Study measures the wider economic impact of Canada’s language education sector

- A new economic impact model from Languages Canada measures the cumulative impact of language students in Canada who go on to post-secondary studies

- The total economic contribution of those students is projected at CDN$6.7 billion over a five-year modelling cycle, with an estimated 75,000 jobs directly or indirectly supported

A new study commissioned by peak body Languages Canada aims to establish the cumulative economic impact associated with language students who go on to post-secondary study.

The report, Comprehensive Economic Impact of International Students in Language Education Programs in Canada, was produced by Roslyn Kunin and Associates (RKA) and it builds on a previous RKA study from December 2020. That earlier work estimated the economic contribution of foreign students enrolled in language studies in Canada at just under CDN$1.8 billion as of 2019.

The new RKA analysis takes a wider frame to model the total economic contribution of those students who build their language skills in Canada and then go on to further study.

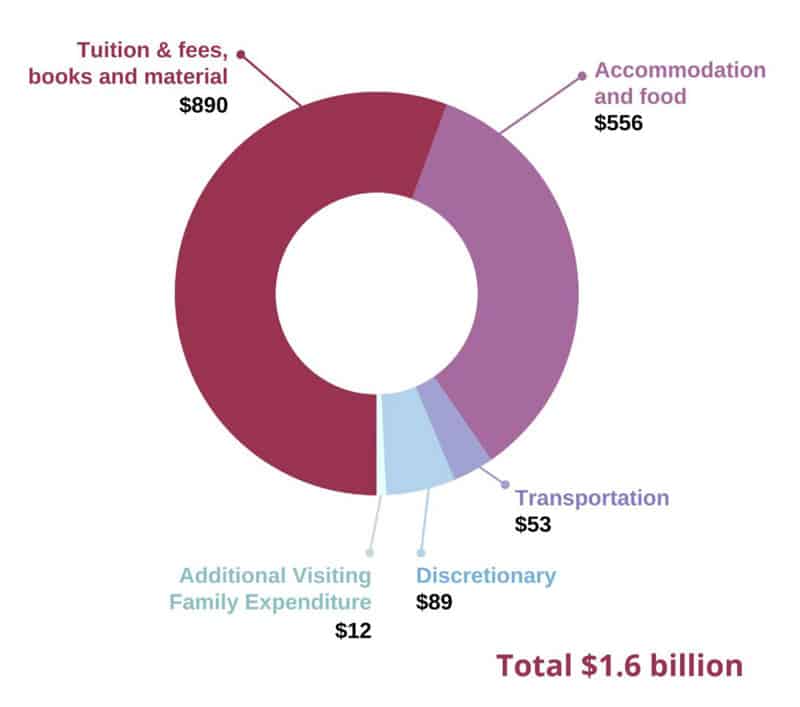

Of the 144,208 students enrolled in Languages Canada member programmes in 2019, RKA estimates that 33,744, or nearly one in four, will go on to further study. It then calculates the annual spending of those former language students who go on to post-secondary study at CDN$1.6 billion per year. As the following chart illustrates, this includes both direct expenditures on (post-secondary) tuition and materials, along with living and transportation expenses and other related spending.

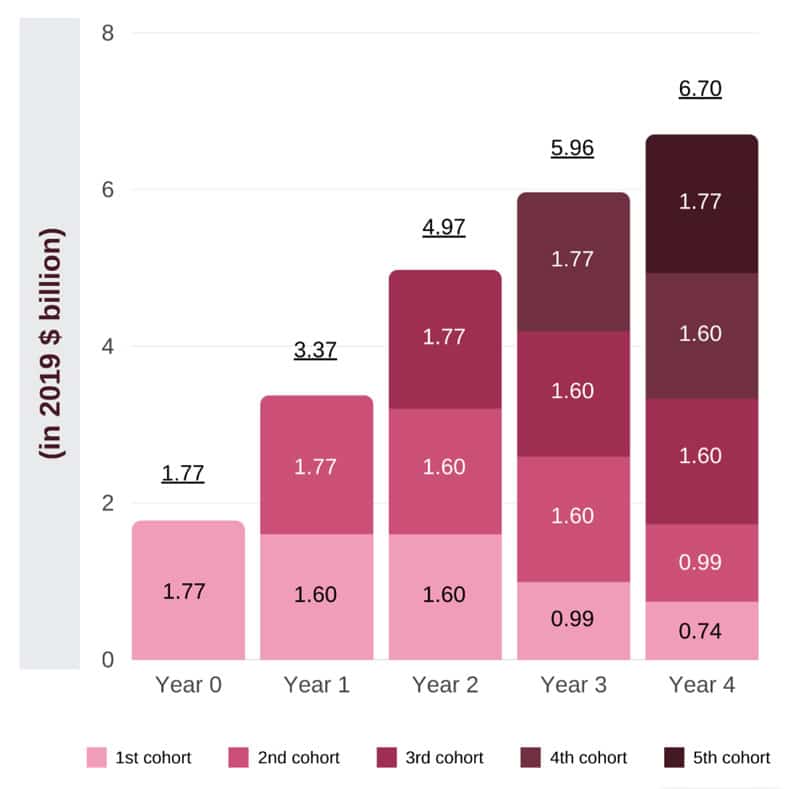

RKA relies on a five-year forecast cycle to determine the full economic contribution of students across both language and academic studies, explaining that, "The five-year cycle allows inclusion of college and university certificate and diploma programmes which last from two to four years on average (not counting post-graduate programmes). Adding the initial language education programme creates a three-to-five-year cycle."

The following chart reflects that cumulative value – both direct and indirect spending again – for five annual cohorts of language students. The model assumes that those students are distributed across various levels of study in a pattern that reflects the broader international enrolment in Canadian higher education: "41% (approximately 14,500) in tertiary and non-tertiary education programmes below a bachelor’s degree, 42% (approximately 14,900) in a bachelor’s or equivalent programme, and 17% (approximately 6,200) in a post-graduate programme (including a master’s or doctoral degree)."

The overarching conclusion of the study is also reflected in the preceding chart, which is that Canada's language education programmes are effectively a gateway for nearly CDN$7 billion in economic impact (over the five-year modelling cycle used in the RKA methodology). That level of economic impact is further estimated to support 75,000 jobs in Canada.

For additional background, please see: