UK ELT reporting continued recovery through summer 2022

- In Q3 2022, UK ELT providers are reporting strong recovery for both the adult and junior segments of the market, according to the latest figures from English UK and BONARD

- Total weeks spent in UK ELT by under-18s have rebounded by a massive 3,254% compared with 2021 after having dwindled to almost nothing during the pandemic

- Most top source countries are contributing significant growth to the sector, but China and Russia are not

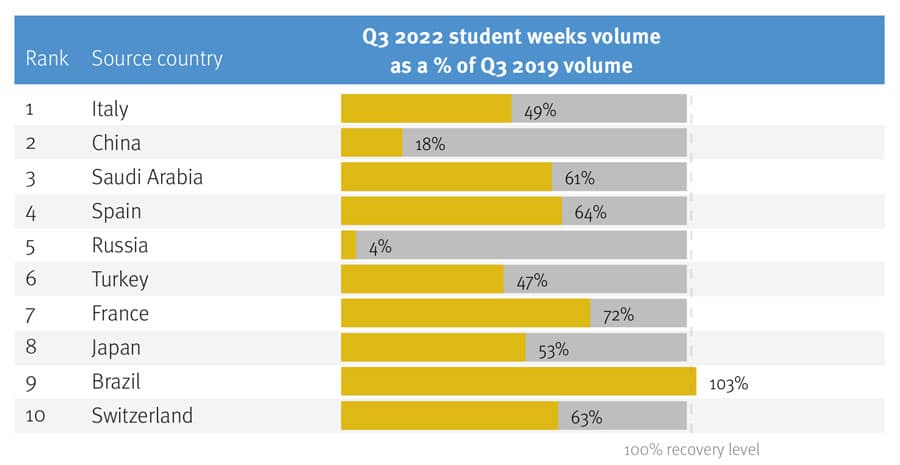

- Overall, student weeks booked for summer 2022 reached 55% of pre-pandemic volumes from the equivalent quarter in 2019

The Q3 results of English UK’s Quarterly Intelligence Cohort (QUIC) programme have just been released, providing a fresh look at the performance of the UK’s English-language teaching (ELT) sector in 2022. The latest update, based on data collection and analysis by industry research specialists BONARD, shows that recovery is finally underway for providers of both adult and junior ELT programmes. Overall, student weeks (204,751) were up by 237% compared to 2021.

The rebound will be especially relieving to ELT centres catering to junior students, as this segment of the market had plummeted during the pandemic. Patrik Pavlacic, BONARD’s chief intelligence officer, said,

“After a period of two years, during which junior students were practically non-existing in UK ELT, Q3 2022 witnessed a strong rebound in the under-18 segment.”

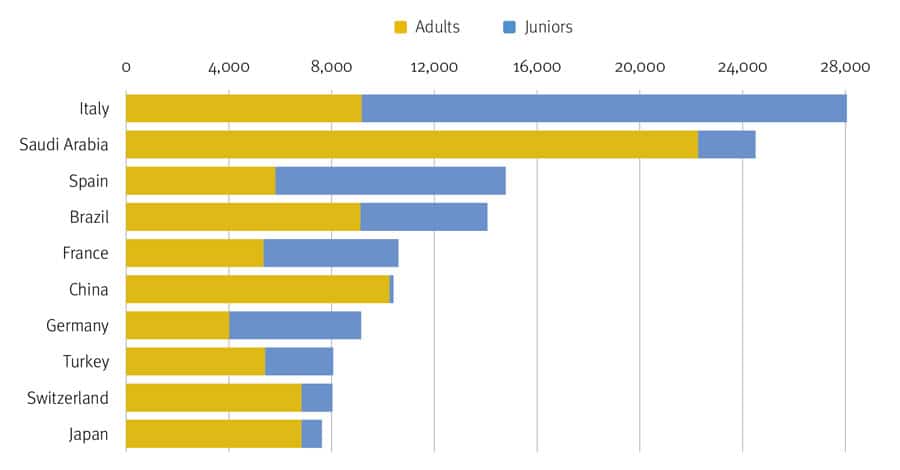

In Q3, the ratio of adult to junior student weeks was essentially the same as in 2019, before the pandemic – with about a 60% to 40% split, respectively. This marks a significant improvement over Q3 2021, when adults made up almost all (96%) of the market. Junior weeks grew more than adult weeks in this latest quarter, with 78,016 more junior student weeks compared with Q3 2021 versus growth of 65,997 weeks for adults. That represents astounding year-over-year growth of 3,254% for the junior market, and a 113% increase for the adult market.

Group bookings picked up substantially over the year, composing 36% of all bookings – nearly three times their proportion in 2021.

The recovery is uneven, however, if we look at the performance of various source markets. Most of the top European source markets for UK ELT have recovered to at least 50% of their levels in 2019. The QUIC report summarises:

“Traditionally strong source countries in Western Europe, such as Italy, Spain and France, are well on track to rebuild their pre-pandemic volume (with a 49%, 64%, and 72% recovery levels respectively). However, the UK top source markets have changed since 2019, and this is a result of major declines from China and Russia. China is now in 6th place and Russia is nowhere on the list. These countries contributed substantial volumes of students and weeks and English UK notes that, “providers will have to compensate elsewhere.”

Top source markets differ for businesses catering to juniors versus those hosting adults:

- Top 5 junior source markets: Italy (29.5%), Spain (11.2%), France (6.5%) Germany (6.4%) and Brazil (6.1%)

- Top 5 adult source markets: Saudi Arabia (17.9%), China (8.2%), Italy (7.4%), Brazil 7.3%) and Japan (5.5%)

Annie Wright, joint acting chief executive for English UK, commented on the overall positive news for English UK members:

“We’re really pleased for our members – the Q3 data shows a real sense of recovery and is testament to their resilience and hard work. We will continue to support recovery with our lobbying work for a youth group travel scheme and our other campaigning work to help where our industry needs it most.”

For additional background please see: