Tracking the growing appeal of European study destinations

- European destinations such as Germany, Spain, Italy, France, and the Netherlands are steadily claiming a greater share of the world’s international students – especially with China closed and Brexit having increased tuition for EU students thinking of going to the UK

International students continue to broaden the range of countries they consider as possible study abroad destinations. This development gained speed during the pandemic, when some countries and institutions offered only online and/or remote learning for longer than others. Even with growing demand for online and hybrid delivery, many students preferred the option of in-person study and would switch destinations to learn in this way.

The "switching" trend has contributed to a different competitive landscape in international education. For example, Canada gained share it might not have had the US and especially Australia opened their borders earlier. China, New Zealand, and Japan lost share because of their prolonged border closures. The UK has become more popular as a result of its new, more generous post-study work rights.

But overall, it is the rest of Europe that has become more attractive to international students from all over the world.

Europe: Student mix changes from country to country

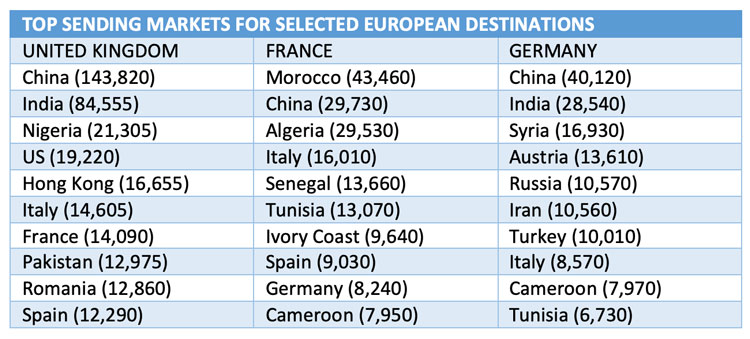

Despite their regional proximity, different European countries have remarkably different student mixes than each other. Consider the following table showing top markets for the UK, France, and Germany.

The UK saw its international student enrolments climb by 9% in 2020/21 over the previous year to 605,130. Two of the UK’s top markets are in South Asia (Pakistan and India) and two are in East Asia (China and Hong Kong). The UK draws more heavily from Europe for its top ten sending markets than do France or Germany, and it is also seeing substantial growth in Nigerian enrolments over the past two years.

France, which now hosts around 370,000 international students, has only one Asian country in its top tier (China), and not surprisingly attracts large numbers of students from African francophone countries.

In Germany, which has seen foreign enrolments rising throughout the pandemic to about 330,000, Asian representation extends past China and India to the Middle East (Iran and Syria) as well as Russia. Germany’s top ten list may be the most eclectic of the three countries in terms of its regional diversity with significant numbers of students from Asia, the Middle East, Russia, Europe, and Africa choosing German universities.

Italy

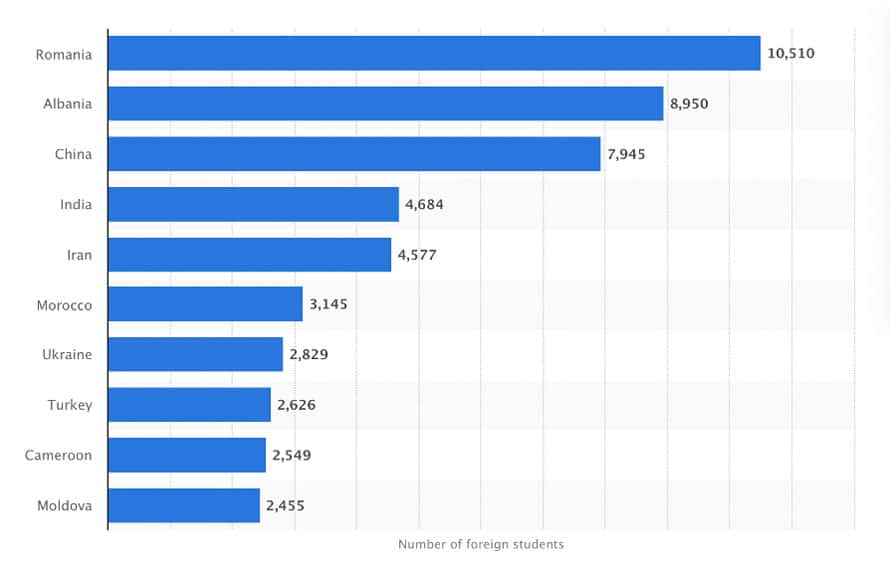

As in Germany, Italy’s international student mix is also quite varied – the following chart shows top sending markets for 2019/20. In total, Italian universities enrolled close to 100,000 international students in 2020/21.

Spain

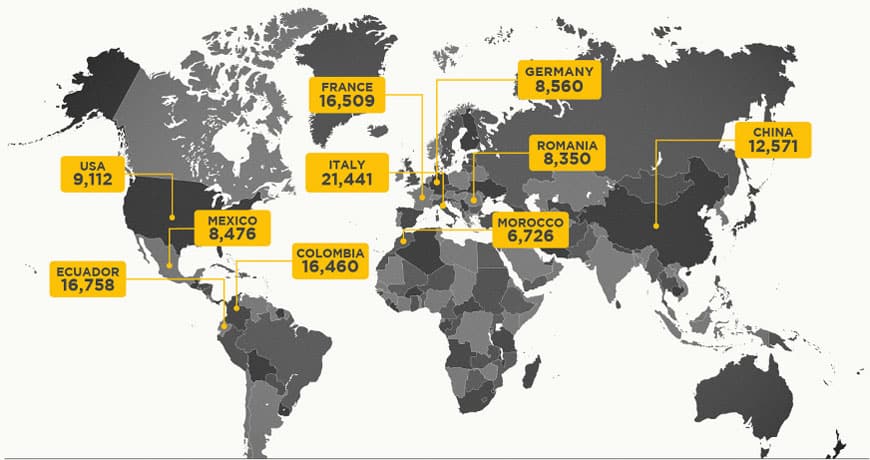

In Spain, meanwhile, Latin America is a major recruitment focus for universities given the Spanish language affinity between the two regions. In 2019/20, 208,370 foreign students were in Spanish universities – up 12% from 185,145 two years earlier. The following map shows top student markets for Spain.

The Netherlands

The Netherlands hosted 12% more international students in 2021/22 than in the previous year for a total of 115,070 according to a new report published by Nuffic, the Dutch organisation for internationalisation in education. Top markets for Dutch universities are mostly European and include:

- Germany: 24,500

- Italy: 7,200

- China: 5,300

- Belgium: 4,797

- Spain (4,687)

- Bulgaria (4,607)

- France (4,294)

- Greece (3,862)

- Poland (3,554)

- India (3,363)

Current demand factors

European countries other than the UK are seeing increased interest from within the region since Brexit terms ended EU students’ ability to access “home fee status.” Faced with the prospect of paying the same fees as non-EU students for UK higher education, European students are looking around within their own region and finding both highly ranked institutions and relatively attractive tuition fees.

Meanwhile, African and Asian students, who might otherwise have chosen China, Russia, or Ukraine as their top destinations, now find themselves unable or unwilling to go to those countries because China’s borders remain shut and because of Russia’s war on Ukraine. Other destinations within Europe are quickly becoming more popular for African and Asian students as a result – not the least because of more affordable tuition at many European universities relative to what students would pay in other leading study destinations, such as Canada or the United States.

For additional background, please see:

- "ICEF Podcast: Is studying in English the only viable option?"

- "Foreign enrolment in UK higher ed surpasses 600,000-student target"

- "Germany: International enrolments for winter 2022 'much better than expected'"

- "France launches new student marketing campaign"

- "Economic impact of foreign students in Spain estimated at €2.2 billion"

- "Netherlands continues to attract more foreign students alongside calls for enrolment caps"