New study anticipates shifts in enrolment and market share into 2021

- A new study highlights that relatively few students plan to cancel plans for study abroad this year, with most planning to defer their programme starts to later in 2020 or 2021

- The study authors also anticipate a shift in destination market share over the next several years, driven in part by the pandemic response of major study destinations

A new study finds that the number of students saying they will cancel their study abroad plans in light of the pandemic has declined in recent months. The unpublished study, “COVID-19 crisis: Planning towards the new normal,” was made available to us by EY Parthenon’s Global Education Practice, and, reflecting findings from other recent research in the field, it projects that the demand for study abroad will surge as the pandemic subsides.

It draws in part on the IDP Connect Survey for this observation. As of May 2020, only about 5% of respondents to the IDP survey said they intended to cancel – rather than defer – their study abroad plans. This is significantly down from March, when 1 in 10 students had intended to cancel.

According to IDP’s April 2020 data, of those students who said they were willing to defer rather than cancel, 18% students would wait for up to three months, 23% would wait for up to six months and 13% would wait for up to a year. In addition, almost 1 in 5 (18%) said they could wait to start their classes “until the institution was ready.”

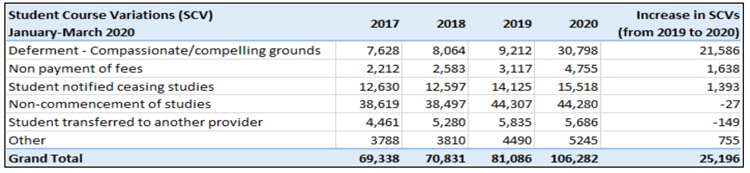

The following table from the government of Australia provides a more concrete example of this deferral behavior. It details the significant increase in the number of international students in the country who deferred their studies in the first quarter of 2020.

“The COVID-19 outbreak has resulted in a substantial increase in the number of students deferring their studies to a later date, but a relatively minor increase in enrolment cancellations,” says an accompanying analysis from Australia’s Department of Education, Skills, and Employment.

The department provides some additional detail that reflects the broad trends toward deferral that we see reflected in other recent student surveys: “It is apparent the majority were in the higher education sector and were mostly Chinese students. As reported [previously], at the end of March 2020 nearly 40% of all Chinese student visa holders were outside Australia as a consequence of travel restrictions, a far higher proportion than any other nationality. It is likely that those students, unable to travel to Australia, underlie the substantial increase in deferments seen in the first quarter of 2020. Nonetheless, given there were more than 60,000 Chinese primary student visa holders outside of Australia at the end of March 2020, it is apparent that the majority of those had not deferred up to the end of March.”

Anticipated shift in market share

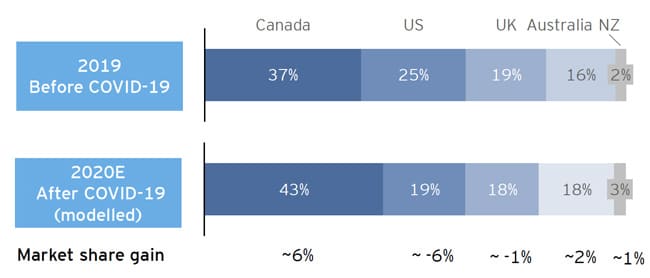

The EY study also includes some high-level modelling to ascertain whether some countries stand to gain market share post-COVID as a result of their handling of the crisis.

This analysis found that Canada might gain about 6%, Australia 2%, and New Zealand 1% more of the global share of new enrolments this year. As of right now, Canada is relatively well positioned to pick up share given that international students with valid study permits are allowed to enter the country despite strict travel restrictions otherwise remaining in place. Canada, which has increasingly positioned itself as a strong alternative to the US for study abroad, also stands to gain students given the US government’s recent moves to limit legal immigration, including for those holding (or hoping to acquire) student visas or post-study work visas.

Other destinations, notably Australia and the UK, have more recently moved to reopen visa processing services and to ease conditions for students needing to maintain visa status, renew their visas, or open a new visa application.

EY’s projection is reflected in the following graphic, which models the expected shift in destination choice among new students planning to begin studies in 2020. If this pattern holds, EY observes, this could establish a pattern of relatively stronger growth for Canada, Australia, and New Zealand, through 2024, and especially so in 2021 when demand for study abroad is expected to surge.

Needless to say, there are many factors that could intrude on this projection, not least of which are immigration policy, the political environment, and the relative health and safety of major study destinations.

Looking ahead to 2021

The EY study authors believe that, based on the most recent surveys with industry observers and students, demand for study abroad will return in 2021, assuming that COVID-19 is well controlled and international borders open again.

Continuing research from QS has similarly found that international students remain determined to follow through on their study plans and that a significant proportion are willing to begin studies online provided they can switch to face-to-face instruction in 2021/22.

For additional background, please see: