Canada’s language school enrolments down by 56% in 2020; “incremental recovery” anticipated this year

- Along with most other leading destinations, Canada has now reported its language study enrolments for 2020

- Total student numbers were down by 56%, a slightly higher percentage drop than in Australia and the US but lower than in the UK, Ireland, and Malta

- BONARD research among agents finds that demand is stronger for Canadian ELT programmes in 2021 than for other leading ELT destinations

- The main issues that will affect the extent of the sector’s recovery are thought to be entry and quarantine requirements

Canada’s language training centres hosted 56% fewer international students in 2020. Total student weeks were down by 49%, but the average length of stay increased by 16% to 11.7 weeks. The new data was presented virtually at the Languages Canada 2021 Annual Conference in May.

Both English and French language sectors felt the impact of COVID, with both down by practically the same percentage (-56% and -57%, respectively). Private-sector providers were more affected: enrolments were down -61% compared with -39% in the public sector.

The enrolment declines compare with reported decreases in the US (-50%) and Australian (-47%) markets and are less severe than those experienced by ELT providers in the UK, Ireland, and Malta, where junior students and short-term summer enrolments account for a larger share of overall programme volumes.

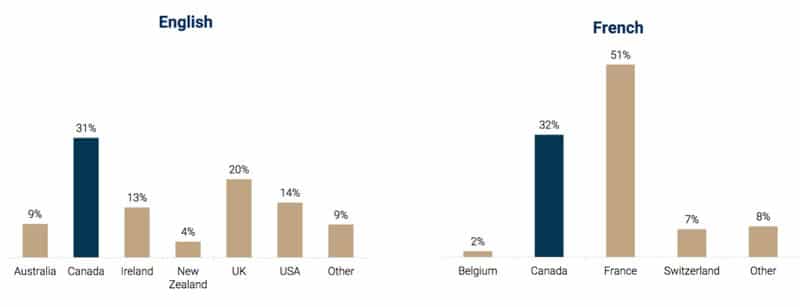

There is room for optimism in 2021, as Languages Canada also presented BONARD research data from a survey of 205 agents showing the most popular destinations for international students considering language study abroad this year. Canada was the frontrunner for English-language programmes and second only to France for French-language learning.

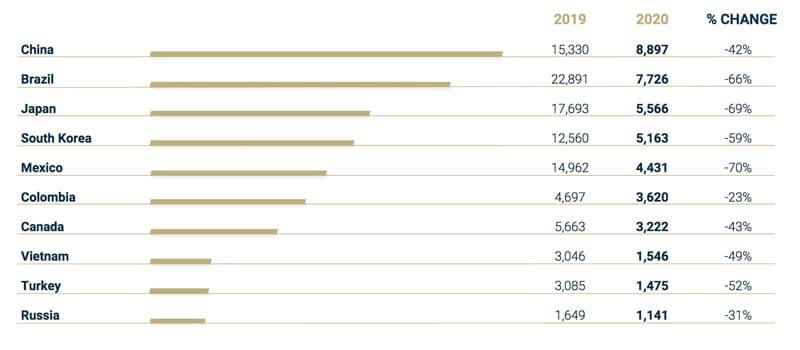

Source market performance in 2020

Some of the steepest declines in enrolments came from three of the most important markets for Canadian programmes – Brazil (-66%), Japan (-69%), and Mexico (-70%). Chinese enrolments did not fall off as steeply (-42%), and for this reason Chinese students represented the top market in 2020, displacing Brazil.

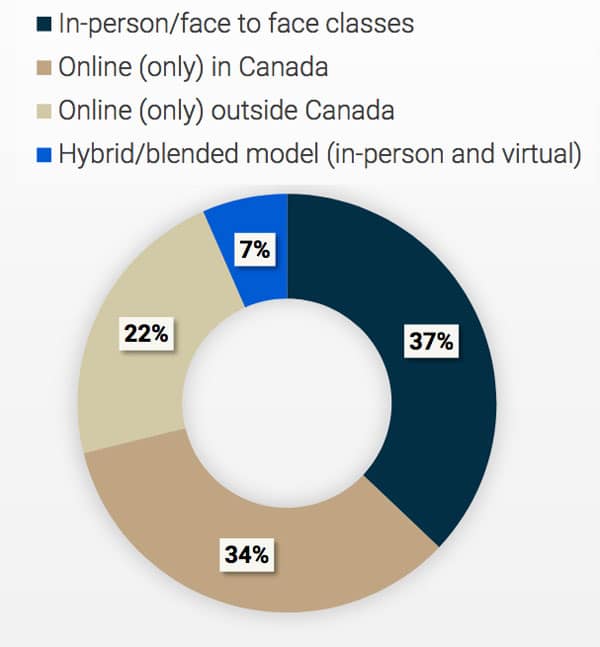

A mix of study options in 2020

Language students in Canada primarily learned through either in-person (37%) or online delivery (34%), with hybrid instruction a much less common model (7%). More than 1 in 5 (22%) of international students also learned English or French from outside of Canada, online in their home countries (see chart below).

How much recovery can be expected in 2021?

In Q2 2021, Canadian providers expected to be operating at 29% of capacity compared with the same quarter of 2019, so there is still a long way to go before a full recovery. But with Canada’s vaccine rollout picking up pace and with international travel beginning to resume, subsequent quarters will likely see more of a rebound. Languages Canada predicts “incremental recovery rather than a sudden return to full mobility,” citing surveyed agents’ predictions that 2021 will see a 31% pick-up in bookings and that in 2022, bookings will increase to 55% of what they were in 2019.

Agents told BONARD that the single biggest determinant of where students will choose to go is entry restrictions, and that restrictive entry rules and changing quarantine requirements have been the main barriers affecting enrolments for Canadian language schools. Both agents and providers said that removing these barriers, including lifting the 72-hour quarantine hotel requirement for incoming travellers, would be the best way of hastening the sector’s recovery. Forty percent of providers believe they would increase their student recruitment if these measures were implemented and 30% said that reducing costs of entry would allow them to sustain their business in the remaining months of the pandemic.

Without existing government emergency subsidies for the sector, more than half of responding Canadian providers said that they would have to shut down within six months.

Measuring economic impact

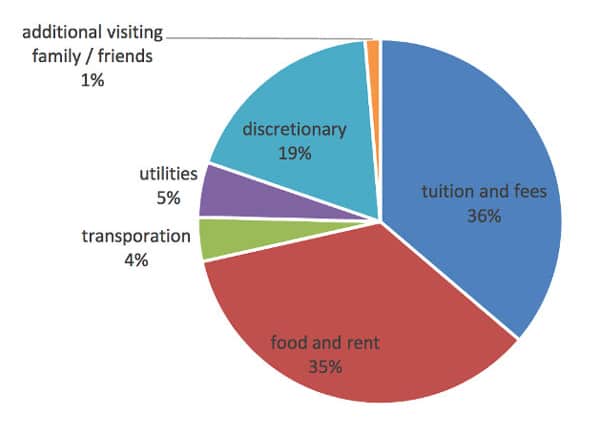

Through direct and indirect spending, international students enrolled in Canadian ELT programmes contributed almost CDN$1.8 billion to Canada’s economy in 2019 according to research by Roslyn Kunin & Associates, which was also presented at the Languages Canada conference in May.

Tuition was but a fraction of their spending (36%), and through their spending on housing and discretionary products and services, language students benefit a wide set of sectors and businesses and help to support 11,930 jobs.

For additional background, please see: