New study benchmarks global student group travel market

- A new survey provides valuable insights into the size and structure of the global student group travel segment

- Half of responding student tour operators reported increased demand in 2019, an increase in business that was of course cut short by COVID-19 this year

- Strong demand for group travel in 2019 suggests that a healthy recovery could happen once the threat of the coronavirus diminishes through 2020 and 2021

Millions of students go abroad for short-term group programmes to other countries every year, but there has historically been little quantitative study of this major category of study abroad. A rare exception is a recent report called The Student Travel Business Barometer 2019 Annual Report, commissioned by the Student & Youth Travel Association (SYTA), the international professional trade association promoting student and youth travel, and produced by international market research firm BONARD.

The report aims to describe the scale and structure of the student group travel sector – a category that is broadly framed to include study tours, language studies, college tours, volunteer placements, and other short-term group programmes. It reflects responses from 149 student tour operators from 26 countries across the world which collectively delivered programmes for 1.8 million travelling students. Both SYTA members and non-members participated in the survey.

Student tour operators and agencies whose business is sending students on both domestic and international trips composed 58% of the market represented by the survey, while domestic-only operators accounted for 24% and international-only operators made up 18%.

Carylann Assante, SYTA’s CEO, explains the importance of the report:

“Our 2019 Business Barometer shows that the student and youth group travel industry is a significant industry segment that was on course to achieve its greatest year ever, prior to the outbreak of COVID-19. The pandemic brought that growth to a screeching halt, but the great value in our Business Barometer is that we now have a benchmark of real data that we can use to measure growth as we hopefully move into recovery phase in late 2020, 2021, and beyond.”

Growth in 2019

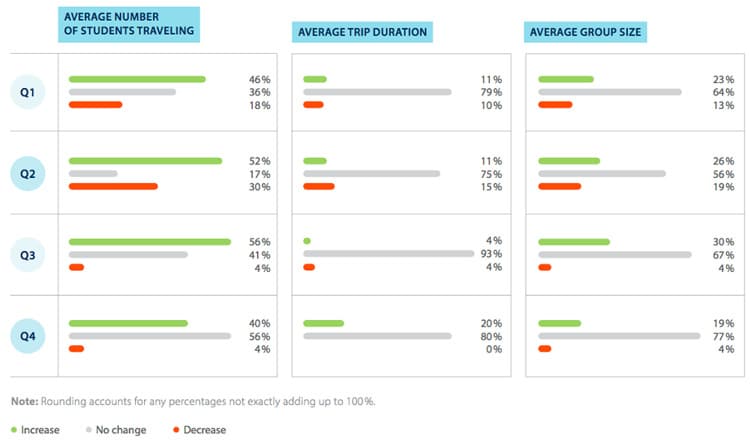

Roughly half of student tour operators reported that demand for international student travel in 2019 had increased over the previous year. That pattern peaked in Q3 2019, with 56% of respondents reporting increased programme volumes for that quarter compared to the same period in 2018.

Ms Assante notes that increased demand in 2019 bodes well for the prospect of a strong recovery once the threat of Covid-19 has diminished and school trips resume:

“We hope that these numbers predict a good sign for recovery later this year and into 2021. If we can count on the strength of Q1, Q2, and Q4 in 2019, we are optimistic that we may be able to see a rebound in business in Q4 of 2020 and Q1 and Q2 of 2021. Of course the majority of our business is derived from school trips, so school openings around the world will be the real determinant of our recovery.”

Other data shows that:

- May is the most important month of the year in terms of the volume of students travelling abroad; on average, each tour operator helped 1,160 students to participate in short-term student travel programmes in May.

- January and July are the months in which students spend the longest time abroad: 10.9 and 10.3 days respectively.

- March and February are the months in which the biggest groups of students travel for short-term exchanges.

- Each quarter of 2019 saw a different kind of exchange become more popular: educational travel dominated in Q1 and Q2, school and college tours led in Q3, and community service and volunteering programs became the most popular in Q4.

A different time

As recent as the report is, its findings point to a much different pre-pandemic time in the industry and in the world. For example, though safety was growing a concern for student travellers in 2019, students’ top priorities for their trips abroad were cost and content (i.e., programme/area of study). And as much as tour operators used mobile applications and social media for business in 2019, only a minority were using GPS technology to track their students on exchanges. It will hardly be surprising to see safety becoming more important even than cost going forward and to see participant tracking or monitoring become more common at a time where contact tracing is crucial in the fight against coronavirus.

Ms Assante adds,

“We anticipate that we may find some striking differences in the attitudes of operators and their customers to all of these issues in 2020 and beyond. Health and safety will be #1 on each operator’s list of priorities for certain, and we expect both technology and sustainability to play a far greater role as trip planning transforms in a post-COVID student travel industry.”

For additional background, please see: