Market snapshot: A guide to international student recruitment in Vietnam

- Vietnam is the top Southeast Asian market for many international educators

- The shape of outbound mobility from Vietnam is changing quickly

- Two of the most important trends are (1) a huge proportion of students choosing to remain in Asia – especially Korea, (2) the popularity of TNE in Vietnam and a growing number of international schools in the country

FAST FACTS

Capital: Hanoi

Population: 99,200 million (2024)

Youth population: 17% of the population is aged 17–25

Median age: 31.6

GDP: US$469.6 billion (2024)

Currency: Vietnamese dong (VND)

Language: Vietnamese

Main language of instruction: Vietnamese in most schools and universities. However, Vietnamese universities are increasingly looking at students’ English-language proficiency in their admissions decisions.

English proficiency: “Moderate” and climbing (it was placed in the “low” tier by EPI as recently as 2021).

Religion: 55% Buddhist. Confucianism, Taoism, Catholicism and Cao Dai are also practiced by significant minorities.

Geography: Vietnam is in Southeast Asia. China is to the north, while Laos and Cambodia are to the west.

Largest cities: Ho Chi Min City (HCMC – 8.2 million residents), Ha Noi (7.4 million), Hai Phong (1.9 million), Can Tho (1.2 million), Bien Hoa (1.1 million), Da Nang (just over 1 million).

Outbound students: 137,000 according to the last UNESCO count. International education consultancy Acumen research says Vietnam represents 37% of the Southeast Asian market, ahead of Malaysia (16%), Indonesia (16%), and Thailand (9%).

Top fields of study for Vietnamese looking at study abroad: Tourism, STEM, business studies, and health-related studies

Vietnam continues to be a key Southeast Asian market for international educators recruiting students abroad. Close to 140,000 Vietnamese students are currently abroad for higher education, and many more are enrolled at the sub-degree level and in language studies.

There is solid potential for growth: almost 30% of Vietnam’s population is expected to be in the middle class by 2026, and by 2035, the middle-class proportion will rise to over half. McKinsey predicts GDP growth of 2% to 7% between now and 2030, and the firm considers Vietnamese consumers to be among the most optimistic in the world. In 2023, McKinsey observed “a clear intent by consumers to ‘splurge’ and treat themselves, with more than 70 percent of respondents saying they intend to increase spending on categories of products or services they spent less on over the past year and a half.”

They may be optimistic, but Vietnamese are also practical and research-oriented when it comes to how they spend their money. McKinsey research found that “90 percent [noted] price increases, fears of inflation, gas shortages coupled with higher fuel prices, and rising interest rates … These mounting financial pressures and uncertainties are accelerating consumers’ shift to more discerning shopping choices.”

Vietnam’s economy grew more slowly than forecast in 2023 (+5% compared with a forecast 6.5%). In 2022, it had expanded at the fastest rate in decades, at 8%.

That Vietnamese are both optimistic and highly aware of economic factors impinging on their ability to spend freely is important for international student recruiters. These characteristics influence families’ decision-making about study abroad. For example:

- Intra-regional mobility: Vietnamese are considering destinations in Asia as much as they are opting for Western institutions. A recent study from Acumen found that Japan and Korea now outpace the US, Australia, and Canada in terms of their popularity among Vietnamese families. Japan and Korea are more affordable, boast highly ranked institutions, and are closer than Western destinations. The 2024 Times Higher Education World University Rankings place 33 Asian universities in the top 200, up from 28 in the 2023 edition.

- Transnational education: Vietnamese now have a solid array of transnational education (TNE) options in their country. Students can study towards prestigious foreign degrees without having to incur the costs of travelling and living abroad. Acumen notes:

“We are seeing significant and sustained interest from international institutions to engage in TNE partnerships in Vietnam, including increased interest from higher ranked universities, as well as from local universities for full in-country delivery of international degrees. [We see] considerable opportunities for institutions able to offer full in-country delivery, through branch campus, ‘campus within a campus’ models, franchise and other types of 4+0 arrangements.”

- Language proficiency: More Vietnamese families in the middle class means more Vietnamese families are able to send their children to a local international school where they can learn in English (or another language) as well as in Vietnamese. The number of international schools in Vietnam is growing very quickly, on par with expansion rates in China and Japan. This represents a challenge for foreign English-language providers given that a larger share of students will be proficient in English by the time they graduate high school in Vietnam. Community colleges and pathway programmes may also find recruiting Vietnamese more challenging for the same reason.

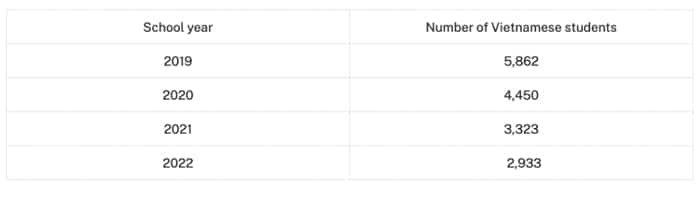

- Level of study: With higher quality domestic options now more available to them at both the primary/secondary and tertiary levels, Vietnamese students are increasingly choosing to wait till graduate school for study abroad, though the majority of degree-seekers are still travelling for undergraduate degrees. In 2023, for example, 17.2% of Vietnamese students in the US were in graduate programmes, up from just over 15% in 2019. Enrolments in master’s programmes are driving the trend. By contrast, the number of Vietnamese students in US K-12 programmes in has been declining steadily, though Vietnam remains in the top 5 source countries for US boarding schools after China, South Korea, Mexico, and Spain.

Study abroad: Korea is by far the top destination

The most popular study abroad countries among Vietnamese students are Korea, Japan, Australia, Taiwan, China, US, Canada, and Germany.

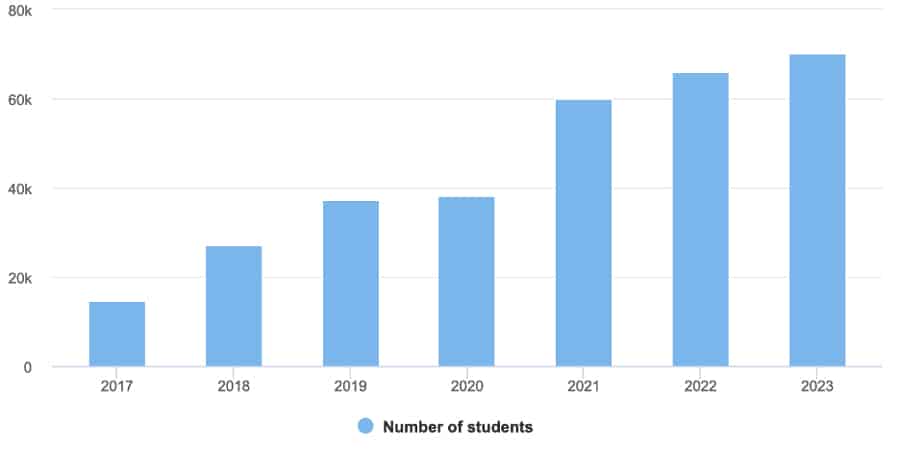

There are now 73,000 Vietnamese students in Korea according to the Korean Immigration Service – a huge increase and one that makes Vietnam Korea’s top international student market, ahead of China, which sent 67,450 in 2023.

University World News reports that most Vietnamese in Korea are in short programmes such as language courses. Learning Korean is a trend in Vietnam and one fuelled by career considerations. VNExpress reports:

“Strong investments by South Korean corporations like Samsung, LG, Hyundai or Lotte Group into Vietnam has massive amounts of Vietnamese employed by Korean companies. By April, South Korea was the largest foreign investor in Vietnam, with total registered capital at $82 billion. The country also ranks second when it comes to ODA, and third when it comes to trade with Vietnam.”

According to the office of South Korean President Yoon Suk-yeol, “Vietnam has the largest-scale and most comprehensive Korean language training and program in Asia.” And according to a 2019 survey by the University of Languages and International Studies, “the rate of language graduates securing jobs after graduation is highest among those studying Korean, at 98%.”

The next most popular destinations are Japan, with 49,000 Vietnamese students according to Intead, and Australia (about 33,000 in 2023). Taiwan is hot on the heels of Australia, hosting close to 24,000 in 2022, up 26% over 2021.

China hosted more than 11,000 Vietnamese before the pandemic. While more recent, post-pandemic numbers have not yet been officially released, this number seems to have more than doubled. Mr. Hung Ba, Chinese Ambassador to Vietnam, spoke at a graduating ceremony in Hanoi in August 2023 and said that 27,000 Vietnamese students were in China in 2021/22. Of that number, 1,700 were on scholarships.

There were just under 22,000 Vietnamese in American colleges according to Open Doors 2023, and 17,200 Vietnamese were in Canadian programmes of 6 months or longer 2023.

Vietnam is a priority market for the UK, despite the UK lagging other Western destinations in terms of attracting Vietnamese to on-campus study; under 5,000 Vietnamese are on higher education campuses in the UK. The British Council, comparing the UK’s share of Vietnamese students compared to Australia, Canada, and the US: “Only six per cent of outbound higher education students [from Vietnam] choose the UK [in 2020/21], down from 13% in 2013/14.”

But the UK is performing well in terms of its TNE provision in Vietnam, with about 80 UK institutions enrolling over 5,000 Vietnamese students. Vietnam is the UK’s 10th largest country for TNE and the top growth market in Asia.

Otherwise:

- Germany hosts over 7,000 Vietnamese students, and it also enrols nearly 3,000 students at the Vietnamese - German University (VGU) in Ho Chi Minh City.

- France enrols about 5,000 Vietnamese students.

- Malaysia hosts about 1,000, and the Malaysian and Vietnamese governments are working on increasing educational agreements.

- Vietnam is a top 3 market for New Zealand, with 5,000 students enrolled at all levels – particularly K-12 – before the pandemic.

Broadly speaking across sub-sectors, Vietnam is top student market for Korea, the second largest for Japan, the 5th largest student market for the US, the 6th largest for Australia, and the 8th largest for Canada.

In terms of growth trends, Canada and the US have not yet regained the numbers of Vietnamese students they had pre-pandemic. Australia has exceeded the 2019 volume, and Vietnam is a growth market for Korea, Japan, and Taiwan.

Top influences

In a 2022 INTO Universities survey, more than 4 in 5 student-respondents stressed the importance of parents as key influencers in their study abroad choices. Parent-respondents echoed the point and indicated that they especially influence choices around study destination, choice of institution, and field of study. Ms Bich Ngoc Vu, INTO’s senior country director for Vietnam, noted: “We in the international education sector must understand that, at least in the context of Vietnam, we are oftentimes communicating with a multi-generational audience, and figure that into our approach to better serving students.”

The INTO survey found a distinct preference for online versus print marketing materials and information, and 92% of students said that face-to-face interaction with university representatives and agents is very important to them.

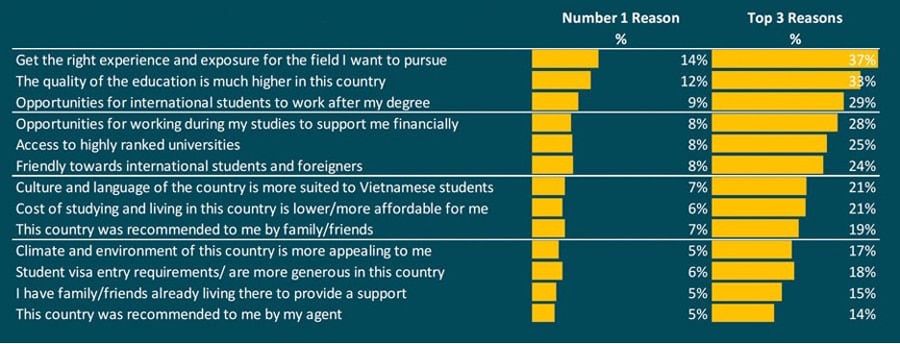

In terms of motivations, Vietnam has always been a price-sensitive market. Even though the economy is growing faster than many and more families can afford study abroad, scholarships are important as competition for Vietnamese students heats up. The US Trade Department observes:

- Vietnamese students in wealthy, upper-class families are still willing to study abroad without scholarships, but they take pride in earning them.

- Vietnamese students in middle-class families can still afford lower-ranking schools, but they prefer scholarships from high-ranking universities.

- Vietnamese students in lower-class families depend on scholarships and/or financial aid to be able to study abroad.

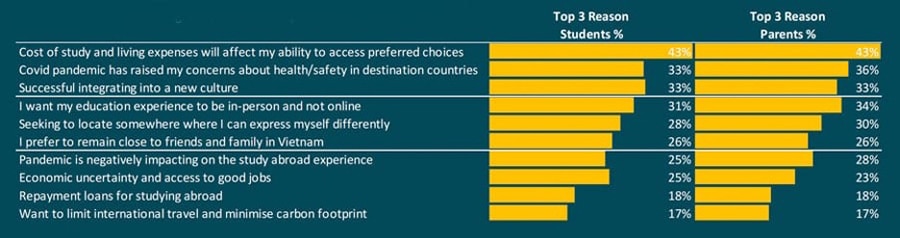

INTO’s research shows that post-graduation work opportunities are also a key factor in Vietnamese families’ study abroad decision-making, and the option to work while studying matters to a significant proportion. The top concern for prospective Vietnamese students is not being able to afford the cost of studying and living, and many are also worried about safety.

Geographical considerations

The US Trade Department notes that it’s important to be aware of regional differences in Vietnam regarding what families prioritise in study abroad:

“In the southern regions, location and financial aid/scholarship packages are key drivers for families. In contrast, in the north of Vietnam, families pay more attention to the ranking of the schools and key performance statistics such as test scores and the number of graduates that move on to 2 and 4-year colleges and universities.”

