US: English language enrolments remained well below pre-pandemic levels in 2021

- The Intensive English Programme (IEP) sector in the US is looking ahead to recovery after another challenging year in 2021

- Total student weeks declined by 9.1% year-over-year

- Fewer enrolments and student weeks from Asia are prompting US IEPs to intensify their recruitment in Latin America

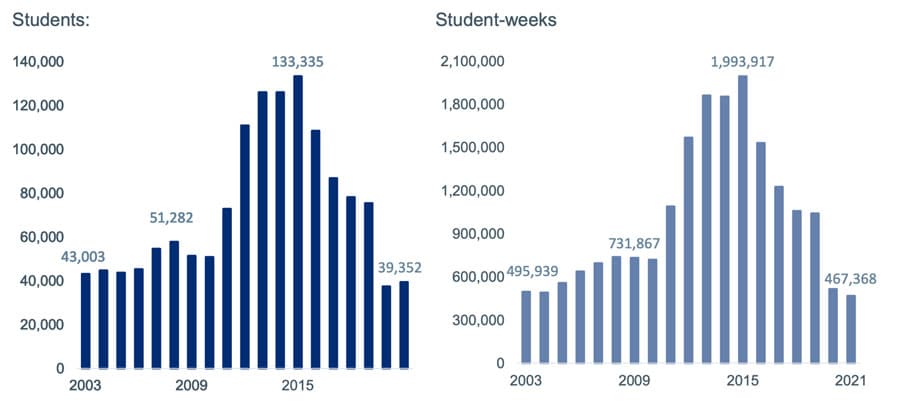

The latest annual survey data from the Institute of International Education (IIE) indicates that there were 5.3% more international students in US Intensive English Programmes (IEPs) in 2021 compared with 2020. However, student weeks fell by a further 9.1% after declining by 51% in 2020. The data was released as part of IIE’s Open Doors reporting and is based on a survey of more than 600 IEPs – within higher education institutions as well as independent centres – throughout the US.

In 2020, fewer IEPs responded to the IIE’s survey and so the above comparisons of 2020 to 2021 trends are not “apples to apples.” IIE notes that if the analysis is limited to those IEPs who responded to the survey in both 2020 and 2021, international student enrolments in US English-language programmes fell by -29% and student weeks by -31%.

In total, 39,352 international students studied in US IEPs for a total of 467,368 student-weeks during the 2021 calendar year.

More than three-quarters (78%) of IEPs returned to in-person instruction in 2021 as COVID-related social distancing measures and travel restrictions eased in the US last year. Another 14% of students were enrolled in hybrid programmes and 8% were learning exclusively online.

Many of the COVID-related adjustments and investments by IEPs became less pronounced in 2021. For example, IEPs decreased their virtual recruitment, their investments in technology, and their curriculum redevelopment/restructuring activities. Staff reductions became less common as did programme closures.

Speaking with ICEF Monitor, IIE research specialist Julie Baer said that a common theme among IEP providers in 2021 was prioritising the health and wellbeing of international students, who were of course still dealing with the many challenges and disruptions of the pandemic:

“Over the course of the pandemic, we have seen how IEPs in the United States have nimbly reacted to shifting circumstances amid the COVID-19 pandemic. Throughout the 2021 calendar year, the proportion of IEPs reporting that their programme’ predominant mode of study was in-person steadily increased, and by the end of 2021, over three-quarters (78 percent) of US IEPs reported that in-person was the primary mode of study.”

Huge realignment of source countries

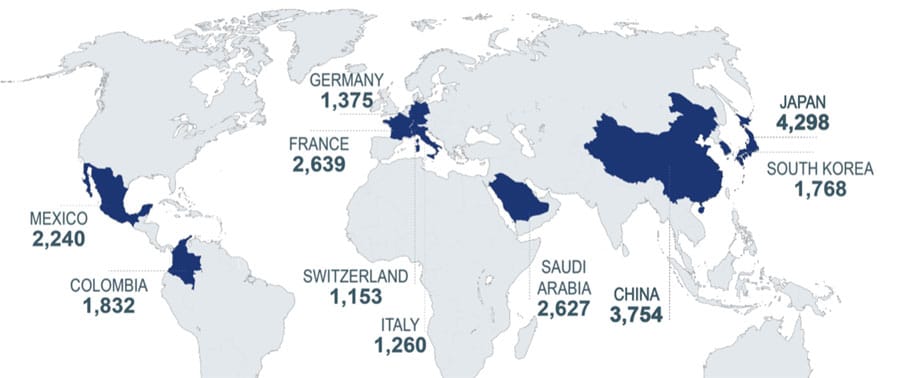

The representation of sending regions and countries shifted significantly in US IEPSs in 2021. Europe and Latin America increased their shares substantially while Asia faded as a source region relative to what it used to be. Total enrolments from Latin American and Caribbean countries, for example, increased by 50.8% while total Asian enrolments fell by 37.7% between 2020 and 2021.

China remains the top source country for IEPs in the US, but Chinese enrolments fell by 59% in 2021 (3,794). Japan moved into second place, sending about 4,298 students (-18.7% since 2020). France jumped into third place (2,639) by sending 10x more students in than in 2020. Saudi Arabia – which had been in the #2 spot in 2020, sent 61.8% fewer students (2,627) and fell into fourth place. Mexico made it into the top five for the first time by sending an impressive 186.8% more students in 2021 than in 2020.

Other notable developments in the top 10 sending markets are that Germany sent 8x more students in 2021 than in 2020, Italy sent 7x more students, Switzerland sent almost 6x more students, and Italy sent close to 5x more students. The number of South Korean students in IEPs fell by 32.7% in 2021.

The next table illustrates just how much the top 10 sending markets have shifted in the span of one year.

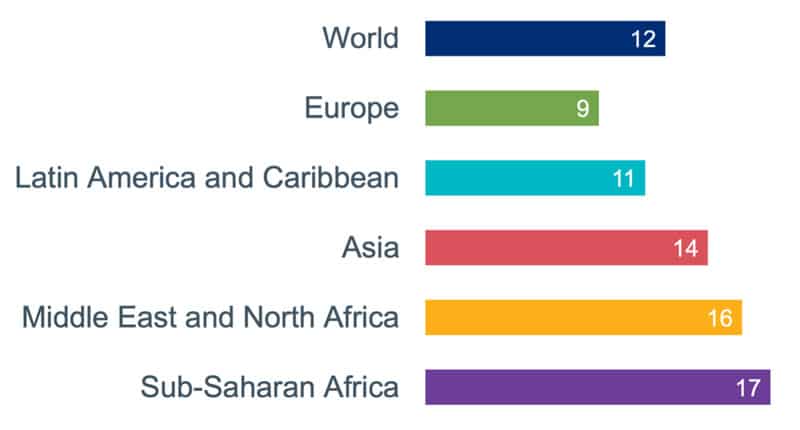

Students from Asia, the Middle East, and Africa spend more weeks in IEP programmes than European or Latin American students. This explains why the overall growth in student numbers (driven by Europe, Latin America, and other regions) did not result in growth in student weeks – declining enrolments from Asia led to fewer total student weeks.

The importance of IEPs to US colleges and universities

The IIE data shows that 32% of international students at IEPs intend to continue from their English-language programmes into further studies in the US. IEPs represent a major recruitment funnel into US higher education and recovery of this sector would impact the recovery of the higher education sector.

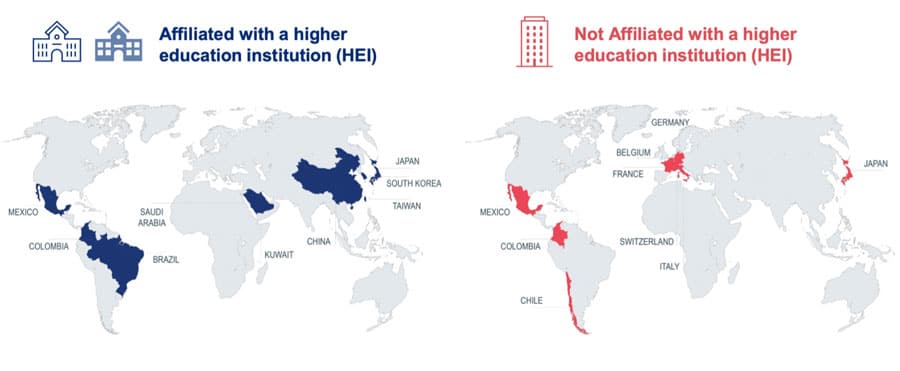

Students are much more likely to say they will progress to further studies if they are studying in higher-education-affiliated IEP programmes. These programmes represent 90% of the IEPs participating in the 2021 IIE survey. More than half (58%) of students in HEI-affiliated English-language programmes intend to move on to further study in the US versus 6% of those enrolled in independent IEPs. With this in mind, it’s interesting to look at the differences between top sending regions for the two categories of IEPs as in the figure below.

Looking at the map above, it’s obvious that if Asian student numbers at higher-education-affiliated IEPs continue to decline, there will be profound implications for US colleges and universities, which remain heavily reliant on Asian enrolments. This is especially true given that another pathway to higher education for international students in the US – schools – are also hosting fewer Asian students. Last year, according to SEVIS visa counts, the share of Chinese students of the total international student population in US K-12 schools fell from 44% to 37%. South Korea and Vietnamese proportions also fell, while Canada and Mexico sent more students to K-12 schools.

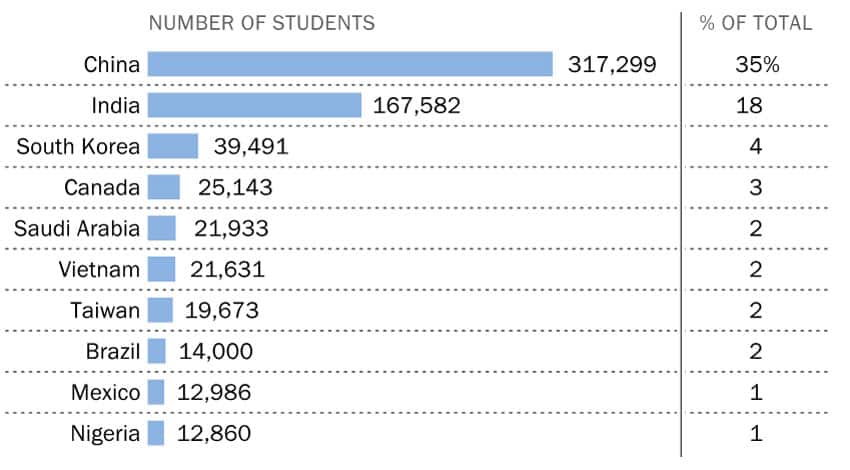

The trends in the IEP and K-12 sectors suggest that going forward – unless the regional shifts in enrolments are temporary – US educators across all sectors will need to intensify their recruitment of Latin American, African, and European students if they want to maintain their total international student numbers. The following chart is one composed by the PEW Research Foundation and it illustrates how much Asian students are represented across the US education system.

Connecting with agents in Latin America

Initiatives to develop other regions are clearly underway. For example, EnglishUSA has announced a Strategic Affiliates programme which involves “agent associations who collaborate with EnglishUSA to promote the U.S. as a premier destination for English language.” In 2021/22, the first pilot of the Strategic Affiliates was with “four agent associations in Latin America (Brazil, Mexico, Colombia and Argentina).”

For additional background, please see:

Most Recent

-

As Iran retaliates across the Middle East, schools close, students worry, and institutions reassess transnational education Read More

-

US: Student visa issuances fell by -36% in summer 2025; OPT uncertainty among factors affecting international student demand Read More

-

Canada and India deepen educational ties; India repositions as an equal player in international education Read More