China: The opportunity remains

- After all of the disruption of the pandemic, many educators have questions about the continuing potential of the Chinese market

- While demand is shifting and the composition of the Chinese market continues to change as well, it remains, as one expert observer explained recently, an “indispensable recruitment market”

The following feature is excerpted from the 2021 edition of ICEF Insights magazine and is reprinted here with permission. The entire issue of the magazine is available to download for free at icef.com.

We have all heard about the changing demographics, increased domestic higher education capacity, and political factors contributing to the slowing of Chinese outbound travel to Western destinations. Many institutions are also reporting recruitment challenges in the form of Chinese families’ reluctance to send their children abroad in the pandemic. But as David Weeks, chief operating officer at Sunrise International Education (a company specialising in media, localisation, and programming for the Chinese market), said at the American International Recruitment Council (AIRC) annual conference late last year, China remains an “indispensable recruitment market.”

This is partly because of its size and substantial population of affluent middle-class families, and also because, as Mr Weeks noted, “Chinese students still want to study abroad because of the many disadvantages of China’s domestic university system.”

A 2021 report from market research firm Bonard and Beijing Overseas-Study Service Association (BOSSA) concurs with Mr Weeks: “A common question is, ‘Has the current situation affected Chinese students’ desire to study abroad and has the pandemic led to any shift in favoured destinations?’ Our answer is [that] the desire for study abroad isn't going anywhere. As a matter of fact, it will stay on an upward slope.”

The report cautions, however, that “the secondary education market, summer camps, and short-term programmes abroad are taking major hits.” While the South China Morning Post (SCMP) reports that the Chinese government is planning to “build ‘a mechanism’” to dissuade Chinese children from going abroad for education, the fact remains that the competition for school places in China is so fierce that demand for overseas study will remain, especially after pandemic-related travel restrictions ease. As the SCMP notes, “In major Chinese cities such as Beijing and Shanghai, fewer than 60% of junior high school students are admitted to a senior high school.”

As for higher education, Mr Weeks told the AIRC audience that the following fundamentals ensure China remains fertile ground for recruiting:

- 130 cities have populations exceeding one million;

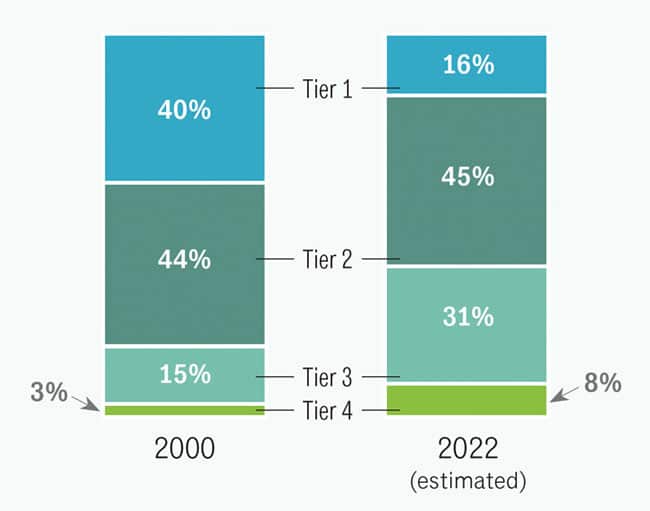

- The middle class is growing fast, especially in Tier 2 and Tier 3 cities;

- The secondary school system is massive, with more than half a million students in international K–12 schools;

- China’s economy is rebounding from the pandemic-related contraction in 2020.

“No next China” to fall back on

In a June 2021 article in Times Higher Education, the British Council’s Matt Durnin argues that for most institutions, the Chinese market remains essential despite the country’s more challenging recruitment environment. Institutions can and should diversify for a number of reasons, but as Mr Durnin says, “There is no ‘next China,’” in terms of the market fundamentals required for sheer outbound numbers. India might eventually prove as fruitful, but not until its development and economic growth improve substantially.

Mr Durnin acknowledges that recruiting in China may feel “sluggish” at the moment – but only in the short term: “Over the medium to longer term … we are likely to return to the pre-pandemic trend line.” His advice to institutions is to “make a clearer case for their return on investment, particularly in terms of employability. This will mean investment in career services and links to Chinese employers.”

Ten ideas for recruiting in China right now

1. Nurture your network of schools, agents, and alumni

Tight pandemic border restrictions mean that travelling to China is virtually impossible at the moment. Increase communications, provide more resources, and if possible, offer more incentives. Sending alumni and/or in-country representatives to well-attended college fairs as representatives is a great idea, as peer-to-peer influence remains strong.

2. Enlist the help of satisfied current students

Testimonials are powerful tools to break through to Chinese prospects considering an increasingly wide range of destinations and institutions. Locate students whose experience with your school has been positive even in the pandemic, and ask them to share their perspective with families in China.

This could be crucial given the many Chinese parents who have indicated in global surveys that they are especially worried about their children’s safety or the possibility of discrimination or racism in study abroad destinations.

Current students can also play a role in your online webinars for Chinese prospects and their parents. Many parents won’t be at all fluent in English, and your students can speak to them or can translate into Mandarin.

3. Adapt online content for China

At the AIRC annual conference last year, Sunrise’s Gavin Newton Tanzer, a co-presenter with Mr Weeks, reported results from research that looked at 2,000 websites whose primary audience was Chinese consumers. Of those websites, “94% were blocked in China or had long time page load, virtually none had any content localisation for China whereas 89% were not optimised for search engines in China.”

Consider this: Google commands just 2.3% of the Chinese search engine market. For your website to even be found in China means you have to invest in being discoverable on Baidu (over 75% of the Chinese search engine market) and on Sogou (15% of the market but the leader in China’s booming voice-activated search market).

Educations.com advises, “Don’t forget to search your own website and competitor’s websites in … Baidu, to ensure you are representing your university with trusted, high-ranking sites.” If you don’t have a landing page specifically for Chinese prospects that is translated into Mandarin, it’s more than time to create one. Ideally, work with a website localisation company with expertise in the Chinese market so that you can reflect cultural nuances and preferences and avoid translation mistakes.

4. Consider more targeted recruiting

Competition is especially fierce for Chinese enrolments in business administration and STEM programmes, but those aren’t the only programmes for which there is demand. A survey by BOSSA, for example, found that there is now more interest in arts and design as well as in education than there was five years ago, and the Center for China and Globalization has also reported more demand for these programmes.

5. Align your career services with the job market in China

Many Chinese students studying abroad want to go home after graduating to find a job in their own economy – China’s Ministry of Education says that 80% of all Chinese graduates returned home after their studies abroad between 2016 and 2019. Work on establishing links with successful Chinese companies and ideally work with them to create practicum and internship opportunities for returning students. Once you do, make sure to broadcast these linkages far and wide: Chinese students and families are ever more interested in the ROI of a foreign degree.

6. Invest in video marketing

Video-only sites such as Douyin, Kuaishou, and Bilibili are huge in China.

7. Monitor your social media

You probably have a presence on social media sites such as WeChat and Weibo – but just being there isn’t enough. Monitoring the conversations and results on those channels should be a priority for your international marketing team. With all your digital marketing, ask agents for their feedback. They know better than anyone what their students are influenced by and what does and doesn’t work.

8. Consider smaller cities

Generally speaking, there is less competition in recruiting Chinese students in smaller cities with rising numbers of middle-class families. McKinsey & Company has predicted that Tier 3 cities will host 31% of China’s middle class in 2022, while Deloitte research concludes that lower-tier cities “represent significant opportunity for success thanks to their population size, increasing personal wealth, low levels of brand loyalty, and a healthy appetite for new products,” as well as increasing Internet penetration in Tier 3 and Tier 4 cities.

9. Investigate the entire customer journey

Carefully consider the perspective of Chinese families evaluating different foreign institutions. Many institutions think they are translating enough content into Mandarin to be effective – but they may not be. Global research consultancy CSA has found that global websites commonly localise only 5–15% of their content to “top-tier” languages such as Mandarin. The analysts say that this can lead to businesses losing up to 80% of their total addressable market at some point along the customer journey. Strikingly, nearly one-half (48%) of the more than 8,700 people they surveyed said they leave a website when they encounter a problem related to insufficiently localised content. The rest “look for support from the provider, a friend or colleague, or online search, social media, or video platform.” Thinking of the journey from enquiry to application to enrolment – and all the customer support needed at each stage of the journey – how much of your content is available in Mandarin for Chinese families?

10. Check your mobile performance

As Educations.com puts it, “In the Chinese market, your website performance on mobile will make-or-break your campaigns. Make sure to double-check your translated pages for mobile, and closely monitor your Google Analytics data on China by device for bounce-rate and conversion.”

The bottom line

Recruiting successfully in China today requires more sophistication than in the past, because much of the opportunity lies in identifying new markets and student segments within the country. Many smaller cities hold promise and offer less competition than the major metropolises do. Students in these cities have unique circumstances, needs, challenges, and priorities – they should not be approached using one broad brush stroke. Identifying excellent agents and partner schools with a presence in target cities is essential for gaining the local understanding required to achieve good results.

For additional background, please see:

Most Recent

-

British Council says student recruitment to UK higher education will get a boost this year from South Asia and the “Trump effect” Read More

-

New Zealand expands post-study work opportunities for international students Read More

-

As Iran retaliates across the Middle East, schools close, students worry, and institutions reassess transnational education Read More