Early lessons from the pandemic: New products and the power of partnerships

- Amidst all of the uncertainty around the COVID crisis, there are also a number of important examples, both within international education and in other business sectors, as to how institutions and organisations are adapting to offer new products and services

- Another important takeaway this year is that key stakeholders, especially students and partners, expect more frequent and personal communications with educators

The pandemic may have brought to a screeching halt many things – including the happy sounds of millions of students on school and university campuses – but not everything. Not, for example:

- Students’ strong interest in study abroad;

- Their need for quality education programmes;

- Their demand for strong language skills;

- Their hope for a better future;

- Their drive to stay connected…to their school and to their friends.

That underlying demand is the foundation for the recovery of student mobility into 2021, and it opens the door as well to opportunities for new programmes and products this year. All around us are examples of businesses and institutions that have had to pivot from their normal messaging and operations to offer new products or services during the pandemic.

New products on the fly

To take just one example from outside of the education sector, Airbnb, the global online platform for listing and renting local homes, had to cancel a planned stock offering because of the coronavirus. They changed course quickly to offer emergency assistance to their hosts, creating a multi-million-dollar relief fund and enacting a free cancellation policy for guests unwilling or unable to travel because of COVID-19.

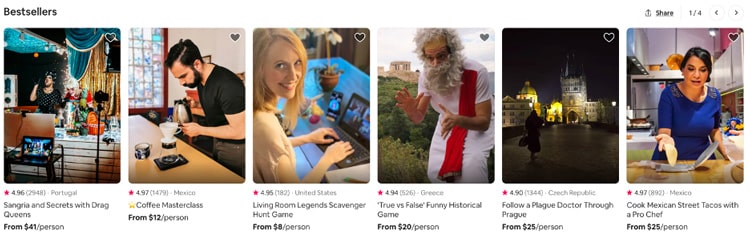

The company also jumpstarted an online experiences initiative, with one such offering – “Sangria and Secrets with Drag Queens” – generating US$100,000+ in one month for its Portuguese host. Fees per guest are around US$40, which underscores just how popular and widely accessed the initiative has been.

More broadly, Airbnb hosts charge US$10–US$50 per person for a 1–2-hour experience. This is of course a different revenue model than Airbnb hosts are used to. It also reflects the double-edged reality of the pandemic that so many of us have experienced: on the one hand, business as usual is out the window. On the other, online or hybrid offerings bring opportunities for new experiments, revenue streams, and some pleasant surprises as well – especially around customer reach and engagement.

The Online Experiences business area might offer food for thought for language schools especially, which have been particularly hard-hit by COVID-19. Many language schools integrate a cultural component (e.g., wine and gastronomy tours in France as part of a programme) and might be ideally positioned to switch to an online extension of their content as a result. It’s easy to imagine the possibilities – for example, a beginner’s exercise workout conducted in Spanish, an Italian cooking class (in intermediate Italian), or a tour of the Irish countryside for English-learners.

A prime time to communicate

Of course, the key to being able to pivot offerings and make students aware of them is keeping communication going. An emphasis on caring for students and staff is key – students will be looking for it in these anxious times and will need more frequent updates and reassurance than usual.

Answering students’ questions well and quickly is therefore crucial. The range of potential questions is massive, from how academic credit will be awarded in light of cancelled classes to whether refunds will be issued for student housing, to questions about scholarships and visas. Solicit feedback from prospective and current international students to determine which FAQs to feature on your website, and if possible, step up efforts on social and chat channels to respond as rapidly as possible to student queries.

In addition, this is the time to be in close contact with your international partners, and agents in particular. Agents refer significant proportions of foreign enrolments and, as always, they are a tremendous resource for market intelligence and student supports during the COVID crisis.

Speaking on a recent episode of the ICEF Exchange podcast, Eddie West, the Assistant Dean of International Strategy and Programs for San Diego State University, echoed the experience of many educators this year when he explained, “One of our biggest agent partners is a group based in Frankfurt, Germany and we have had more communication with them over the last couple of months than we probably had in the entire year before that. We find the greatest benefit when we go beyond the sort of standard blast emails and we connect directly with our partner over phone or Zoom or whatever and say ‘What is the real deal? What is going on?’ You get so much nuance and context when you actually connect directly. And so we have tried to be a lot more intentional about reaching out directly to our partners overseas.”

For additional background, please see:

- “ICEF Exchange Episode: How can schools engage with agents now?”

- “The growing importance of fee protection programmes”

- “COVID-19: Social media engagement is up and so is interest in online programmes”

- “Resetting international recruitment for extraordinary times”

- “When it comes to marketing and recruitment, start with relationships”