Survey measures the expected impacts of COVID-19 across education sectors and regions

- A global survey reveals that education executives differ in their sense of how COVID-19 will affect their business in the long term depending on what sector they work in and what region they come from

- Across the survey sample, there was wide recognition that online technology has never been more important, as millions of students rely on online learning platforms and services during lockdowns across the world

- Following from this, those respondents who are most confident about the future are those working in the education technology sector

A broad survey of education executives conducted in March shows that concern is widespread that COVID-19 and its societal and economic effects will be damaging in the short term, but that many believe their organisations and institutions will recover in the long term and/or even be better off than before the outbreak took hold.

The survey is part of a broader research effort conducted twice annually with HolonIQ’s Global Executive Panel, which is composed of more than 2,000 ministers, presidents, vice chancellors, CEOs, senior executives, and investors. The panel represents both private and public institutions in all levels of education, from pre-school all the way to lifelong learning.

HolonIQ’s March 2020 flash survey gathers insights from more than 700 respondents within this panel, and from 50 countries. Respondents from Europe, Latin America, and North America were heavily represented in the survey sample.

Near future looks grim, but hope lies ahead

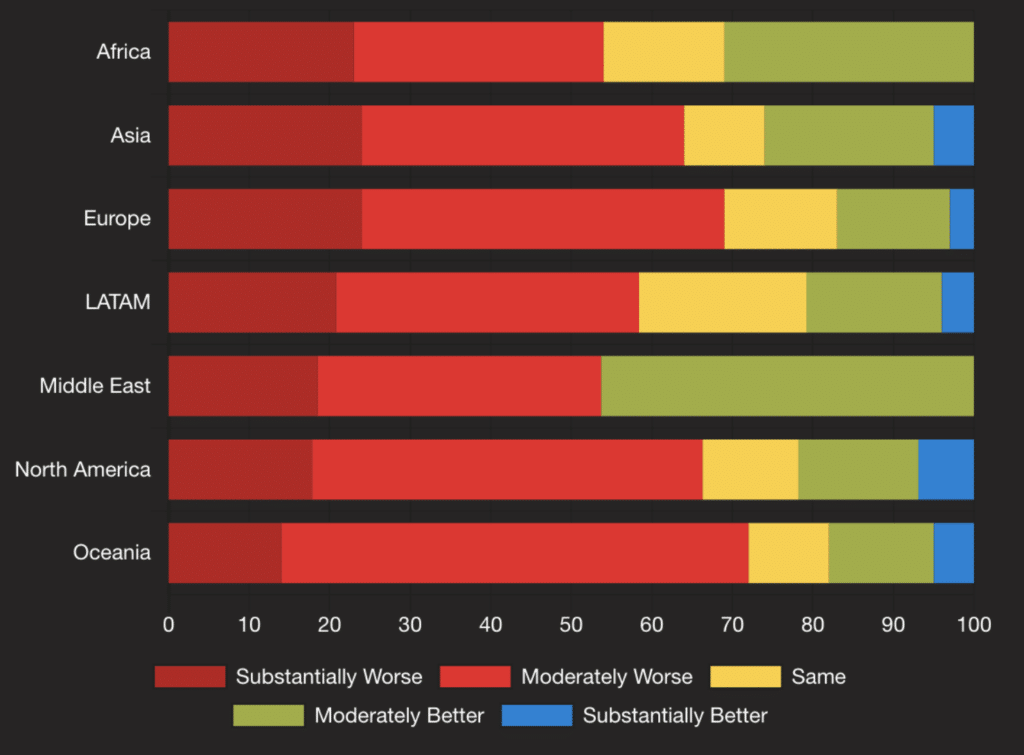

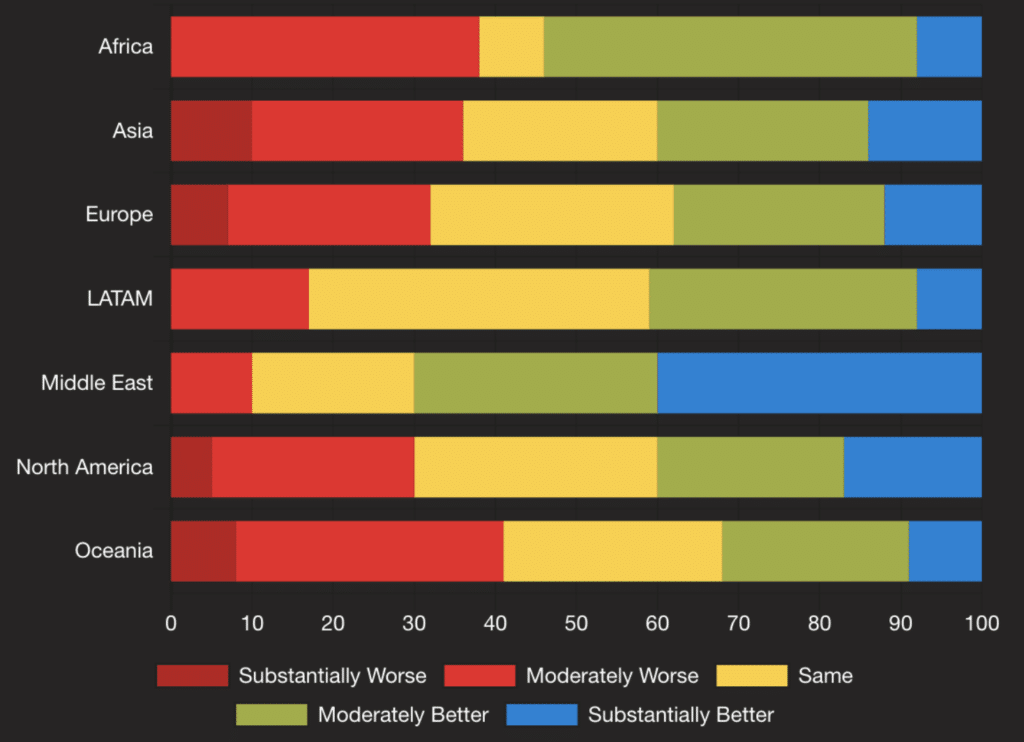

European and North American executives were the most likely to think that their organisations are going to be worse off in the short term (69% and 66%, respectively) due to COVID-19; Oceania (including Australia) was not far behind (62%). Concern falls significantly in Europe and North America when it comes to the long-term impact of the crisis, with more saying they think their institution will be better off than worse off in the long-term.

This suggests hope for the future among a large majority of respondents, a sense that things are going to be very difficult in the days ahead but that there will be a chance to recover afterwards. There is slightly less optimism in Australia, where 41% think their institution will be worse off in the long term.

The following charts reflect these broad regional impressions of the near-term and longer-term impacts of the pandemic.

In Latin America, 58% think their institution will be worse off in the near term, but only 17% believe the damage will stretch into the long term. Just over 4 in 10 (42%) think their institution will find itself in much the same position as before the virus struck, and the same proportion think that it will actually be in better shape in the long term.

Asian executives agree that their institution will feel the hit in the near term from Covid-19, but they are among the most upbeat about long-term prospects. A quarter of Asian respondents said they think their institution will revert to the same position as before the crisis, while 40% think it will be in better shape. Even more bullish about the long-term future are African executives (54% think it will be better); in the Middle East, fully 70% think their institution will be better positioned after the Covid-19 outbreak ends.

Looking at results according to stakeholder

We noted earlier that the survey gathered data from executives representing a wide variety of sectors and education levels. Among institutional representatives across the global sample, half believe that things will be worse in the long term; by contrast, only 18% of education technology providers (EdTech) feel that way, with far more (58%) thinking that they will be in better shape in the long term, not surprising given the huge shift to online learning right now as students stay away from physical classrooms. There is every likelihood that this shift will not end when COVID-19 dies down; the level of experimentation and invention at play now in the EdTech space is phenomenal and the products and services that capture key audiences now will be poised for success down the line.

Most investors (64%), meanwhile, see no great change to their fortunes in the long term as a result of COVID-19.

Assessing the global education landscape

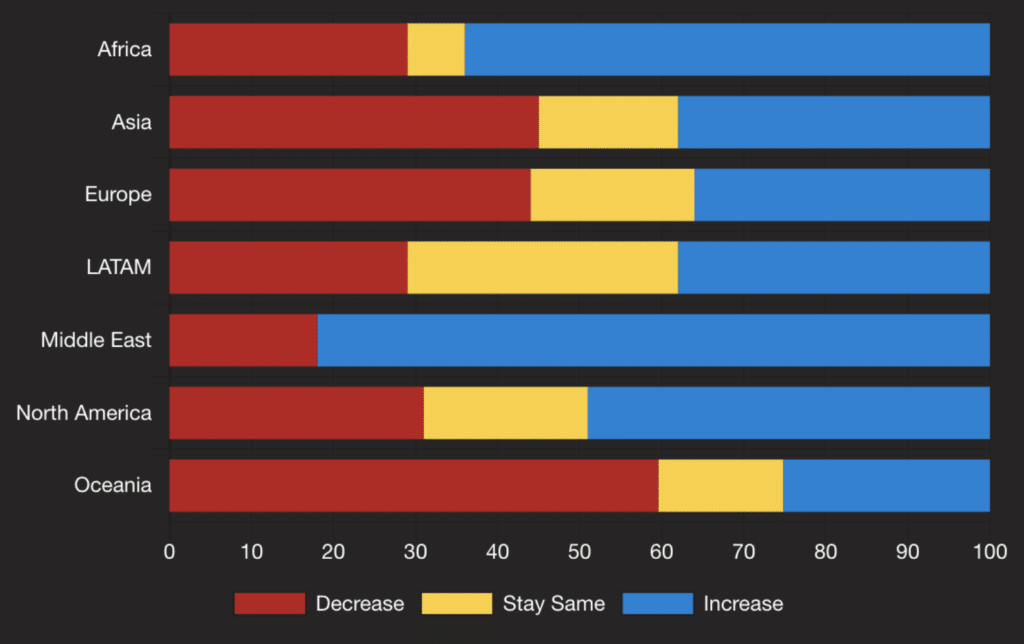

Not surprisingly, most agree that current conditions are worse right now than in the past. About one-third think things will improve over the next six months, but more than half expect less fortunate conditions to persist.

More than 40% of the global sample expects a decrease in enrolments/customer demand, three times the proportion that felt the same way in September 2019. The same proportion anticipates more demand, a result very likely influenced by the EdTech segment of the sample, who are right now as busy as they ever have been trying to meet demand for online learning.

As you can see from the following chart, education executives in Oceania (Australia) are the most pessimistic about demand returning to former levels in the next half year. The survey report attributes this to “the significant exposure to Asian markets for international education.”

Globally, more than half (57%) of respondents expect “disruption” (i.e., a new and fundamental change to the education landscape that leads to different ways of operating) within the next 24 months. Some respondents commented that COVID-19 has hammered home the importance of online learning.

Strategies going forward

One quarter of respondents say that investing in new technologies is their main plan for growth going forward, an increase of 10% since September 2019, not surprising given the way that upgrading technology and the ability to deliver lessons online has been a matter of survival for many institutions as the outbreak took hold. There is slightly less interest in investing in new markets for growth than there was last quarter (down by 6%) and about the same commitment to growing in existing markets.

One of the most significant differences in the latest survey versus the one conducted last fall is with regards to staffing. Like businesses in so many other sectors, many educators are having to lay off staff given the upheaval and revenue losses that COVID-19 has inflicted on the economy. In September 2019, only 7% expected a decrease in staffing within the next six months, while in March 2020 this rose to 26%.

The report notes that “Short-term challenges with potential gains in the longer term is a pattern across multiple aspects of the March 2020 survey. One North American respondent said, “We will have short-term cash flow challenges due to schools not being able to pay, but long-term gain as schools will now be more open to online tools post-virus.”

For additional background, please see:

- “Resetting international recruitment for extraordinary times”

- “Coronavirus update: Educators adjusting deadlines and programmes; agents provide their perspective”

- “COVID-19 triggers cancellations and delays but most students intend to follow through on study plans”

- “Internet trends report highlights online learning and visual marketing”