Language travel sector tempers expectations for timing of pandemic recovery

- A newly released survey of agents and schools finds a modest increase in optimism for recovery in the near-term but a more conservative outlook for business volumes through the first half of 2023

The latest edition of the ALTO Pulse survey measures expectations across the language travel sector as to the extent and timing of the recovery from the COVID-19 pandemic. As in other Pulse survey cycles, the Q4 2021 edition from The Association of Language Travel Organisations (ALTO) looks ahead roughly 18 months for indications of how language travel volumes may recover through spring of 2023.

The overall picture in the Q4 2021 cycle is of increasing optimism in the short-term, with many industry respondents reflecting a slightly greater expectation for recovery of business volumes through spring 2022. But this is followed by a more conservative outlook (relative to earlier survey cycles) for the first half of 2023.

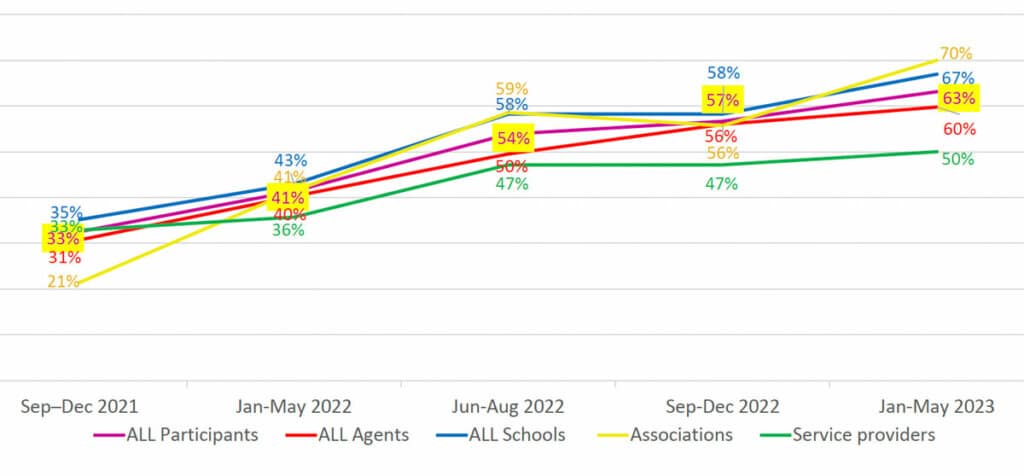

As we see in the following chart, the overarching view in the survey is that business volumes will recover to roughly half of pre-pandemic levels by summer 2022. What is different in the Q4 2021 survey cycle is that expectations flatten out after that, with respondents indicating that they expect only to reach roughly 60% of pre-COVID volumes by the end of 2022 and only slightly more than that (63%) by spring 2023.

Earlier editions of the Pulse survey found that respondents were expecting to reach roughly 65% of pre-pandemic volumes by the third quarter of 2022 (as of the Q1 2021 survey cycle) or by the fourth quarter of 2022 (as reported in the Q2 Pulse). One of the takeaways from the chart below is the industry does now not expect to reach that threshold until roughly mid-way through 2023.

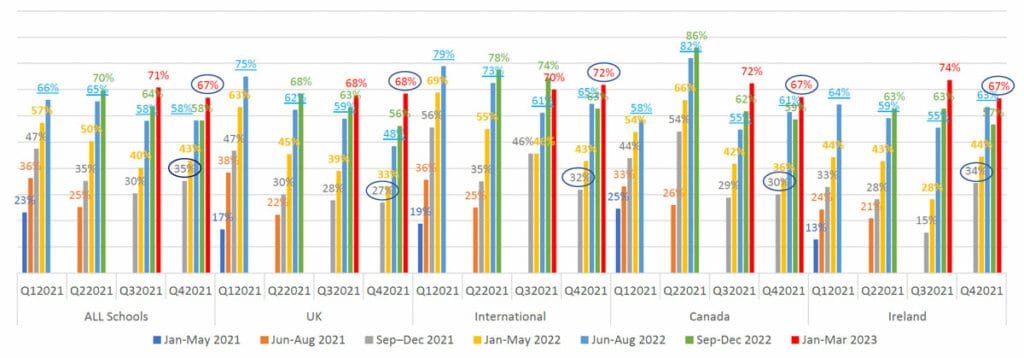

In the next chart below, we see that, while there are some variations from quarter to quarter, expectations among schools in some of the major language learning destinations are quite consistent over time.

ALTO explains, "In Q42021 destinations featured above stay in line with the average school projections “All Schools” improving from 35% (Jan May 2022) to 67% (Jan May 2023)."

"It’s interesting to look at how projections submitted for the same period (e.g. Jun Aug 2022) change over four different quarters in 2021. It’s a steady decline in the UK, whereas Ireland and international organisations pick up some hope towards the end of 2021. Canadian schools experienced a sudden rush of optimism in Q2 2021, presumably when the mass vaccine programme was rolled out but came back into average range in the second half of the year."

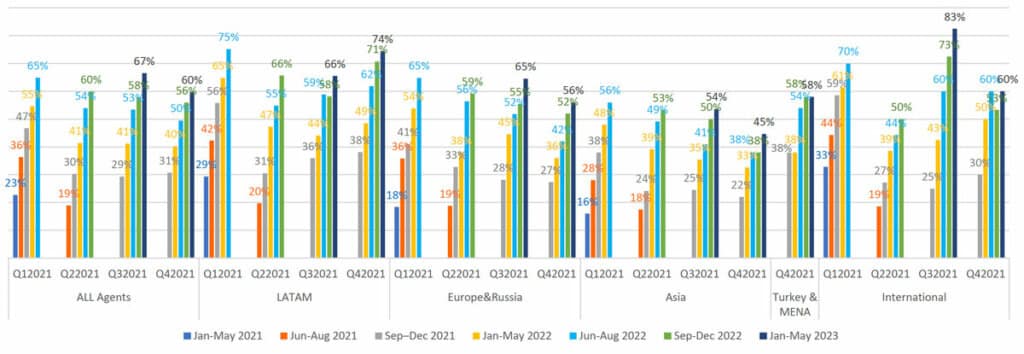

We see, in a final chart below, a similar pattern playing out among agent-respondents. "Agency projections in Q4 2021 for Sept-Dec 2021 are slightly up on the Q3 figures, but long-term projections show a gradual decline from January 2022 onwards," says ALTO.

Also of note in this edition of the Pulse survey is that Latin American agencies are showing, for the first time, an above-average level of optimism with agencies in the region expecting to recover roughly 75% of pre-pandemic business volumes by spring 2023.

For additional background, please see: