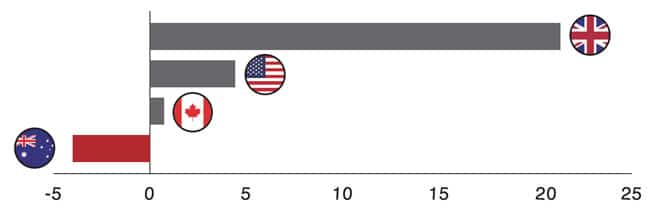

Slowing in Chinese commencements for most major study destinations

Educators and governments in the major English-speaking study destinations – Australia, Canada, the United Kingdom, and the United States – have known for some years that the flow of Chinese students into their countries has been projected to slow through this decade. A new report from consultancy Education Rethink examines student visa data (or their closest equivalent) for the four countries to provide insights regarding the extent of the slowdown – especially relative to growth trends from other source markets. The report, released this week, is entitled Rethinking China: The End of the Affair.

The report sets out the big picture right away in highlighting that,

“When viewed in the aggregate, growth in Chinese student demand for the four major English-language study destinations has slowed considerably since 2016…The number of student visas or their closest equivalent issued to Chinese nationals for the US, UK, Canada and Australia grew a total of 4.5% from 2016 through the latest period for which data is available in 2019. This may not sound like much of a slowdown, but consider that the number of total outbound Chinese students grew 22% from 2016 to 2018 alone. Chinese students continue to go abroad in droves, but they are increasingly looking beyond the traditional destination markets.”

The authors, former British Council staffers Jeremy Chan and Anna Esaki-Smith, add that,

“While visa issuance may not be a direct apples-to-apples comparison with higher education enrolment, it can get us very close to the mark, and much more quickly than other national-level sources.”

To this end, the report relies on Immigration, Refugees and Citizenship Canada data on the number of new study permits issued for Canada through August 2019; Australian Department of Education and Training data for the number of year-to-date commencements through August 2019; British data on the number of tier-4 student visas issued through June 2019; and SEVIS data (from the US Immigration Department’s Student and Exchange Visitor Information System on the number of F-1 student visas issued for study in the US through September 2019.

Snapshot by destination

The report asserts that the Chinese student population in the US peaked in 2017/18 and enrolments have softened since despite US visa issuance to Chinese students increasing by 21% this year compared with an average of 8% in the rest of the world. The report notes, however, that “the fact that [the number of visas issued] has marginally rebounded in the last year by some 4,000 visas should not distract from the bigger picture – there were 45,000 fewer visas issued to Chinese students in 2019 than there were in 2016.”

The decline in Chinese student enrolments is most pronounced in the English-language training sector. Enrolments in undergraduate and graduate programmes are up slightly, but this trend is somewhat inflated by the number of Chinese students in Optional Practical Training (OPT) programmes. Enrolments in OPT are not necessarily considered an indicator of “active” study in the US given that they represent a work extension to academic programmes already completed.

The report concludes as well that “Peak China” occurred in Australia in 2018. In 2019, the growth trend has been either modest or declining in some sectors, with year-to-date commencements from China down through August 2019.

Chinese commencements are relatively flat in Canada, in contrast to significant surges in enrolments from other sending markets.

Of the four, the UK will register the largest growth in Chinese commencements in 2019 but “overreliance on Chinese enrolments means there is little room for further, sustainable growth beyond current enrolment levels.” Chinese students compose nearly half (45%) of all international student visa recipients in the UK.

The report notes that only two of the four countries – Australia and Canada – are taking significant steps to diversify their international student populations so as to be less exposed to the risk entailed by slowing growth in Chinese outbound.

This risk is significant, particularly as Chinese students are ever more aware of destinations in Asia and Europe, destinations that the report notes “offer some combination of better value, closer proximity to home, or more familiar and seemingly safer environments.” In addition, the Chinese government has not only succeeded in vastly expanding its higher education capacity and moving several of its institutions into in prominent positions in world university rankings, but it has just set a mandate to greatly improve the quality of its undergraduate programmes. If successful, this reform will very likely encourage more Chinese students to study at home in the future.

Other factors contributing to slowing Chinese growth include:

- Geo-political tensions making the US and Canada feel less welcome to some Chinese students;

- Weakening Chinese currency increasing the price-sensitivity of Chinese students;

- The growing attractiveness of alternative destinations (e.g., Japan, South Korea, Germany and the Netherlands).

Drop in ELT students

The report notes that,

“Given that language programmes are largely indistinguishable from one country to the next, enrolments in these programmes serve as a sort of canary in the coal mine for student sentiment, portending declines in other sectors as well. Many language students go on to pursue further study in the country where they first studied English as a foreign language, meaning that US higher education institutions should take note. The fact that the number of Chinese students enrolled in language programmes declined 22% from March 2018 to March 2019 (and is down more than 37% from its peak in November 2016) is a very worrying sign of things to come for US education writ large.”

Growth in the UK

The weakened British pound – thanks to Brexit concerns – as well as China/North America political and trade tensions, may be significant drivers of the growth in the number of Chinese students coming to the UK in 2018/19, according to Mr Chan and Ms Esaki-Smith. They project that Chinese enrolments will likely surge again now that two-year post-study work rights in the UK have been restored (effective for students graduating in 2021 or after).

Mr Chan and Ms Esaki-Smith predict that the extent to which Chinese students are over-represented in the total UK international student population – i.e., non-EEA plus EU students – will be all the more obvious once Brexit occurs, because EU student enrolments will almost certainly decline at that time.

However, the report also notes that the restoration of two-year post-study work rights will make the UK more attractive in general to international students around the world. With this policy change, UK institutions will be better positioned to diversify their international student populations.

Canada’s strategy

As the report notes,

“Today, Canada is the only one of the major host destinations in which China is not the largest sender of international students. This represents a dramatic reversal from only a few years prior, when China was the primary engine of growth in international enrolments in Canada.”

Study permits to students from countries other than China grew by nearly 15% last year, while growth in these issuances was nearly flat for China. Canada is the least reliant on Chinese enrolments of the four countries, and this summer announced a new internationalisation strategy whose main focus is diversification.

The push for diversification in Canada is particularly well timed given rising political tensions between Canada and China. In 2018, the Canadian government arrested Meng Wanzhou, the chief financial officer of Chinese tech giant Huawei Technologies, at the request of the United States government, which is accusing her of violating US trade sanctions against Iran. China issued a “travel warning” to Chinese students considering Canada as a study destination in the wake of the arrest.

Contrasting trends in Australia

Following average growth of 13.3% between 2013 and 2018, the growth curve in Chinese enrolments in Australia is now very modest – or declining in some sectors. The report’s analysis found that the share of Chinese students in the overall international student population in Australia is gradually falling; it reached a high of 29% in 2018 but that proportion fell to 26% in 2019. Some experts believe that major Australian universities need to do more still to reduce their reliance on Chinese students, but the Education Rethink report highlights a general trend of diversification in Australia.

The slowdown in Chinese commencements in Australia is particularly acute in the language (a drop of -9.5% so far this year) and school (-11%) sectors. The report notes that, “In this regard, Australia resembles the United States, where declining enrolments of the youngest and most mobile students are a harbinger of things to come for other sectors.” By contrast, the number of Colombian students in Australian English-language programmes was up by 19.5% in August 2019, and in the school sector, the number of Vietnamese students rose by 22% – further signs of diversification.

Life after “Peak China”

The report emphasises that the evidence of diversification in Canada and Australia is encouraging for all four traditional destinations:

“That they have managed to do so while expanding their overall pie of international enrollments shows that traditional host countries can thrive even in a post-China world, but it will require new international strategies.”

For additional background, please visit: