Private partners helping to drive growth of US higher education online

American universities have dramatically expanded their online programme offerings over the past five years and there are indications of continuing strong growth through 2020. One of the reasons is the emergence of a new kind of service provider: the "online enabler" or online programme management (OPM) provider.

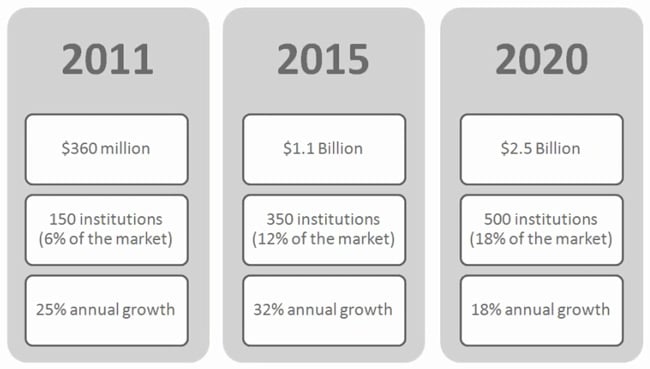

As the following figure illustrates, the OPM market in the US has grown to US$1.1 billion this year, representing nearly a tripling of revenues for the segment since 2011.

A recent survey by the research firm Eduventures found that about 12% of US universities - or 350 institutions - are engaged in OPM partnerships in the US. The firm projects that by 2020 the OPM market will more than double again to reach US$2.5 billion in revenues. At that point, nearly one in five US universities will be engaged with an OPM provider.

What makes it grow?

The OPM field has expanded rapidly in the US over the past decade, and the last five years in particular. There are now nearly 30 OPM providers operating in the US, ranging from the "Big Five," a group that accounts for about half of the total market and includes market leaders such as 2U and Pearson Embanet, to a broad cross-section of mid-sized firms and then a group of smaller niche players.

Growth in the sector is being driven in part by a sense of urgency from the universities, a consideration that extends even to leading institutions such as Georgetown University and Yale. The online higher education market in the US has grown quickly over the past decade, but that growth is flattening out in recent years and institutions are keen to earn a share of the market.

They are also actively seeking enrolment growth and new student groups to serve. The traditional university business model in the US is under pressure. Competition is on the increase, affordability is an ever-increasing concern for students and families, and the prevailing demographic trends mean that the traditional prospect pool for American universities will barely grow at all over the next decade.

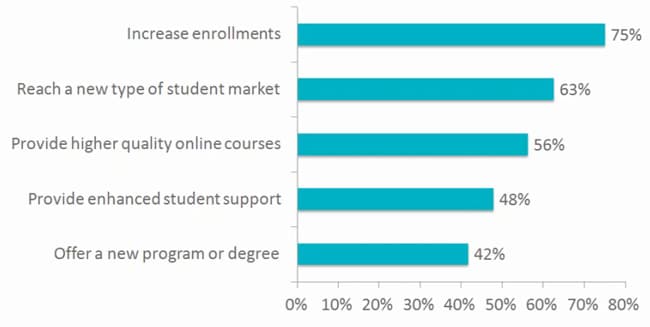

It is no surprise then that respondents to this year’s Eduventures survey cited "increase enrolment" and "reach a new type of student market" as their top institutional priorities for an OPM partnership.

Going global

As the University of Florida example illustrates, universities often open OPM deals with the goal of reaching beyond their traditional prospect segments and catchment areas. For some, that may mean growing out-of-state enrolment. For others, it may mean a focus on non-traditional segments, such as adult learners that have some post-secondary credits but not yet a full degree (the "degree completion market"). For international educators, the rapidly growing online capacity of US universities also represents another layer of competition in global education markets. Some institutions and providers are already explicitly targeting international markets, where the online programmes on offer may constitute a complete education experience for some foreign students. For others, online study may be a means of preparing for studies abroad, or completing part of a degree programme at home before venturing overseas. Academic Partnerships is an example of one OPM provider with international ambitions. The firm has introduced an alternative credential programme targeted to foreign students and has been actively building agent networks in markets abroad over 2014 and 2015. CEO Randy Best said recently to Inside Higher Ed, "What we want to do is provide a new, global credential that efficiently uses time of the students and addresses the affordability issue for all global citizens, and we believe that it can become the common currency across borders in postsecondary education." "Over the next five years, US schools will see a significant portion of their student body becoming international students, and those students will be primarily online," he adds. "We’ll be exporting our education versus importing the student."