Canada’s K-12 schools prioritise new markets for enrolment growth

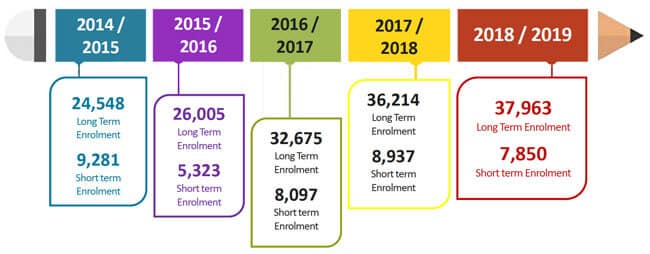

The number of international primary and secondary students coming to CAPS-I (Canadian Association of Public Schools – International) member schools to study for four months or longer grew by nearly 5% last year –from just over 36,200 in 2017/18 to nearly 37,970 in 2018/19. The growth in long-term numbers was not reflected in the trend for short-term enrolments of less than four months: in 2018/19, 7,850 international students were enrolled for shorter study periods at CAPS-I schools, a drop of more than a thousand students (-12%) from the enrolment reported in 2017/18.

The following chart takes a longer view and indicates that total long-term foreign enrolment in Canada’s public K-12 schools has grown by 55% over the five years from 2014/15 through 2018/19. Short-term numbers have been more volatile over this period but have declined by -15% overall.

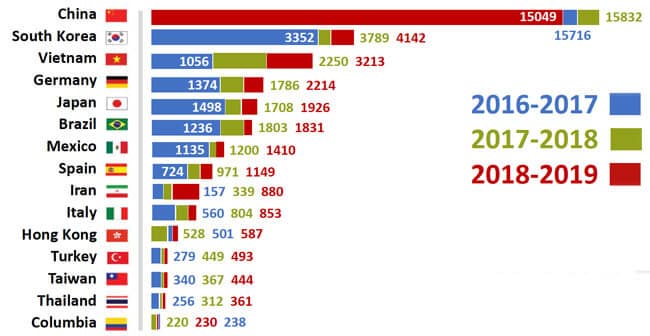

Long-term students came from 149 different countries and short-term students came from 84 in 2018/19. China remains by far the major contributor of long-term international enrolments to Canadian secondary schools, sending 15,049 students in 2018/19 for programmes of four months or longer. Even so, Chinese long-term enrolments were down last year by nearly 700.

Bonnie McKie, the executive director at CAPS-I, told ICEF Monitor that,

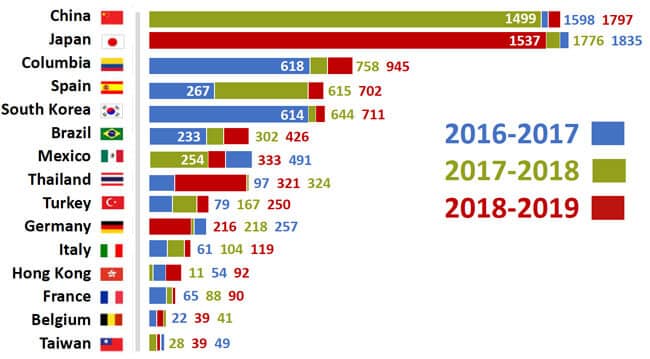

“The 2018/19 school year was the first time some of our members experienced a decline in full academic year enrolment of Chinese students primarily due to some shifts in the agent marketplace, greater competition, and more international offerings in China. However, last year, the number of Chinese students enrolled in our members' shorter-term programmes surpassed those from Japan, the latter which has traditionally been the #1 source market for K-12 short-term programmes.”

There were close to 1,800 Chinese students studying for less than four months in Canada at the K-12 level last year, compared with just over 1,530 students from Japan.

Vietnam one of several growth markets

We also asked Ms McKie to comment on the notable growth from Vietnam, where long-term enrolments have tripled between 2016/17 and 2018/19. She explains,

“Canadian public schools have been engaged in Vietnam for some time. However, recent trade missions to the region by CAPS-I, provincial associations, and other sectors as well as Trade Commissioners dedicated to Education at the Embassy of Canada in Hanoi and Consulate General in HCMC have ensured Canada's remains high profile in the market. A growing economy and proliferation of agencies not only in [Ho Chi Minh City] and Hanoi but in other large urban centres across Vietnam has also contributed to recent growth in enrolment.”

Ms McKie added that the “mature” markets of South Korea, Germany, Japan, and Mexico are helping to fuel steady growth, and that the “newer markets of Spain, Iran, and Italy have also shown year over year growth recently.” She anticipates further declines from China in the years ahead, continued growth from the many markets now contributing greater numbers of K-12 students, as well as new potential from the Middle East and Africa, and says:

“To support our members' efforts to continue to diversify their international student populations, CAPS-I will offer five trade missions in 2020-2021 (up from our usual three per year) with two to South America, three to Europe and one to two markets in Asia. CAPS-I has also just returned from participating in ICEF Dubai – the association's first exploratory visit to the region and will be formulating a plan as to how to become more engaged in some of those promising Middle Eastern/North African markets as well.”

For additional background, please see:

- “Canada: New international education strategy focuses on diversification and outbound mobility”

- “Slowing growth in foreign secondary enrolment carries important implications for US recruiters”

- “Slowing in Chinese commencements for most major study destinations”

- “Canada’s foreign student enrolment took another big jump in 2018”