Rapid growth projected in online programme partner space through 2025

- Private partnerships for the online delivery of higher education programmes are rapidly increasing in number

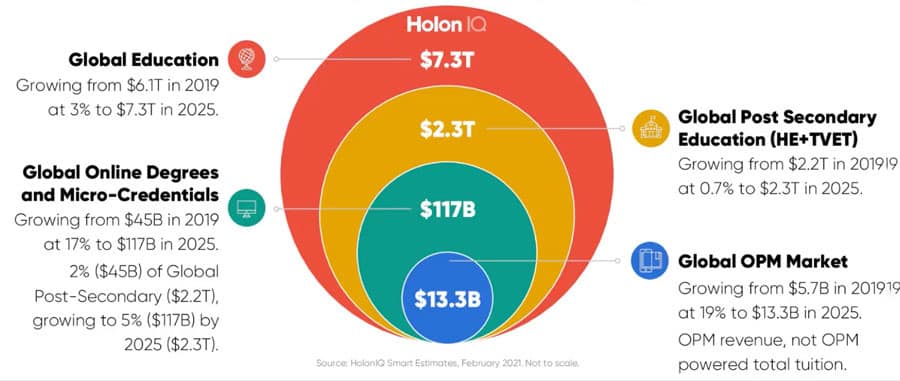

- This market segment has grown quickly over the last decade and is projected to reach US$13.3 billion worldwide in 2025

A 2015 study of online programme management (OPM) providers in the United States sized the market at US$1.1 billion at that time (in the US alone). That same analysis estimated that the US market would more than double in size by 2020 to reach US$2.5 billion.

A more recent analysis prepared by market intelligence firm HolonIQ estimates that the OPM market, while still heavily weighted to the US, had reached US$5.7 billion globally. HolonIQ further projects that the market will grow at 19% annually to reach US$13.3 billion in 2025. If that forecast holds true, that would make the OPM sector one of the fastest-growing market segments in international education through the first half of this decade.

OPMs help universities and colleges bring their programmes online. They typically offer a broad basket of services – everything from strategic advice and instructional design to technology and systems to recruitment, retention, and student support. Universities remain responsible for core academic functions – notably admissions, teaching, and curriculum – via such partnerships.

Essentially, OPMs bring expertise and tools to the table to help institutions get their programmes online more quickly.

They also bring money. Launching an online programme is expensive, typically requiring millions of dollars to move an institution through design and development phases and on to the point at which the programme can operate profitably. In many partnership deals, the OPM provider covers those costs and takes a significant share of the resulting tuition revenue. HolonIQ estimates that 80-90% of OPM partnerships worldwide are based on a revenue-sharing model.

Speaking at a recent webinar to present the company's findings HolonIQ Co-CEO Patrick Brothers said that the adoption of digital technologies, including those that support online programme delivery, is the number one challenge facing higher education institutions worldwide.

OPM partnerships are one response to that challenge, and they are clearly grounded in the need to expand institutional capacity for online programme delivery. Roughly one in three university-respondents to a recent Holon IQ survey indicate that they take a strategic partnership approach to outsourcing digital capability while another 22-35% said that they use such arrangements as a short term "gap fill" until they can build capacity within their institutions.

Whatever the motivation, the scale of the digital adoption challenge is measured in part by growing student demand. Sampling just the 23 US institutions with the largest online student numbers, HolonIQ found that total online enrolment at those universities had grown by 3.5 times between 2012 and 2020 (from 2.6 million to 8.7 million students).

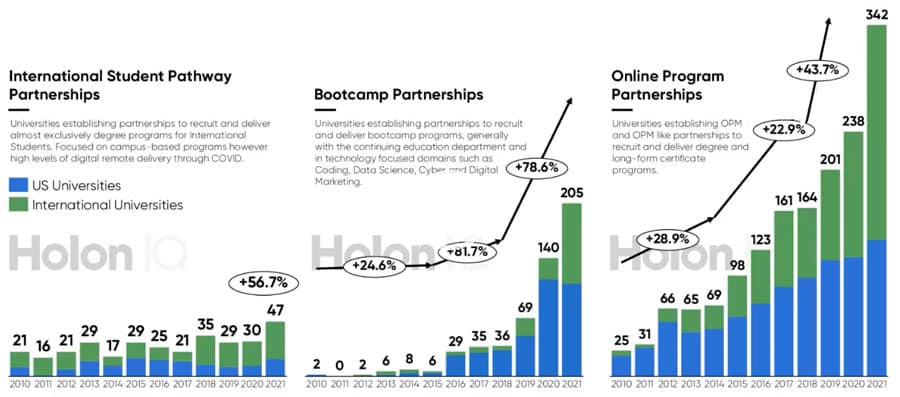

In total, the HolonIQ analysis finds that there were more than 1,700 universities and branch campuses from 82 countries engaged in OPM, bootcamp, and international pathway partnerships as of December 2021, with roughly 40% of those in the US. As we see in the charts below, there were 594 new university partnerships established in these categories in 2021 alone, with 342 of those, or roughly 60%, in the OPM space.

As the charts illustrate, bootcamps are the fastest-growing category. These partnerships focus on technology fields such as coding, data science, or digital marketing.

"Universities establishing relationships with private partners who are often bringing curriculum and instructors and also, importantly, bringing relationships with technology firms and, more broadly, industry who are looking to hire graduates," adds Mr Brothers.

Looking ahead, HolonIQ foresees a variety of scenarios for the continued development of the OPM space, all of which hinge around two important dimensions of the market. First, the extent to which universities will continue to outsource for online delivery capabilities, as opposed to building capacity internally. And second, the extent to which the partner marketplace remains fragmented across multiple participants or specialist providers, as opposed to becoming more consolidated around a smaller number of providers or platforms.

For additional background, please see: