Southeast Asian students increasingly considering “studying abroad” closer to home

- A new report provides insights on outbound mobility from Southeast Asia, as well as TNE and international school trends in the region

- Intra-regional mobility and TNE enrolments are becoming more common

- Agent use is common and the role of agents is expanding

For many schools, colleges, and universities, Southeast Asia is an increasingly crucial source of students given that (1) the push is on to diversify beyond India and China and (2) Southeast Asian countries send tens of thousands of students abroad every year. A new report from international education consultancy Acumen sheds light on mobility and internationalisation trends in the region, with a special focus on Indonesia, Malaysia, Thailand, and Vietnam.

Outbound mobility flows

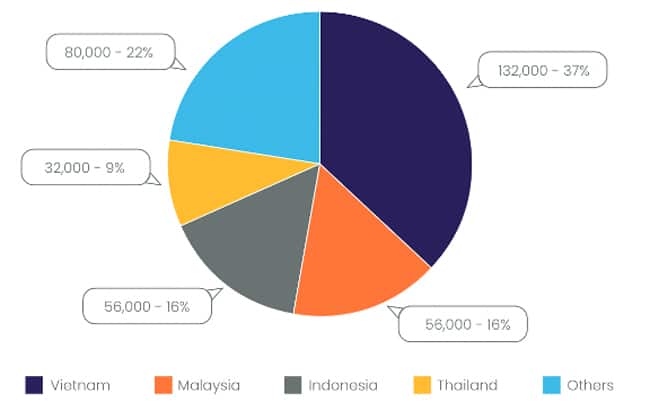

The 2024 Key Trends in Southeast Asia report shows that 132,000 Vietnamese students were abroad in 2021/22, representing 37% of the market. Malaysia and Indonesia each sent more than 50,000, while Thailand sent 32,000.

English-speaking destinations remain popular among Southeast Asian families, but there is now also significant interest in regional alternatives.

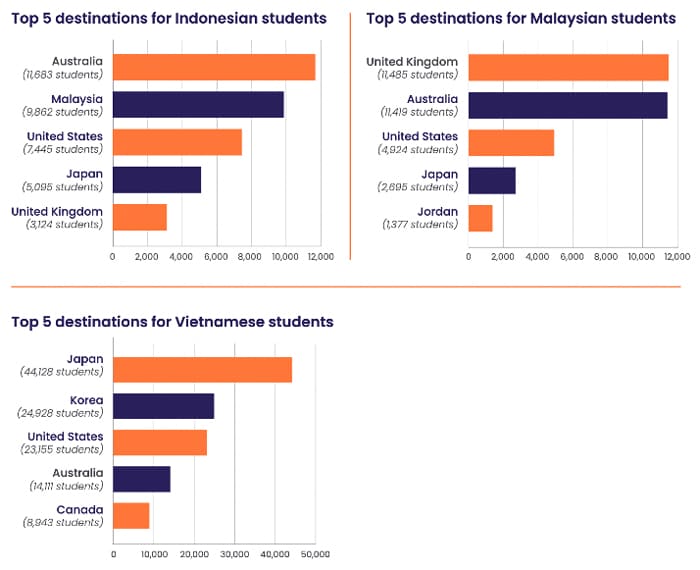

According to UNESCO data, Australia hosts the highest number of outbound Indonesian students, followed quite closely by Malaysia; the US, Japan, and UK round out the top five destinations. Malaysian students remain most interested in the UK, Australia, and US but some are also choosing Japan and Jordan. Vietnamese students, meanwhile, are more likely to be studying in Asian destinations than Western ones, as illustrated in the charts below.

China is not captured in UNESCO data but, leading into the pandemic, it was also very competitive in Southeast Asia. The Chinese government has not released international enrolment data for the years 2020–23, but in 2019, China hosted 28,600 Thai students, 15,000 Indonesian students, 11,300 Vietnamese students, and 9,500 Malaysian students – making it the top destination for a very hefty proportion of Southeast Asian students.

The report notes that Western institutions face more competition than before in Southeast Asia given Japan’s drive to increase its foreign enrolment to 400,000, Korea’s target of 300,000 by 2027, and Taiwan’s goal of 320,000 by 2030. These competitors are increasingly tying post-study work opportunities into their offer – a huge selling point for international students.

Asian destinations offer students from the region not only cost savings (due to proximity), but also a robust set of top-ranked universities. For example, 33 Asian universities ranked within the 2024 Times Higher Education top 200, up from 28 in 2023. The US still has a higher number of institutions in that top rank (56), but it also has a very strong currency in 2024 that makes it more expensive to study there.

The allure of TNE

Along with intra-regional mobility, transnational education (TNE) is becoming more entrenched in Southeast Asia not least because it offers even more of a cost benefit (e.g., no travel, no accommodation expenses. The report notes:

“We are seeing significant and sustained interest from international institutions to engage in TNE partnerships in Vietnam, including increased interest from higher ranked universities, as well as from local universities for full in-country delivery of international degrees."

Acumen’s experts consider Vietnam to be a market where there is solid room for expansion, saying it presents “considerable opportunities for institutions able to offer full in-country delivery, through branch campus, ‘campus within a campus’ models, franchise and other types of 4+0 arrangements.”

Australian providers are deepening their TNE presence in the region, notes the report, and becoming more invested in a niche market: professionals wanting to fast-track their careers through micro-credentials and shorter degrees. Overall, Acumen estimates there are now about 20,000 Vietnamese students enrolled in Australian TNE programmes, with RMIT, Swinburne, and Western Sydney University the market leaders.

Southeast Asian students are increasingly drawn both to both stand-alone programmes and to programmes that transition to a study abroad experience, says the Acumen team, and TNE (including progression agreements) are a highly important recruitment channel in the region, “particularly in Malaysia where financial constraints and post-pandemic travel hesitancy mean this option is becoming increasingly attractive.”

International schools’ popularity

Enrolments are trending upward in bilingual and international schools in the region: 600,000 students were enrolled across 1,905 international schools in 2022 – an increase of almost 25% compared with 2017. Acumen’s executives believe this demonstrates “the growing ability and willingness of families to pay for an international education, at an earlier age” and that higher enrolments will also serve to better prepare Southeast Asian students for study abroad.

There are variations across markets:

“In Vietnam for example, the fastest growing market segment has been premium bilingual schools (rather than full international schools.) In Malaysia, which has a mature international school segment, A-levels are becoming less popular due to a range of factors. This includes the emergence of alternative and more cost-competitive university pathways, as well as the academic rigour of A-levels, which is less attractive to some students seeking a less challenging route to tertiary education.”

Southeast Asian families’ growing interest in international and bilingual schools does present a competitive threat for some providers. The report warns that “foundation pathways are facing intense competition from this market segment,” and that Indonesian families , in particular, perceive “international school qualifications … as offering more flexibility and portability for students than foundation pathways, which are perceived as locking students into a particular institution.”

New directions for agents

Acumen’s experts note that Southeast Asian families’ common use of education agents fits into a larger context of using agents or intermediaries in general, for banking to real estate. Parents’ reliance on agents remains strong amid a prevalent post-pandemic legacy of increased concern about sending children abroad. Parents look for “individualised, humanised service which is difficult for education providers to deliver from a different country and time-zone and without a deep understanding of local cultural preferences.”

Agents may be called on for more specific advice and services, as noted in this passage from the report:

“As consumers sharpen their focus on ROI from international education, agents will become less focused on providing general information to families and will concentrate instead more on specialised advice, pastoral care and graduate outcomes, beyond what institutions may be able to offer directly.”

Shifting patterns in Malaysia

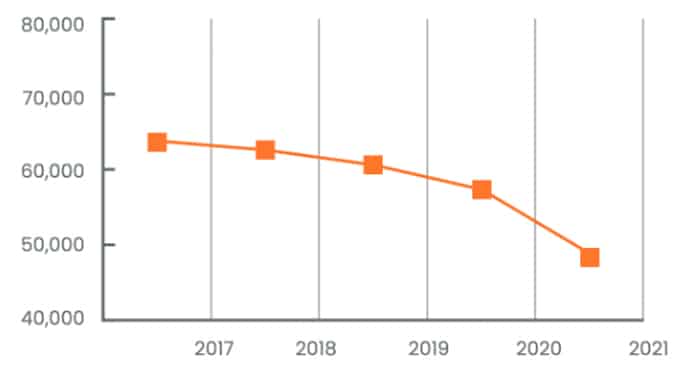

Malaysian demand for foreign education is changing in important ways. For example, Acumen research shows that while the UK remains the top market for Malaysian students, Australia is once again becoming more competitive. In contrast, undergraduate Malaysian enrolments are declining in the US, likely due to the Ringgit’s weakness relative to the US dollar.

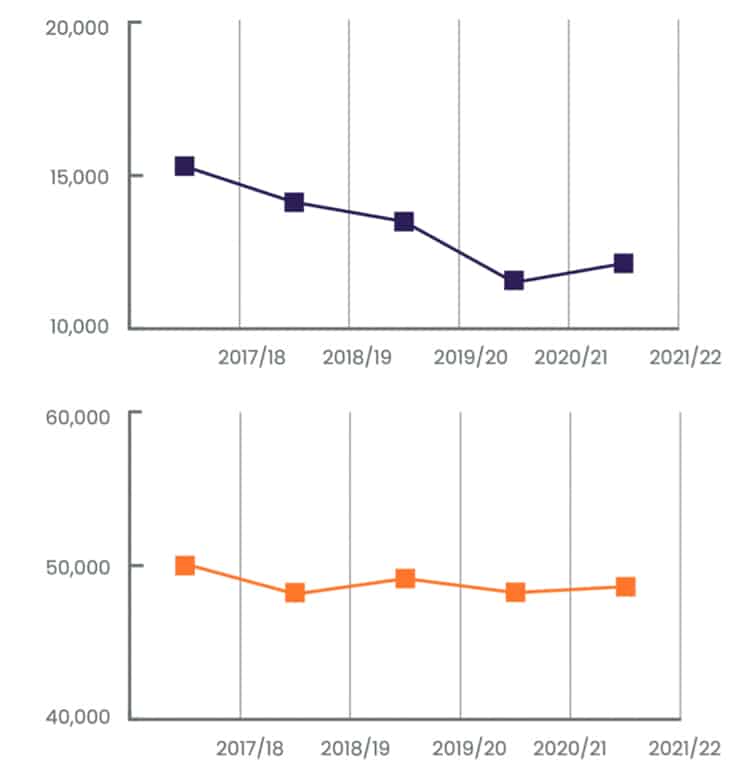

The report also charts increasing (1) postgraduate demand among Malaysian students bound for the UK and Australia and (2) interest in TNE delivered in Malaysia. The following charts from the report show how the UK has been able to maintain its dominant position in Malaysia in no small part because of its TNE provision in the market.

Getting it right in Southeast Asia is a must

Supply/demand dynamics in Southeast Asia make this region a crucial one for many student recruiters. As Acumen points out:

- Supply: “Some local education systems in Southeast Asia face both capacity and quality constraints, opening up further opportunities for international education providers. In 2021/2022 only 550,000 places were available for new enrolments at Vietnamese universities, for 795,000 applicants - a shortfall of almost 250,000 places.”

- Demand: “The region’s economic development has led to a rising middle class with the financial capacity to pursue higher education, including TNE programmes offered by foreign institutions. Southeast Asia is home to some of the fastest growing economies in the world, led by Indonesia, Vietnam, and the Philippines.”

Read the full report for Acumen’s comprehensive review of the region’s potential and advice for recruiting effectively in an ever-more competitive context.

For additional background, please see:

- “Recruiting in the massive – and unique – international student market of Indonesia”

- “Malaysia exceeds target for new international student applications in 2022”

- “South Korea aims to attract 300,000 international students by 2027”

- “Vietnam remains a key growth market in Southeast Asia”

- “UK: Transnational education expands at fastest rate ever”