In 2022, IDP IQ’s Demand Tracker found that:

“Roughly 40% of demand comes from here followed by 30% from the capital city Hanoi. However, there are opportunities in other key cities for institutions since Vietnam is a diverse country with different skills and development needs in each region… for instance, Danang and Hoi An are growing hospitality and tourism industry centres.”

The British Council notes:

“Hanoians are more conservative and more of a challenge to convince, while Saigonese are more open minded and more willing to experiment with new ideas. Therefore, it will typically take more time for you to follow up with prospective parents/students in Hanoi than in HCMC. While traditional advertising channels such as newspapers and magazines are still preferred in HCMC, digital channels such as news sites, social networks and forums have more impact in Hanoi. Word-of-mouth and referrals from alumni and family members also affect the decision-making process of parents in Hanoi more than with those in HCMC. Institutional ranking and prestige of the foreign institution also much matter to Hanoians, meanwhile Saigonese care more about practical benefits that really fit what they need. Scholarships and tuition fee discount will help you win a student in Hanoi, but not always in HCMC.”

Marketing considerations

The US Trade Department’s January 2024 brief on Vietnam notes:

“The most popular social media sites for Vietnamese students are Facebook, YouTube, Instagram, and Tik Tok. Vietnamese parents are highly engaged on Facebook. These users aged 18 – 35, account for 75% of the Facebook users in the country. It is also a popular platform for streaming videos.

Regarding search engines, Google takes the top position among Vietnamese users. Standing second is a local alternative: Coc Coc These search engines will lead users to educational opportunities, such as the official institutions’ websites. Thus, investing in and updating your website is an effective way to promote the institutions.

LinkedIn is the most popular platform that students use to search for job opportunities. Users receive job advertisements and get alerts on free training programs.”

What does the changing composition of Vietnamese outbound mean?

Lack of quality K-12 schools – and universities – in their country has traditionally been the top driver of demand for study abroad among Vietnamese families. This has created ample opportunities for foreign K-12 schools, pathway programmes, and English-language training providers.

But this is changing – and fast. Increasing proportions of Vietnamese students are enrolling in international K-12 schools and TNE at the tertiary level – in Vietnam. This means that more Vietnamese families are choosing domestic options for good parts of students’ school careers. It will be more challenging for Western institutions to compete at the K-12 and undergraduate level especially given the growing popularity of Korea and Japan as study destinations among Vietnamese families.

Scholarships could be a crucial element of recruitment strategies, and highlighting post-study work opportunities and work placements will also provide an edge. The British Council also notes: “Once in the UK, Vietnamese students need access to a careers service where they can access information about local employers and relationships with them, so that they will be better prepared before returning home, and then can get employment in Vietnam more quickly.”

Given the intense competition for Vietnamese students, on-the-ground representation via agents, in-country representatives, and school/university staff and faculty is a must.

Speaking with Intead, education consultant Hien Do provided this advice to US educators recruiting in Vietnam; the advice is relevant for institutions in other countries as well:

- “Provide application assistance. The university application process to get into a Vietnamese university is more straightforward than the process used by US institutions. So, applying to the US can be intimidating. Providing clear insight on the must-have vs nice-to-have aspects of applying to your institution can go a long way. Also talking about the selection process, including any specific test score or GPA requirements, can help students set their expectations.

- Focus on the personal touch. Be responsive. Handle emails and inquiries promptly so prospects feel less intimidated and more seen. Connection matters so much and can make all the difference when it comes down to the prospect’s decision. [Dao recalled what an impact it made when Michigan State University sent someone to the airport to pick up her nephew on his big flight to the US: ‘His parents could not stop talking about it. He was half a world away and it made a big difference. It was a big deal.’”

Finally, a key consideration for Western schools and universities today in terms of Vietnam is whether they can begin, or expand, partnerships with Vietnamese universities. These institutions have become much more interested in collaboration and joint/dual degrees than in the past, and partnerships have become one of the best new pipelines leading students from in-country to overseas studies.

Helpful links

- A list of international schools in Vietnam can be found here.

- Vietnam’s top universities are Duy Tan University, Ton Duc Thang University, Vietnam National University, Hanoi University of Science and Technology, and Hue University.

- Vietnamese Ministry of Education and Training

- Information on Vietnamese universities requiring higher English proficiency

For additional background, please see:

- Get first-hand market insights and connect with agents from Vietnam and throughout the region at ICEF South East Asia, 11–13 June 2024, Ho Chi Minh City, Vietnam

- “Southeast Asian students increasingly considering studying abroad closer to home”

- “Parents and in-person counselling key factors in recruiting Vietnamese students”

- “International school openings, enrolments, and revenues continue to expand”

- “UK transnational education expands at fastest rate ever”