New forecast warns that US is falling behind in the global race for talent

- A new analysis finds that the US is losing market share of tertiary-level international students to Australia, Canada, and the UK

- India is forecast to become the #1 source market for US educators by 2030, and Nigeria is expected to vault from 10th position to 3rd

A new HolonIQ analysis focused on the US and its competitive position relative to other leading study abroad destinations finds that:

- Within the total global international education market, the US is losing share of foreign students to Australia, Canada, and the UK.

- Unless it can reverse this trend, it will face serious challenges in (a) competing for the world’s brightest students and (b) filling STEM jobs with talented workers. STEM industries and workers are the main drivers of countries’ innovative and scientific power.

These conclusions arise from preliminary findings from a special US focus that is part of Holon’s Global Student Flows Project, launched in 2018 to chart and forecast the flow of international students studying in higher education in various countries around the world.

Preliminary findings stem from “a 12-week effort including over 40 interviews with policy makers and economists, source and destination country higher education experts and the latest versions of our global flows qualitative framework and quantitative forecasting models.”

Overall predictions for international student mobility

International student mobility rebounded quickly once the most acute phase of the pandemic ended and travel restrictions fell away. HolonIQ expects growth to continue until 2030 at a rate of 4.2% versus a historical average of 5.2%. The most likely scenario, says the firm, is that 9 million students will travel abroad for higher education by 2030, up from just over 5 million in 2019. Those students are expected to spend more than US$500 billion while studying in their host countries.

What’s happening in the Big Four destinations?

Overall, the “Big Four” together account for 37% of the total share of international students. However, that 37% is now dispersed quite differently across the four destinations than it used to be. Australia, Canada, and the UK have been competing much more vigorously than the US for international students in recent years and as a result, says HolonIQ:

“The US has dropped from just under 60% share of the Big Four in 2000 to around 40% today, losing almost 20% share to the other three. If the US had held on to the position it had in 2000, today the market would have an additional 350,000 students and $20B+ of direct expenditure, primarily tuition for US Higher Education Institutions.”

In contrast to record-high growth in international enrolments for Canada in the UK in recent years, the US trend was “a clear deceleration to 0.1% growth over the five years [leading up to 2019/20].”

India predicted to be # 1 source market for US

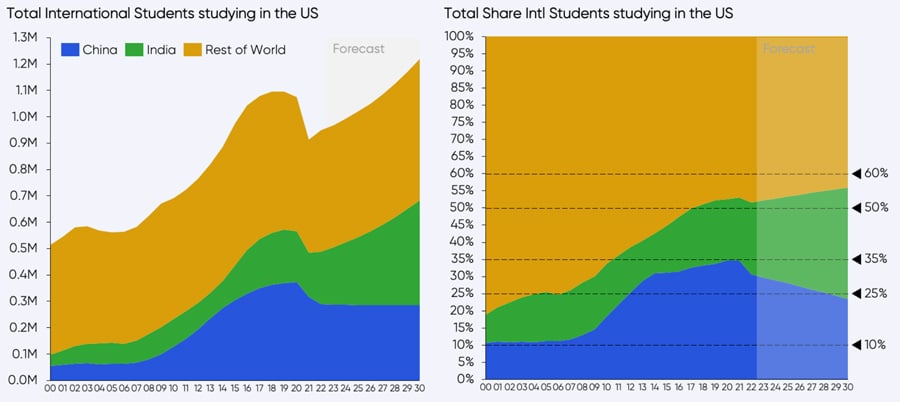

Before the pandemic, Chinese students made up about 35% of international students in the US, and China has been the main source market for US institutions for years. But the flow of Chinese students has been weakening, and SEVIS data show that the number of Chinese students in the US fell by -29% between January 2020 and January 2023 (368,800 to 262,992). By contrast, the number of Indian students grew by 30% in that same time frame to 253,630. This year, Indian students represent almost the same share (23.4%) as Chinese students do (24.3%) in the total US international student population (spanning all sectors and levels of study).

HolonIQ sees this trend accelerating to the point that there will soon be more Indian than Chinese students in the US (see following chart). By 2030, Indian students may well represent 1 of every 3 international students in the US. If Chinese outbound to the US strengthens more than expected, Chinese students could compose the same proportion – but there is considerable doubt as to whether it will strengthen. Overall, the firm forecasts over 1.2 million international students pursuing higher education in the US in 2030.

What about emerging markets?

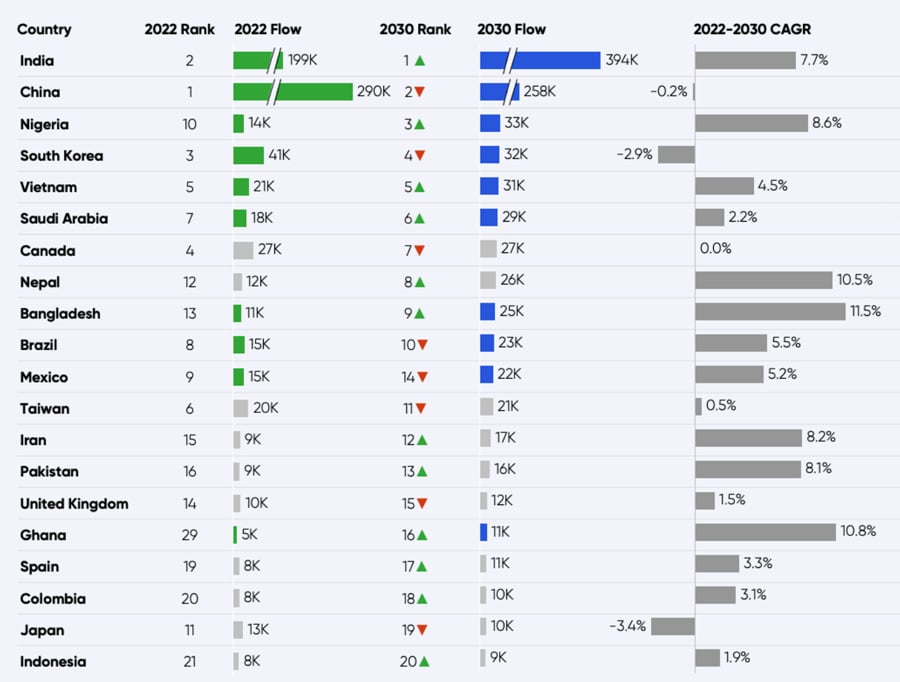

After India and China (see next chart), Nigeria is expected to vault into the #3 spot from its #10 position in 2022. That forecast sees the number of Nigerian students jumping from 14,000 in 2022 to 33,000 in 2030. Rounding out the top five, predicts HolonIQ, will be South Korea and Vietnam. If Saudi Arabian demand picks up due to the significant new Saudi scholarship programme, Saudi Arabian enrolments could move from 18,000 in 2022 to 29,000 in 2030 – but as with China, there is uncertainty concerning the potential of this market for the US.

Otherwise, Nepal, Bangladesh, Iran, Pakistan, and Ghana are forecast to be major movers in the next few years. In particular, Holon IQ predicts that Ghana will rise from 29th to 16th place in terms of top markets for US educators. In 2021/22, there were around 5,000 Ghanaian students in US higher education; HolonIQ sees this number rising to 11,000 in 2030.

Australia, Canada, and UK not the only competition

HolonIQ warns:

“The UK, Australia, and Canada are taking share from the US, and this will likely continue without a coordinated campaign to re-establish momentum, leadership, and growth. The US may well outperform our most likely forecast, but not without clear, coordinated, and actionable policy and plans.”

Other countries are also working hard to claim share of international student mobility. Germany, France, Spain, and Japan are particularly notable in this regard.

Germany had set a goal of hosting 350,000 international students in 2020 and this target has now been achieved. It continued attracting international students throughout the pandemic – one of the only major destinations to do so – and recorded growth of 8% in 2021/22. Germany has become increasingly popular thanks to a combination of quality education and free tuition for non-EU students pursuing bachelor’s and master’s degrees at most public institutions. The growing number of English-taught degrees now available – around 3,400 – is also a draw.

France also posted growth of 8% in 2021/22 to reach more than 400,000 international students. French educators are expecting even more foreign students to arrive in 2022/23 given an 18% rise in applications compared with last year. France is most competitive in Africa; it enrols more sub-Saharan African students than any other study abroad destination.

Spain enrolled 208,370 international students in 2019/20 – up 12% from 185,145 two years earlier. Spain offers serious competition in the Latin American markets that are becoming a greater focus for US educators (especially Colombia).

Japan has set a goal of recovering its international student enrolments by 2027 – these had fallen to about 231,000 in 2022 – the lowest level in a decade. There were about 300,000 international students in Japan in 2018, and 2018 was the sixth consecutive year of growth for Japan’s foreign enrolment. Japan is especially attractive in some of the most important student source markets for the US: China, Vietnam, Nepal, South Korea, and Indonesia.

For additional background, please see:

- “US foreign enrolment once again exceeds one million students”

- “US: Indian enrolments surging for fall 2022 as Chinese numbers decline”

- “New report highlights the increasing competition for international students from sub-Saharan Africa”

- “Search analysis tracks student interest in English-taught degree programmes in Europe”