Latest UK visa numbers indicate continuing strong growth in international HE enrolments this year

- UK study visa grants reached nearly 490,000 in 2022, an 81% increase over pre-pandemic levels

- China and Nigeria, along with a number of important South Asian markets, are the main growth drivers

- Just over nine in ten study visa grants in 2022 were for higher education

- The surging visa numbers have been accompanied this year by continuing media speculation of a more challenging political climate for international education, with the Home Office reportedly exploring proposals designed to curb foreign student numbers

International enrolment in British higher education jumped by more than 12% in the 2021/22 academic year, on the strength of increasing demand from non-EU markets and especially so from China, India, and Nigeria.

If the latest Home Office visa figures are any indication, that pattern is extending into 2023 with record-high visa grants led again by student demand from outside the European Union.

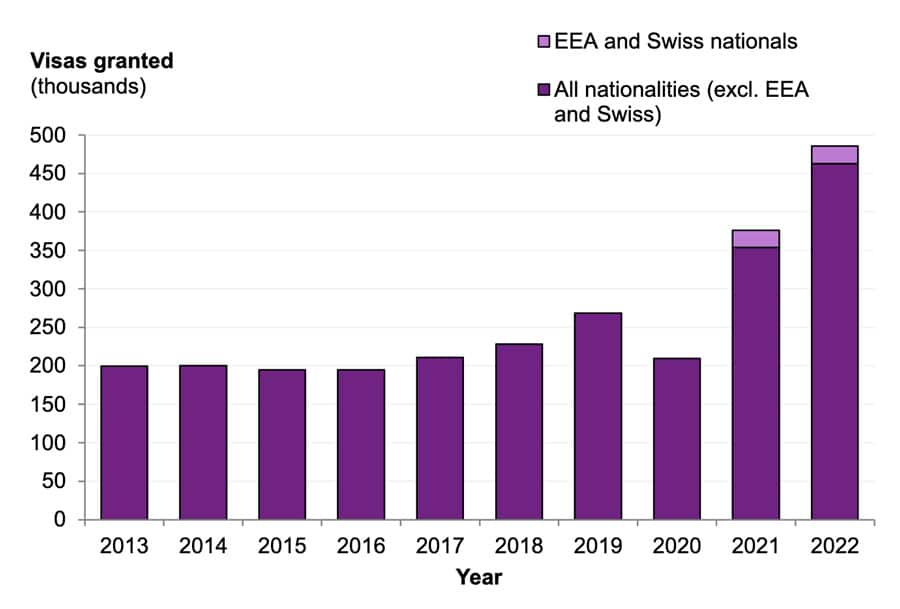

The UK government reports a total of 485,758 sponsored study visas granted to main applicants for the full calendar year 2022. This is 81% above pre-COVID levels (from 2019) and a 29% increase year-over-year.

The Home Office data releases acknowledges the 12%+ growth in higher education enrolments for 2021/22, but points out as well that the growth in visa grants through 2022 is even greater. "The Home Office visa data…shows a larger increase in demand for sponsored study visas over a similar period (+63% granted in the year ending June 2022 (405,779) compared to the year ending June 2021 (249,645), after a significant fall during COVID-19). This suggests that the recent rise in visa numbers are more pronounced and reflect both effects of emerging from the pandemic, alongside the steadier growth of enrolments from foreign nationals in the higher education sector."

Just over nine in ten (91%) visa grants for 2022 were for students admitted to higher education in the UK.

South Asia leads the way

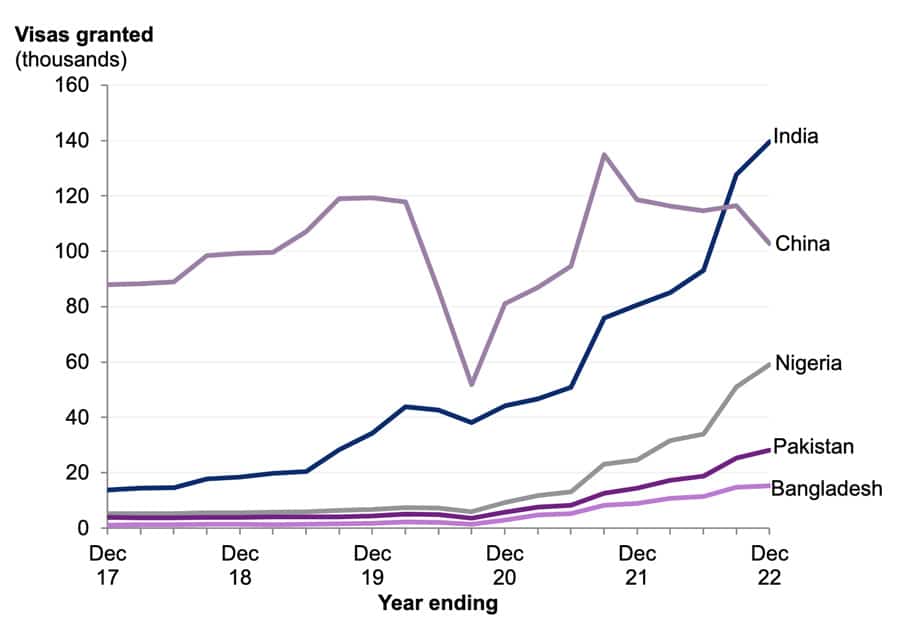

The visa data also reveals a different mix of growth markets for 2022, with South Asian markets playing a key role. As we see in the chart below, grants to Chinese students tapered off in 2022 while grants to Indian, Pakistani, and Bangladeshi applicants all recorded notable gains.

The Home Office explains, "There were 139,539 sponsored study visa grants to Indian nationals in 2022, an increase of 105,278 (+307%) compared to 2019 (34,261). Chinese nationals were the second most common nationality granted sponsored study visas in 2022, with 102,842 visas grants, 14% fewer than the 119,231 in 2019. Chinese and Indian nationals together comprise half (50%) of all sponsored study grants.

Of the top 5 nationalities granted sponsored study visas, Bangladeshi nationals saw the largest percentage increase in grants, increasing from 1,745 to 15,277, closely followed by Nigerian nationals whose number increased from 6,798 to 59,053."

Not this again

This picture of surging visa grants for 2022 comes amid continuing media reports in the UK of a more challenging political climate for international education. The Home Office has a reported interest in new restrictions for international students. And Home Secretary Suella Braverman has reportedly proposed reducing post-study work terms for foreign graduates from the current two years to a period of six months.

Times Higher Education, for example, has reported, "that on 20 January government departments were formally asked to outline their positions on visa policy options.

It is thought that not just the [Department of Education], but a range of departments including the Treasury, the Department for International Trade and the Department for Business, Energy and Industrial Strategy – fearing damage to the UK’s economic position – have set out opposition to the Home Office plan on reducing the time allowed under the graduate visa route."

Opposition to any such proposals will be bolstered by the findings from a recent public opinion poll, which found that 64% of respondents would like to see the number of international students in the UK "increase of stay the same". In contrast, just over one in five (21%) would like to see those numbers decrease.

Responding to media reports of the Home Office proposals, Universities UK International Director Jamie Arrowsmith said:

"International students make a huge positive contribution to our universities and to the UK economy…It is vital that government does not introduce policies that create lasting damage to the UK’s global reputation and competitiveness, and to local economies up and down the country.

For many years, the visa and immigration environment meant that levels of international recruitment to the UK stagnated while other countries saw huge growth. This placed the UK at a strategic disadvantage, representing lost opportunities for collaboration, lost talent that could contribute to our universities and businesses, and lost economic growth. In essence, government made a deliberate policy choice not to take advantage of a national strength – to put students off, rather than attracting them to the UK.

To rectify this, in 2019 the UK government published an International Education Strategy and introduced the Graduate route, which allows international students to work in the UK for up to two or three years after graduation…We strongly urge the government not to reverse course. Our universities know that recruitment must be sustainable, and they will continue to work with their local and regional partners to ensure that they have the capacity to welcome and support international students and provide a world-class experience. But a repeating pattern of boom and bust in international recruitment would be a big mistake. We need stable and well-managed policy which keeps the UK attractive while ensuring that we continue to demonstrate exceptionally high levels of compliance with all visa and immigration requirements."

For additional background, please see:

Most Recent

-

New Zealand announces strong foreign enrolment growth along with a new international education strategy Read More

-

The surging demand for skills training in a rapidly changing global economy Read More

-

US issues corrected student visa data showing growth for 2024 while current trends point to an enrolment decline for 2025/26 Read More