability efforts of institutions;

- The most appreciated assistance for students considering a university were “help with [their] application (52%), the ability to connect with existing international students (51%) and meeting with admissions staff at fairs or information sessions (50%).”

Enrolments across destinations

Our own research finds that there are at least 110,000 Brazilians studying abroad in 2024. Some destinations do not offer specific numbers, but rather growth rates, so 110,000 is likely a conservative estimate.

Argentina: 20,515 Brazilian students were in Argentina in 2020 according to the latest UNESCO data.

Australia: Brazil was Australia’s 8th largest market in 2023 (16,370 on study visas) and is, so far, 10th in 2024 (as of March 2024 government data, marking an increase in enrolments (17,540). In 2022, it was the Australian English-language sector’s #5 market (9,655 students, 296,460 weeks). BONARD notes, however, that Brazilian visa grants were down by 39% between Q1 2023 and Q1 2024 and calls this “an opportunity for other destinations.”

Canada: Brazil was the #12 top market overall in 2023 (15,615 students), posting 8% growth over 2022. For the language sector, it was #2 after Japan in 2022, with 12,370 students enrolled, up massively from 4,330 in 2021.

France: French institutions hosted 5,435 Brazilian students in 2021/22, up 7% from the year before.

Germany: There were 4,670 Brazilian students in Germany according to the last UNESCO count (2020).

Ireland: More than 12,700 Brazilian students were in Irish English-language programmes in 2023, making Brazil the 3rd largest market for the ELE sector.

Malta: Brazil was the 6th largest market for Maltese ELT providers in 2022, sending 2,090 students (under half the level of enrolments in 2019).

Portugal: Portuguese universities hosted 17,030 Brazilian students in full-degree programmes in 2022/23, making Brazil the top sending market.

Spain: There were 3,810 Brazilian students at all levels in Spain in 2021/22, mostly in degree programmes. Brazil was the 15th largest student market for Spain that year.

UK: Brazilian students contributed the 3rd largest volume of student weeks to UK ELT providers in 2023 and in 2022 was the second fastest growing market.

US: Brazil was the #4 market for US Intensive English Programs (IEPs) in the 2022 calendar year and for higher education providers, the 9th largest market in 2022/23 (16,030, +8% over 2021/22).

The Brazilian education system and recruiting environment

- The vast majority (over 75%) of Brazil’s more than 2,500 higher education institutions are private, and they account for almost 90% of enrolments in higher education. The quality of education delivered at these institutions is variable, and there is much more of a focus on practical training than on research.

- That said, top Brazilian universities have important areas of research expertise: including agriculture, biomedicine, engineering, physics, tropical diseases, biodiversity, and biofuels.

- Brazil hosts the most top-ranked universities in Latin America, with four in the top ten for the region: Universidade de São Paulo (#1), Universidade Estadual de Campinas (Unicamp) (#3). Universidade Federal do Rio de Janeiro (#6), and UNESP (8).

- Secondary school completion rates are far, far higher in the largest cities of Brazil than in rural areas and much higher among white Brazilians. Most affluent Brazilians attend private schools, where tuition is out of range for poorer households. There is also a growing list of international schools in Brazil.

- Many Brazilian outbound students have already completed an undergraduate degree in their country. They then go abroad for English-language studies to increase their chances at a job, and a growing proportion are interested in graduate studies. For example, in 2022/23, 49% of Brazilian students in the US were enrolled in undergraduate programmes but a significant 32% were studying at the graduate level.

- The Canadian province of Alberta offers an excellent guide to the Brazilian education system, including structure, accreditation, and credential comparison.

The US International Trade Administration also offers these important insights that are relevant not just to US recruiters but those in all destinations:

“Approximately 80 percent of Brazilian students who study abroad come from Brazil’s southern and central eastern states (São Paulo, Rio de Janeiro, Brasilia, Minas Gerais, Pernambuco, Rio Grande do Sul, and Paraná). Among these states (each of which presents excellent opportunities for overseas recruitment), São Paulo, Rio de Janeiro, and Brasilia represent the three best locations to recruit Brazilian students to study in the United States. São Paulo has the largest applicant pool (36 percent) and attracts the most talented students to its own university campuses. The capital city of Brasília (11.6 percent) located in Distrito Federal (Federal District) has the country’s highest GDP per capita at approximately USD $16,500, over twice that of São Paulo, the region with the second-highest GDP per capita. The state of Rio de Janeiro (13.3 percent), the country’s hub for the oil and gas industry, attracts many engineering and science majors.”

For additional background, please see: