Global ELT market estimated to have recovered to 90% of 2019 levels in 2023

- A new BONARD research report reveals significant changes in the shape of demand for ELT

- Of the eight major English-language destinations, some are facing more challenges to their post-pandemic recovery than others

- BONARD identifies rising English-language proficiency in key markets and intra-regional mobility in Asia as top challenges for the leading destinations

- Visa processing delays and high rates of visa refusals in some countries also appear to be affecting market share of the global ELT market

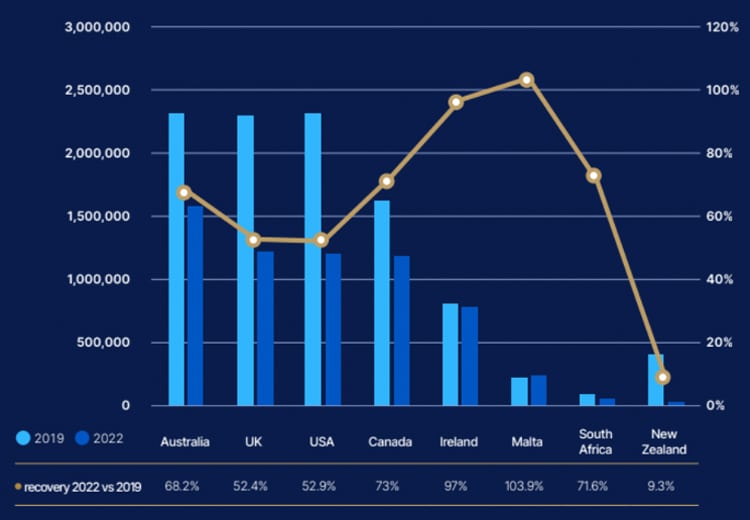

Every year, the research firm BONARD tracks the performance of the ELT sector in the major English-language destinations of Australia, Canada, Ireland, Malta, New Zealand, South Africa, the UK, and the US. Its research programme is widely recognised as a comprehensive performance benchmark for the sector.

In December 2023, the firm published a report detailing trends in 2022 and part of 2023 that serves as an indication of what may happen in 2024. Full-year data for 2023 may not come out until later this year, but the report – “Global ELT Annual Report 2023” – can be considered the most recent authoritative source of information about the current shape of global ELT.

Summing up the contents of the report, Dr Ivana Bartosik, BONARD’s international education director, said:

“The global sector is reconfiguring, with new source countries growing fast and other traditionally strong source countries which the sector relied upon – the likes of China, for example – being slower than expected in their recovery. We have also tracked some shifts in students’ preferences in terms of destinations and courses. While some of these shifts may be temporary, it is important for the sector to be aware of them.”

On the basis of available data, BONARD estimates the global ELT sector will have come very close to its 2019 volume – 90% to 95% – in 2023 on the heels of 2022 when “the sector recovered 63% of its pre-pandemic student week volume and 55% of its student numbers.” Performance has been mixed across destinations, with certain countries boosted or dragged down by specific factors. For example:

- Canada was strong in 2021 but hampered in the second half of 2022 because of visa processing issues;

- The UK posted impressive volume increases but recovery in some markets was weak and Brexit continues to affect mobility to the UK from key source markets;

- US ELT providers faced visa processing issues and high rates of visa refusals.

Australia, Malta, and Ireland all rebounded well in 2022, less challenged by the issues faced by the language travel sectors in Canada, UK, and US. In particular, Malta exceeded its 2019 volume – the singular destination of the eight in this respect.

Source markets

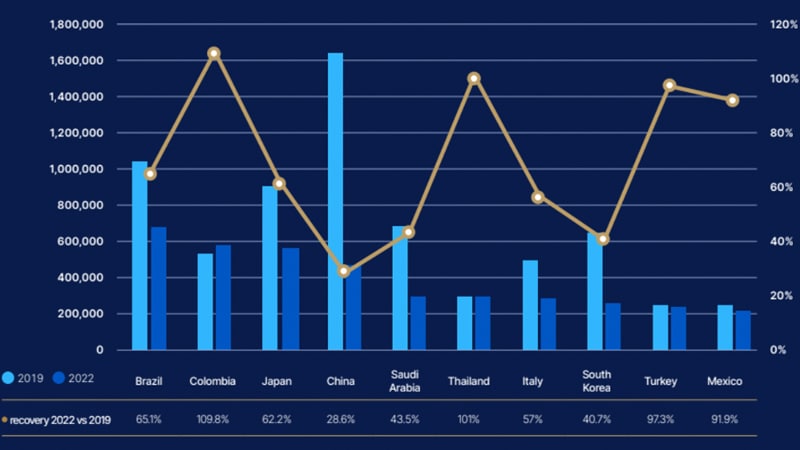

Latin American students were major drivers of the overall rebound in 2022–2023, with the key markets of Colombia, Chile, Argentina, Peru, and Ecuador fully recovering their 2019 market volume. Australia and Canada are the chief beneficiaries of this trend.

Japan displaced China as the largest Asian market in 2022 – but this was also linked to China’s borders being closed for longer than Japan’s during the pandemic. Now that China’s borders are open once again, stronger outflows from this market can be expected. Thailand jumped to the #6 position, exceeding its 2019 volume.

Demand from Turkey was solid – and this market recovered to 97% of what it was in 2019.

Mobility from Italy was much weaker than from the rest of Europe. Italy regained 27% of its 2019 value compared to the overall European rebound of 80%. This slower rebound is troublesome especially for ELT providers specialising in youth programming, as Italy is the main market for this sub-sector.

Top trends

BONARD notes the following as noteworthy shifts in the global ELT market:

- Slower recovery in the junior sector, in part because of accommodation shortages;

- Longer stays by students, in part because of the rising cost of air travel;

- Lower average age of students;

- Shortage of staff – vacancies are still high even after the pandemic;

- Destinations losing or gaining market share because of visa processing issues.

Top challenges

English proficiency: BONARD experts note that students in key source markets are becoming better at English due to better in-country English-language teaching quality, which will have a massive effect on the global ELT market. To remain relevant, BONARD analysts believe “investing in the development of a unique and highly specialised education offer” will help to convince students that there is still value in studying English abroad.

BONARD Chief Intelligence Officer Patrik Pavlacic elaborates:

“This could involve connecting students with networking opportunities, professional development, and career prospects. Destinations where students have access to work opportunities may gain a competitive advantage in this changing landscape. However, work rights alone will not be enough. It will be essential to provide students with meaningful work opportunities that enhance their personal and professional growth and meet their individual goals.”

Branch campuses: BONARD has also observed rising interest in opening branch campuses and other TNE initiatives among the larger ELT providers. This dovetails with IDP data suggesting that in general, students are becoming more open to the idea of obtaining foreign degrees delivered in their own country. IDP data showed a 10% drop between 2021 and 2023 in the proportion of students saying they preferred to study abroad rather than at an accredited partner of a foreign institution located in their own country.

Intra-regional mobility: BONARD is noticing a distinct trend of Asian students staying within Asia to learn English, with the result that ELT providers in Singapore, the Philippines, and Malaysia are enjoying significant demand. More broadly, we noted the allure of regional hubs in our predictions for 2024.

Pronounced shifts demand new strategies

The BONARD report underlines how quickly the ELT industry is changing – and that some of the shifts are particularly challenging for providers in the traditionally leading destinations. Those providers must contend with rising English proficiency in top source markets, rising intra-regional mobility in Asia, accommodation shortages, and sometimes their country’s reputation for slow visa processing and/or high rates of visa refusal. BONARD’s advice for ELT providers facing those sorts of issues – i.e., that they develop new competitive advantages – is astute.

For additional background, please see: