Sweden’s international student numbers up for the first time since 2011

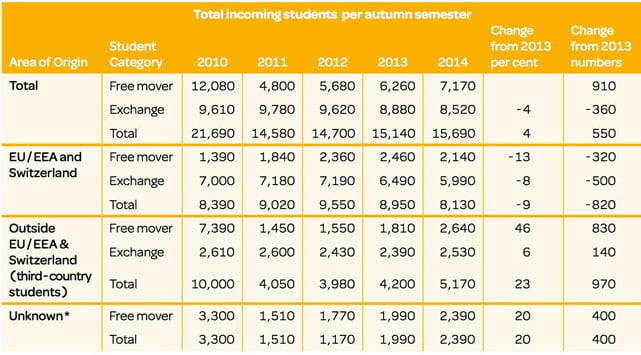

The Swedish government moved to introduce higher education tuition fees for non-European Union/non-European Economic Area students in 2011, and foreign student enrolment in the country promptly took a sharp downward turn. The decline was especially notable in the number of new, non-EU "free mover" students (that is, those enrolling outside of a formal exchange programme), which dropped from 7,390 in fall 2010 to 1,450 in fall 2011, the first intake for which non-EU tuition fees came into effect.

Fees currently average SEK100,000 per year (US$11,700) but with some notable variances among programmes and institutions. As University World News reported recently, "Some institutions charge higher fees, such as the University College of Arts, Crafts and Design in Stockholm which charges SEK285,000 (US$33,300), and the KTH Royal Institute of Technology in Stockholm which charges [US$28,300] for courses in architecture."

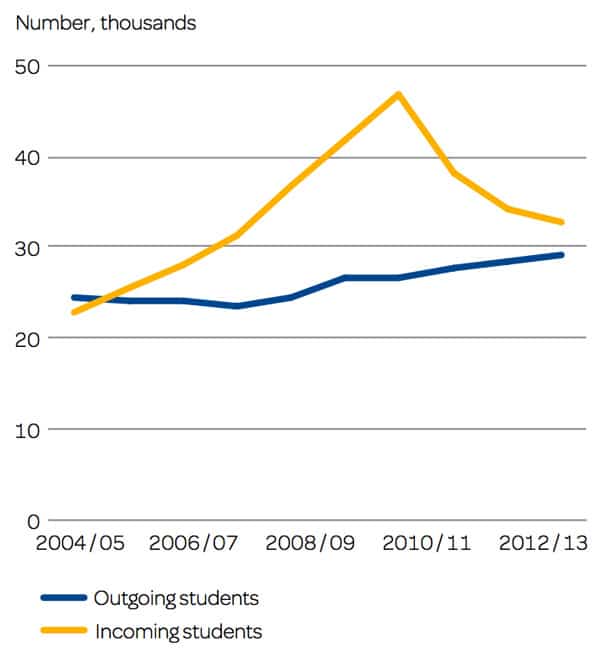

Reflecting the sudden shift in 2011 from "free" to "hundreds of thousands of Swedish krona", total student numbers, including both EU and non-EU enrolments, continued to decline through the 2013/14 academic year.

The bigger picture

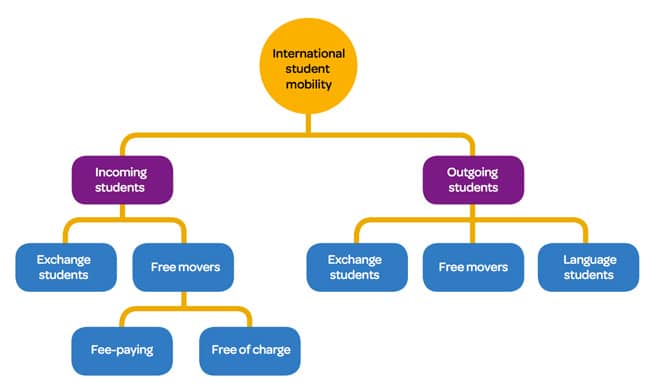

With this broader perspective on student mobility squarely in mind, let’s step back from looking only at commencements to consider the more comprehensive enrolment pattern for fall 2014. The UKÄ reports that in addition to the new fee-paying students indicated in the table above, there were also 1,300 continuing, fee-paying students in Sweden as of fall 2014. This puts the total non-EU enrolment at just over 3,600 students for that intake, representing a 30% increase over the roughly 2,800 fee-paying students enrolled in fall 2013. While Sweden’s fee-paying students come from 107 countries, 25% are from China and another 14% (about 500 students) are from India. The number of Indian students in Sweden has reportedly quadrupled since 2011. University World News notes as well that this segment of Sweden’s international enrolment is highly concentrated among only a few universities. "Half of the fee-paying students are attending four Swedish universities: Lund University (578), KTH Royal Institute of Technology (503), Chalmers University of Technology (308) and Uppsala University (301), while the other half is distributed among 25 universities and colleges." If we think in terms of fall enrolment from year-to-year (as opposed to counting students for the full academic year), the total number of incoming students rose for the first time since 2011 to reach 25,400 in fall 2014. Seen through the lens of the academic year, however, and keeping in mind that the most recent academic year data is for 2013/14, the UKÄ notes, "During the academic year of 2013/14 about 32,600 incoming students were attending first and second-cycle programmes in Sweden, which is 1,400 fewer than in the previous academic year. In 2013/14 about 18,500 of the total number of incoming students were free movers and 14,100 exchange students. The number of exchange students declined by 900 (6%) and the number of free movers by 500 (3%)." So there are a couple of countervailing trends at work here:

- On the one hand, the overall number of international students has continued to decline through 2013/14;

- On the other, we see accelerated growth in the number of fee-paying students between 2013 and 2014, to the point that total incoming numbers nudged slightly upward in fall 2014 for the first time in several years.

It will be interesting to see if that increase for fall 2014 translates into overall growth for the 2014/15 academic year. There are, however, other factors that have prevented the increasing numbers of fee-paying students from having a greater impact on overall mobility figures. First, up to fall 2014 the year-over-year increases in fee-paying commencements have been too modest to influence larger enrolment trends in the country. At the same time, Sweden has also seen some declines in the number of incoming exchange students and these have largely offset any gains from increased fee-paying enrolment.

Factors driving growth in fee-paying enrolment

Sweden has been a ready case study of the effects of introducing (or dramatically raising) international student fees, and it has certainly been a commonly cited example in the debate over international tuitions in neighbouring Finland. However, the Swedish experience, particularly the ongoing recovery of its fee-paying enrolment, provides other important lessons as well. To begin, the Swedish example illustrates the value of sustained marketing and recruitment. Several Swedish institutions began recruiting more actively in the wake of the 2011 fee change and their efforts have been rewarded in the years since with growing numbers of fee-paying students.

The impact of increased recruiting is particularly notable for postgraduate programmes with non-EU/non-EAA applications to master’s programmes increasing by 25% since 2011.

In conjunction with the introduction of non-EU/non-EEA tuition fees, the Swedish government also moved to expand scholarship support for incoming students. In total, the government currently provides about SEK250 million (US$30 million) in scholarship and grant funding for foreign students. Along with this expanded financial aid, Sweden has also moved to expand work rights for international students in Sweden. Students are now permitted to work during their studies, to remain and work in Sweden after graduation, and, particularly in the case of doctoral students, to pursue permanent residency in the country. Finally, there has also been a significant expansion of English-taught programmes within Swedish higher education institutions over the past decade. There are more than 800 such programmes in Sweden today (only Germany and the Netherlands have more among European countries), representing nearly a quarter of all university programmes in the country. These measures suggest a cohesion in the efforts of Swedish policy makers and institutions to further internationalise higher education in the country, and as such they represent a valuable example for many study destinations regardless of fee policy.