Agent survey finds growing interest in alternative destinations; many students “hedging” plans with multiple applications

- INTO’s annual global survey of education agents finds an increasing volume of applications for study abroad being submitted by students and agents

- Higher application volumes stem from students lacking clarity and certainty about preferred destinations’ policies and from a quest for “the best deal”

- Alternative destinations in Europe and Asia are becoming much more popular in the wake of new policy settings in the Big Four study destinations

The 2024 edition of INTO University Partnerships’ Global Agent Survey has just been released amid a context of intensifying competition for international students and policy-related volatility in top destination markets.

In total, 1240 agents from over 65 countries responded to the survey, which was distributed in March 2024. Chinese and Indian respondents made up roughly half of the sample.

Affordability matters

As INTO notes:

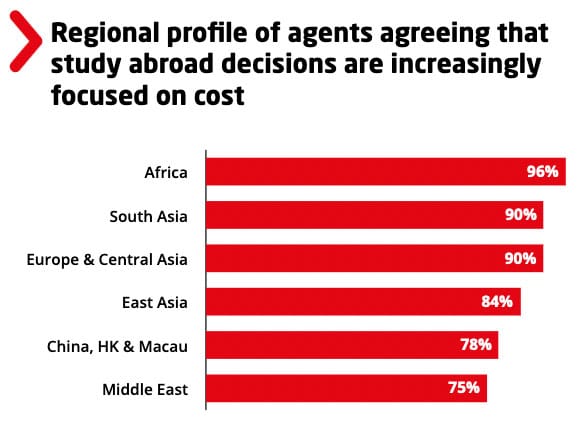

“Policy discussions that simply assume ranking or prestige of a university is the best indicator of quality of incoming international students significantly overlook the fact that affordability is a major barrier for students. Over 80% of our agents agreed that study abroad discussions are becoming increasingly focused on cost.”

Price-sensitivity was highest in Africa (96%) and lowest in the Middle East (75%).

Alternative destinations on the rise

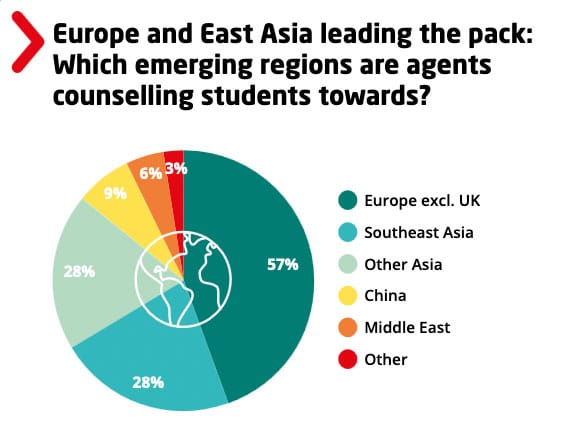

Three of the “Big Four” destinations (Australia, Canada, and the UK) have tightened their immigration settings and have become even more expensive to study and live in. Not coincidentally, agents indicate a growing trend of students applying to alternative destinations – especially in Europe and Asia.

Agents from South Asia and Middle East & Africa regions cited Europe the most (especially Germany and Ireland), while Chinese agents noted increased interest in intra-regional options, especially in Southeast Asia. Chinese agents also highlighted “rising interest in international schooling options, more localized pathway provision and a heightened sense of priority given to geographic and cultural proximity.” INTO suggests this means “there are significant opportunities for future growth in transnational educational arrangements.”

