Coursera filing provides insights into revenue drivers for online learning

- Revenue from individual students is driving dramatic growth at this leading platform for online learning

- Shorter courses and stackable credentials are key offerings for that consumer segment

- The company also anticipates considerable international expansion in its next phase of growth

On 5 March 2021, leading MOOC platform Coursera submitted its IPO – initial public offering – filing with the US Security and Exchange Commission (SEC).

The IPO now sets the stage for one of the most-anticipated public stock offerings for years in the edtech space. It also provides some rare insights into the financial performance of the edtech giant, and how its business model continues to take shape within the rapidly changing landscape for online teaching and learning.

For context, Coursera is the largest – by revenue and user base – of the major MOOC platforms. The company raised US$130 million in a 2020 funding round, at a valuation of US$2.5 billion, and has been noted as the platform with the fastest-growing user base during the pandemic. Coursera enrolled nearly 80 million of an estimated base of 180 million learners across major platforms in 2020.

"One third of the learners that ever registered on a MOOC platform joined in 2020," says industry authority Class Central. "The pandemic brought many people into online education. MOOC providers, in particular, benefited immensely by attracting many learners with their free online courses from top universities."

The Coursera IPO filing provides a clear indication of this growth. Total revenues grew by 60% from 2019 to 2020 to reach nearly US$300 million last year. Even so, the company is not yet profitable, recording a net loss of US$67 million for 2020 (and an accumulated deficit since founding of US$343 million).

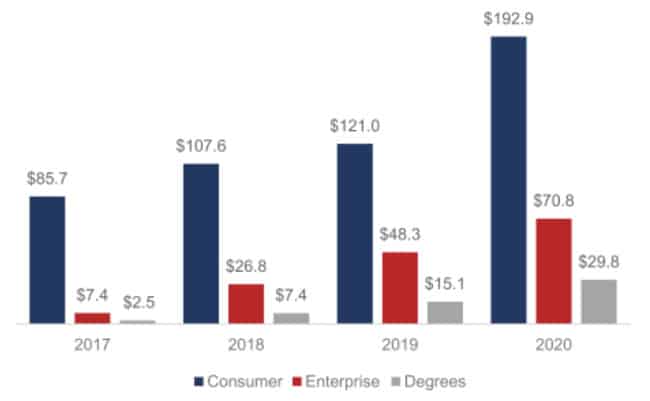

Much has been made in recent years of Coursera's shift to enterprise services, which provide training programmes for government and corporate clients, and its expanding portfolio of university partners, for which the company serves as an online partner helping institutions to develop and launch online degree programmes.

But the IPO documents show clearly that – while the degree and enterprise revenue streams are also growing quickly - it is the consumer segment that is driving overall revenue growth. That segment reflects students who pay fees directly to Coursera for shorter courses and stackable credentials. And it is those programmes which drove enrolment and revenue growth in 2020.

In this respect, the IPO filing shows a company following a rapid growth trajectory after moving away from its MOOC roots free open courses and toward shorter courses, certificates, and other credentials that command tuition fees from paying students.

"We’ve seen billions struggle during the pandemic," says Coursera Co-Founder and Chairman Andrew Ng. "At school, many learners and instructors were ill-prepared to move learning online. At work, digital acceleration is threatening many jobs as skills rapidly become obsolete. The staggering scale of disruption has underscored the need to modernise the global education system. Leaders tasked with creating a level playing field now recognize that learning online will be a powerful means of providing individuals with the skills they need and promoting social equity."

The path to further growth

Looking ahead, Coursera has a multi-pronged strategy to drive future growth. This includes a continuing emphasis on enterprise clients, a further expansion of online degree programmes, and building an even larger user base. The company spends a whopping 37% of revenue on marketing and recruitment, but there is some indication in the filing as well that its cost of acquiring a new student, degree students in particular, are much lower than those typically associated with traditional higher education institutions.

The company also clearly sees further room for global expansion, noting that,

"Approximately 51% of our revenue for the year ended 31 December 2020 came from learners outside of the United States."

"We see a particularly large opportunity to help emerging economies that lack the ability to absorb the large and growing influx of adult students by delivering education in a scalable and affordable way. We plan to continue to market our offerings and programs to individual learners, businesses, academic institutions, and governments globally, providing us broad access to the addressable market while also building on our global brand as a leading learning destination."

For additional background, please see:

Most Recent

-

ICEF Podcast: Together for transparency – Building global standards for ethical international student recruitment Read More

-

New analysis sounds a note of caution for UK immigration reforms Read More

-

The number of students in higher education abroad has more than tripled since the turn of the century Read More