New data reveals most searched-for study destinations

The body of research underlining the importance of online channels to international student recruitment is growing. Among the key findings we have reported in recent months:

- Digital tools, including online search and more specialised school selection sites, play a key role in the discovery phase of students’ research - that is, the point at which they are researching different institutions and trying to identify schools that could be a good fit.

- Given the growing prominence of online platforms - including search sites and online directories in student decision-making processes - senior staff should be devoting substantial attention to these platforms, perhaps more than they have in the past.

- Recent surveys from the UK point to a shift in marketing spending toward digital channels - and to paid and organic search in particular. However, they also indicate that recruiters are struggling with measuring the performance of their online campaigns.

- Nearly two-thirds (63%) of the agents responding to the 2015 ICEF i-graduate Agent Barometer indicated that 20% or more of their leads came from online sources in 2015. And for nearly a third, online sources accounted for 40% or more of total leads.

Google research on education-related search volumes highlights the growing role of online search in the "student decision journey" and an increasing trend of students searching exclusively online for information about study programmes. One of the most important findings offered by the search giant is that non-branded search - that is, queries for more specific programmes or locations as opposed to those for an individual institution or school - is key. Google’s analysis finds that as many as 9 in 10 prospective students don’t know which school they want to attend at the onset of the search process and they reflect this non-brand orientation in their search behaviour. With this in mind, Google has recommended that recruiters target their search marketing efforts to promoting particular programmes in specific locations.

Platform insights

As these findings suggest, online search and discovery channels should now be a priority for senior marketing and recruitment staff.

Interestingly, school selection sites that operate at scale and that can therefore aggregate large volumes of student search data are now also providing valuable insights into shifting patterns of demand and behaviour online.

For example, Hotcourses, a global search platform targeted to international students, released a new analytics services late last year called "Insights" that allows for greater analysis of usage and search patterns across its websites. The company recently released a white paper commenting on some of its initial data observations, with a particular emphasis on a few key destinations and a set of emerging markets: Thailand, Indonesia, Vietnam, Brazil, Malaysia, Saudi Arabia, and Egypt.

The paper draws on 14 months of Insights data reaching back to November 2014, and relies on data from 23,000,000 Hotcourses users in 2015 alone.

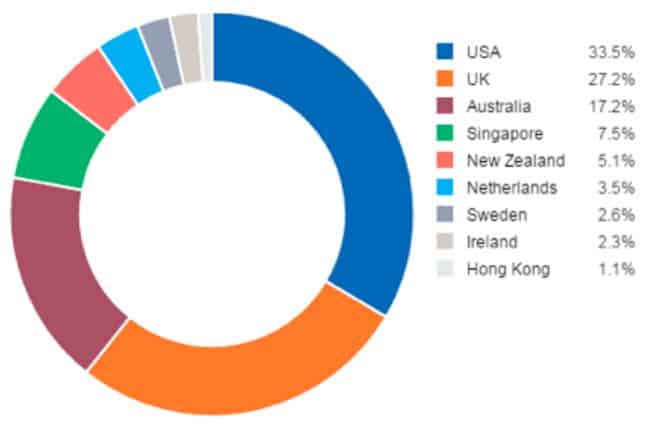

Among its high-level findings, Hotcourses finds that the US remains the most searched-for destination, with a 33.5% share of platform searches in 2015. The UK follows with 27.2%, and then Australia with 17.2%.

Trends in the US, UK, and Australia

An important segment of the Hotcourses whitepaper looks at "diversification markets" for the US, the UK, and Australia. It defines a diversification market as "a country which current constitutes less than 10% of students in a country." In other words, these are source countries that are particularly significant to the diversification efforts of American, British, and Australian institutions. In terms of these emerging markets, the US received the greatest volume of searches from Brazil (15.6% overall in 2015), Vietnam (9.9%), Thailand (6.7%), Indonesia (5.2%), and Saudi Arabia (4.4%). While Brazilian students remain those the most likely to be searching for the US of students in the diversification markers, Hotcourses notes a drop occurring through 2015 from this market (from 16% to 15.2%), which it imagines is a result of the ending of the hugely influential Brazilian scholarship programme, Science Without Borders. The UK received the greatest volume of diversification market searches from Thailand (13.3% overall in 2015), Indonesia (11.1%), Vietnam (7.0%), Brazil (6.8%), and Saudi Arabia (4.2%). As we noted earlier, Hotcourses notes that the general trend is negative for the UK, with the UK either flatlining or losing share of searches from prospective students. However, there is one bright spot: "The UK sees an increase from 37.3% to 41.1% in searches from Indonesia from the first to the second half of 2015 …. this would indicate Indonesian students are looking beyond the traditional countries of USA, Australia and NZ." Australia, meanwhile, is generating the most searches from these diversification markets: Vietnam (16.6%), Indonesia (13.4%), Thailand (11.1%), Brazil (6.5%), and Saudi Arabia (2.4%). Hotcourses notices a significant drop in searches for Australia from Indonesian students (from 15.4% to 11.5% over the course of 2015). It relates this to a wider context of Indonesian students feeling unwelcome in Australia: "In the early part of 2015, there had been a number of high profile news stories where asylum seekers from Indonesia were refused entry to Australia, and this appears to have filtered through into the extent to which prospective students wish to study in that country."

Top subjects searched for by different markets

Overall, Engineering, Health and Medicine, and Business and Management are the top subject searches, but there is some variation. These are the top subject searches (in order) the report notes for five countries:

- India: Engineering, Health and Medicine, Business and Management, Applied and Pure Sciences, Computer Science and IT;

- Saudi Arabia: Engineering, Health and Medicine, Business and Management, Applied and Pure Sciences, Social Studies and Media;

- Thailand: Engineering, Health and Medicine, Business and Management, Creative Arts and Design, Social Studies and Media;

- Russia: Business and Management, Creative Arts and Design, Social Studies and Media, Health and Medicine, Applied and Pure Sciences.

Overall, the Hotcourses report sheds fascinating light on the study interests of prospective students from key markets as reflected in these students’ search behaviour. The insights from this report alone could help to finetune recruitment tactics for specific markets - including those "diversification markets" that educators are increasingly aware they have to consider in their enrolment strategies.

Most Recent

-

New Zealand announces strong foreign enrolment growth along with a new international education strategy Read More

-

The surging demand for skills training in a rapidly changing global economy Read More

-

US issues corrected student visa data showing growth for 2024 while current trends point to an enrolment decline for 2025/26 Read More