Finding opportunities within crisis in Brazil

Brazil is one of the most important emerging economies in the world, and, by extension, an education market of great importance as well. It is by far the most populous nation in Latin America, and its booming middle class has been an important driver of growth over the last decade and more. Rising disposable incomes and consumer demand helped ensure Brazil’s membership in the BRIC club - along with Russia, India, and China - and they have also helped fuel steady and strong growth in outbound student mobility.

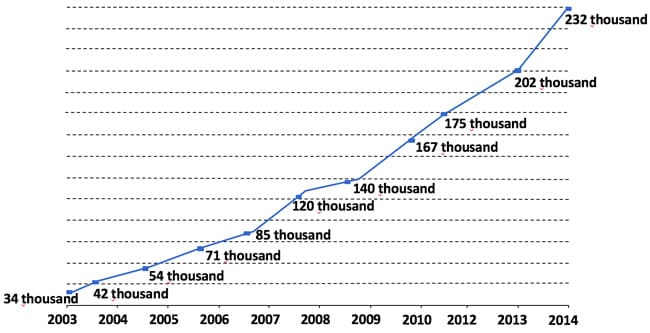

The number of Brazilian students studying abroad - as measured by the Brazilian Educational and Language Travel Association (BELTA) - grew by nearly 600% between 2003 and 2014. Reflecting the great importance of language travel in Brazilian outbound, BELTA puts the total number of Brazilian students abroad at 232,000 in 2014 (and 202,000 in 2013) whereas UNESCO pegs the total number of tertiary-level students studying outside Brazil at just over 32,000 for 2013.

The country is in a full-blown recession at this point and the latest forecasts have it that the economy will shrink by 3.1% this year and nearly 2% in 2016.

The classic recessionary symptoms – weakened currency, rising unemployment, rising inflation, higher interest rates, and teetering public finances – are now unfortunately in full effect. Earlier this fall, urban unemployment rates reached the highest levels in five years. Economists calculate that Brazil’s median household income grew 87% between 2003 and 2013. But inflation has nudged up to 10% and this, combined with worsening employment and economic outlooks, has placed a profound chill on consumer spending.

Of particular relevance to international travel and study, the Brazilian currency, the real, has plummeted in value over 2014 and 2015. The real has dropped by 30% against the US dollar this year alone, with the net effect that it is now considerably more expensive for Brazilians to travel abroad, particularly to the US, the long-time destination of choice among Brazilian students.

A commitment to building skills

BELTA is the leading Brazilian association for education travel agencies. It counts more than 450 agencies among its membership, which in combination represent an estimated 75% of the Brazilian outbound market. Its members report a distinct spike in demand - ranging between 21%-40% - for English for Special Purposes programmes in the first half of this year (compared to the same period for 2014). BELTA President Maura de Araujo Leão explains that programmes focused on English for specific professional fields or disciplines (e.g., English for Business, English for Engineering) are especially in demand this year, as opposed to more general ESL studies. "The demand is always there," says Ms Leão. "We need to learn a foreign language and English of course is the language of the world nowadays. But now students look for a language programme that can provide more specialised knowledge. For example, an engineer working for a multinational in Brazil will look for a language programme that offers a specialty for their careers. This makes it a richer experience for them. Instead of saying, ‘Oh, I went abroad for a four-week programme of English’; it’s much better to say, ‘I went for this programme that brought me more knowledge in my professional field.’" For these students, Ms Leão adds, study abroad is a way of strengthening their curriculum vitae in a more competitive job market. Whether the student has already lost his or her job, or is concerned about the possibility of job loss, further study abroad is a way of building skills and becoming better prepared for the next career opportunity. The same considerations appear to be also driving a notable bump in demand for post-graduate programmes this year. BELTA members report a 600% increase in demand for post-graduate studies in 2015. This is admittedly against a smaller base from 2014 but again reflects the determination of Brazilian students to continue building their skills and to gain further qualifications that can help them pursue new opportunities in a challenging job market.

Open to new destinations

The other notable shift in Brazil this year is that students are moving to more affordable study destinations. With the changing foreign exchange rates making traditional favourites like the US so much more expensive, the emphasis is shifting to hosts such as Canada and even more so to still more-affordable destinations such as Malta, South Africa, and Ireland. Driven in part by the Science Without Borders programme, and by strengthening educational ties between the two countries generally, Brazilians took out more resident permits in Ireland than any other nationality last year (and in 2013 as well). But cost plays a part too and Ireland, as a more affordable European destination, allows the chance for a longer stay. "Brazilians love Ireland," says Ms Leão. "People who are just getting out of university, they look for a place where they can go for a long-term. If you don’t have enough English, you need to stay for a longer period." "Students look for a country where they can work, and that makes Ireland very attractive," she adds. "Australia and New Zealand also offer that opportunity. Canada also has the chance to work for those in higher education programmes and we see people looking for this following either undergraduate or graduate studies."

Looking forward

The determination of Brazilian students to continue to develop their skills abroad reflects an important and enduring perspective in Brazil. “We’re going to come through this,” says Ms Leão. "When the crisis is behind us, people have to be ready. They can’t just be sitting still in the meantime." She adds that international educators also have an opportunity now to strengthen their working relationships in Brazil. "I think educators should be very loyal to their agents," she says. "This is the moment to choose the right agents and be patient and supportive."