Brazilian agents reporting strong growth this year with many exceeding pre-pandemic volumes

- A newly released agent survey shows growth in Brazilian outbound mobility this year

- Most agents report business growth equalling or exceeding pre-pandemic volumes

- The market remains heavily skewed to language studies and to English-speaking destinations

- Agents play a critical role and support the decision-making process of most Brazilian students heading abroad, but students are most influenced by information from social media, parents, and friends

More than half of education agents in Brazil (54%) say their business volumes this year have exceeded pre-COVID levels in 2019. Another 14% say that they are stable relative to 2019, but nearly a third (32%) indicate that their business is still operating below pre-pandemic levels.

The overall trend, however, is toward growth with volumes up 18% on average compared to 2019.

Growth in Brazilian student outbound is the main takeaway from this year's agent survey from the Brazilian Educational and Language Travel Association (Belta). The survey draws on responses from 317 agents across the country, both members of Belta and non-members, that were collected between December 2022 and April 2023.

Agents report that Brazilian demand remains overwhelmingly weighted towards language studies. But as we see in table below, there are some important shifts this year compared to 2019, especially with regard to professional courses (certificates or diplomas), which have jumped from the 5th most popular programme option in 2019 to 2nd this year.

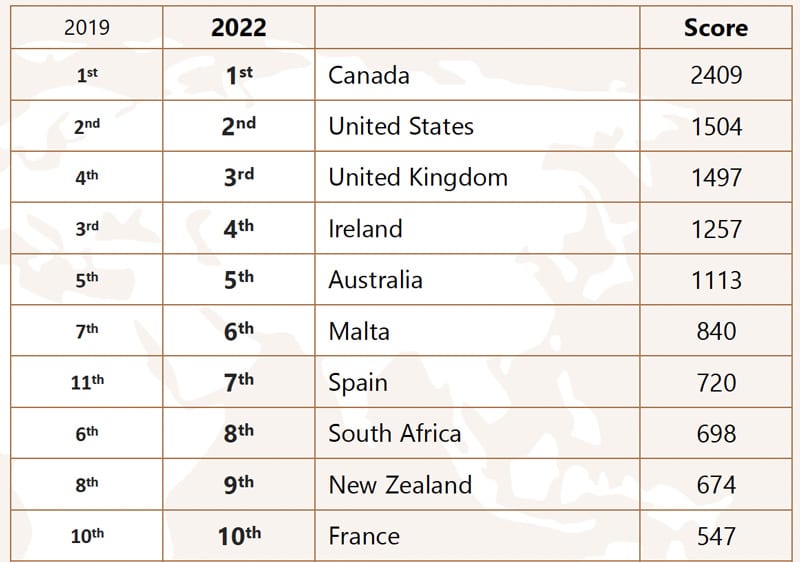

The survey reveals that Brazilian students are primarily motivated to study abroad by their interest in having an international experience, building language skills, and experiencing a new culture. Student preferences this year are very consistent with the patterns we saw before the pandemic, with English-speaking destinations – Canada, the US, United Kingdom, Ireland, and Australia – claiming the top spots in the table of preferred destinations.

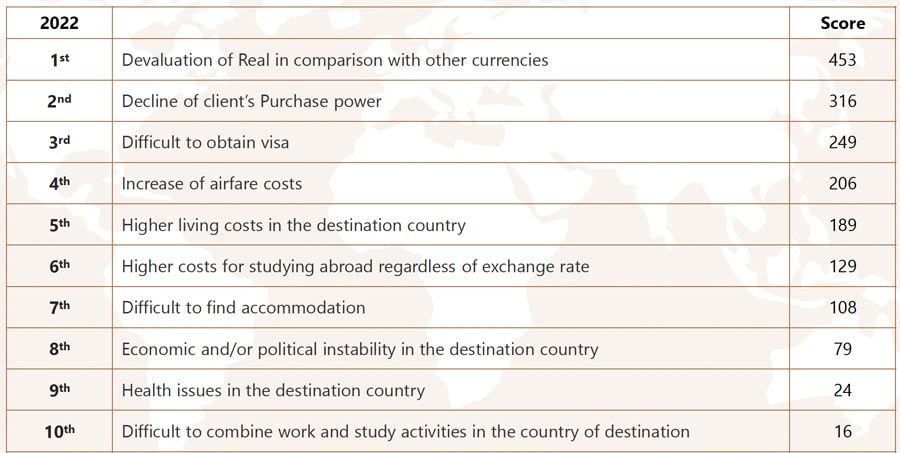

Perhaps not surprisingly, aside from any delays or difficulties in obtaining a visa, all major hurdles for students (as reported by agents) relate to rising costs this year. This reflects student or parent concerns around how the Brazilian real is performing against other major world currencies alongside rising costs of travel and costs of living across destinations this year.

Those cost concerns are reflected in the average reported spend for Brazilian students in 2022 of US$8,307 – a roughly 40% increase from the average spend reported for 2019.

That increased spending this year translated into an estimated combined total business volume of R$3.7 billion (US$760 million) for responding agents this year.

A parallel student survey, also conducted by Belta, finds that roughly two-thirds of outbound Brazilian students (64%) book their programmes through an agency. But the survey suggests as well that students rely heavily on social sources to inform their preferences and plans, including social media but also their immediate circle of friends and family.

Taken together, the findings point to continued strong demand in the Brazilian market, the importance of affordability and managing costs, the crucial role of education agents in recruiting Brazilian students, and the major influence of family and friends in shaping student choice.

For additional background, please see: