Junior language travel market continues to develop

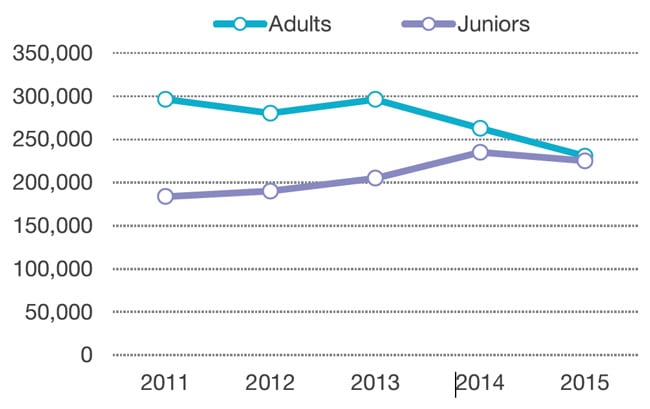

Junior students have become an important growth segment in recent years, especially in Europe, where students under age 18 now compose a significant proportion of language travel enrolments. Juniors accounted for nearly half of all language students in the UK (see chart below) and Ireland (47% each) and Malta (48%) in 2015. The average stay for a junior student tends to be roughly half (or less) that of an adult learner, but the segment has nevertheless accounted for a growing proportion of student weeks over the past several years.

- In Canada, the number of junior students fell by 5.2% in 2015 compared with 2014;

- In the UK, the number of junior students in private English UK member schools decreased by 9%; average student weeks also fell;

- In Ireland, the junior market grew very modestly in 2015 - by 1%, compared with 19% in the adult segment;

- More than 200 language schools responding to a global ALTO survey reported a 3.8% decrease in junior student weeks in 2015, after a 9.1% increase in 2014.

As these developments illustrate, junior student flows are affected by some of the same pressures that influence the adult ELT market, such as economic downturns in source markets, increased language-learning options in these markets, and language-learning technologies that can dampen demand for language travel. But although there was an easing off of junior student demand in some markets in 2015, the future looks bright. Language schools are reporting that students are travelling to learn a language at ever-younger ages. Parents who have grown up in the age of globalisation know how integral English proficiency is to securing a place at a good university and to improving career prospects, and they are looking for safe and exciting programmes for children as young as four. Schools participating in the 2015 ALTO/Deloitte Travel Industry Survey indicated that of their junior student enrolments (28% of total enrolments across the 228 schools represented), nearly half (12%) were students aged 16 and under (versus 16% for 16-18-year-olds).

Where are juniors going?

As of 2015, the top 10 junior student destinations in terms of student weeks booked (as reported in the 2015 ALTO/Deloitte Travel Industry Survey) are:

- UK: 20%

- US: 17%

- Canada: 14%

- Ireland: 9%

- France: 8%

- Malta: 5%

- Australia: 5%

- Germany: 5%

- Spain: 4%

- New Zealand: 3%

Where there’s a niche, there’s a way

The adult language-learning market has lately been characterised by increased demand for professionally or academically oriented English language programmes as well as for recreation-heavy offerings (e.g., English Plus Tennis, English Plus Art and Design). General English has become less of a source of growth, according to many schools and agents. Similarly, more specialised programming is also a trend in the junior market. Speaking with Study Travel Magazine, Thom Jones of Inspiring Learning – a British company that provides ski trips and adventure activities to enhance English-language learning – noted of the junior market that “… there has been excellent growth and real vigour, but the markets are changing too and demanding something new, both in terms of academic ‘currency’ and experiences.” There is a lot “new” to choose from, especially in the form of English Plus programmes. Junior students today can pair English learning with sports, drama, design, computer programming, and countless other interests. But not all “plusses” are equal; some are special enough that they form the basis for premium pricing on top of the normal English Plus fees. For example, Alpadia Summer Camps – offered in Switzerland, France, Germany, and England – include numerous activities within their standard pricing, then charge a premium for extra activities, including creative arts, cooking, horseback riding, mountain hiking, and adventure sports.

Age matters

Another segment of the junior market some schools are catering to is families, with programmes in which whole families travel and study together (albeit with juniors and seniors in separate classes). This niche is especially important for schools with programming for the youngest students in the junior age range whose parents feel more comfortable being with their children as they travel to learn English. At the older end of the segment, there is a growing supply of courses geared to preparing students for university and careers, whether through exam test preparation, internships, portfolio- or resume-building, or study skills workshops. Across the junior age range, ELT providers are factoring in the various ways students like to learn, from one-to-one homestays with tutors, amidst luxury facilities and accommodations, in immersive language villages with no technology, or using sophisticated apps and technologies to extend what can be accomplished in a classroom. Specialised programming in the junior ELT market reflects an intensified competitive landscape as well as increasing demand among students’ families for unique experiences. But at the end of the day, if a junior programme doesn’t produce notably better English proficiency for students, it will pay the price through bad word-of-mouth – magnified by the lens of social media. Also commenting to Study Travel Magazine, Remco Weeda of Ceran Lingua International in Belgium summed up the balance short-term junior programmes must strike: “Summer courses are short so utilisation of time is absolutely essential. Once students feel that their needs are met and that they are really learning, the value of the course is easily identified. The activities, programmes, excursions, and sports coaching then become a very welcome bonus.”

More demand, more competition

The junior segment has been a bright spot in a global language travel market that has seen more intense competition and slower growth in recent years. Looking ahead, we can no doubt expect more specialised programmes and greater competition for junior students as the market continues to grow and develop.