International students “hedging their bets”

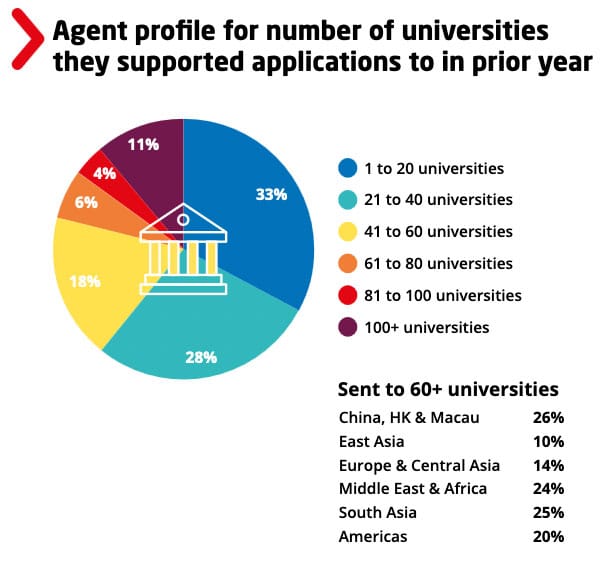

Students are applying to an increasing number of institutions and destinations, and many are working with multiple agents, hedging their bets. The noise created in the marketplace as a result is well illustrated in the finding that 21% of agents submitted applications to more than 60 universities in 2023, and 11% sent them to more than 100 institutions. As INTO notes:

“There are some strong incentives for students to [submit so many applications] at present. In some countries limited availability of visa appointments, or large delays to visa decisions, coupled with lack of clarity about evolving landscape, increase the reasons for needing a good back-up plan should their preferred destination become less desirable, or accessible.”

INTO points out the administrative burden placed on institutions with so many applications whirring around and sometimes little indication of which ones are from truly serious leads, calling it “pressure on universities to effectively resource admissions” that will “ultimately result in lower rates of conversion and enrolment.”

INTO makes a prediction for 2024 based on all the frenzied application-sending from anxious students:

“We believe that in 2024 this will likely impact on the timing of when students commit to study abroad decisions, both in terms of confirming places (and completing a financial deposit), or if primary choice remains uncertain, potentially opting to defer enrolment until greater clarity is available.”

Destination specialists are the exception, not the norm

Less than a quarter of agents said they specialised in sending students to only one destination in the past year. More than three-quarters (78%) said they’d recruited students to more than one destination; 44% had sent students outside of the Big Four (Australia, Canada, UK, US); and about a third (34%) had sent students to institutions across the “Big Four.” From this, INTO concludes:

“In this global, highly competitive and increasingly crowded landscape, it is essential that universities and colleges can find ways to clearly communicate their proposition in order to stand out and be positioned effectively relative to a global range of options.”

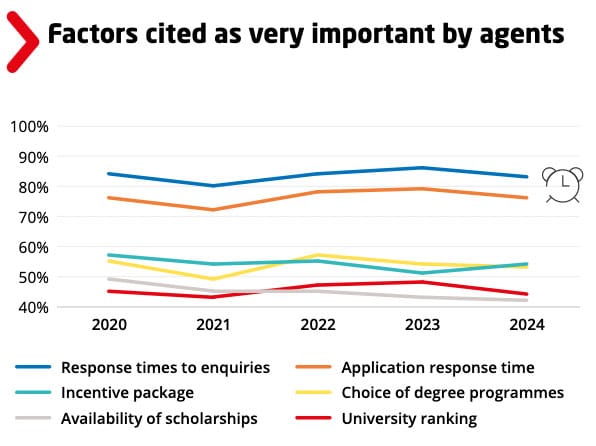

Time is of the essence

While institutions may not be able to control policies, they do have a lot more control over how well and how quickly they get back to student enquiries – and the chart below shows how important this is to agents.

INTO elaborates:

“Service response times stand out from the crowd in terms of importance to agents. It seems reasonable to conclude that delivering on these will enable institutions to stand out also. That does not mean that outcomes, student experience, employability don’t count. They do. But, if there is one area to focus limited resource, service standards feel like a great place to start.”

Growing participation in training and accreditation programmes

The past few years have seen an increasing number of professional qualification programmes available to agents, and the INTO survey shows that some of these are now industry standards. For example, “one in four respondents indicated they had participated in ICEF’s agent certification programme” and “of those sending to the UK, 79% of respondents indicated they had received some form of training from the British Council,” whereas, "By contrast, only 17% of those sending to the United States indicated they have received training or certification."

For additional background, please see: