Student housing investments jumped in 2022 but still lag behind demand

- A new report estimates the total global investment in student housing at more than US$31.5 billion in 2022

- However, this still has any new stock of student beds lagging behind demand, with the result that a majority of students are housing in private accommodations in many destinations

A new report from online booking service Amber Student focuses on trends in student housing in three key study destinations: the United States, United Kingdom, and Australia.

Reflecting similar findings in another recent analysis from industry research specialists BONARD, Amber reports a notable increase in investments in student housing in 2022. This includes US$7 billion in new housing developments in the UK, US$6 billion in the US, and another US$3 billion in Australia.

BONARD reports an additional US$5 billion investment in purpose-built student accommodation (PBSA) across Continental Europe in 2022. Amber estimates that the global value of housing investments in 2022 exceeded US$33.5 billion.

Even so, student demand for housing continues to considerably exceed supply in most destinations, to the point where access to affordable housing is an increasingly pressing issue for students when planning for study abroad.

Amber's analysis estimates that roughly 10% of students in the UK face issues while searching for accommodation, noting that, "There is a huge demand and supply gap: With the 2023 intake starting, at least 207,000 students are likely to face a crisis situation with their accommodation."

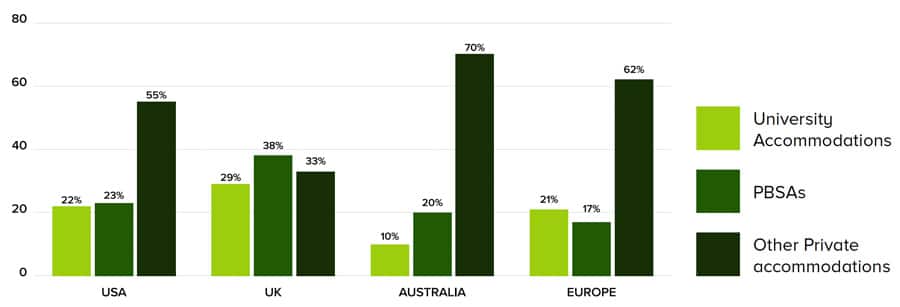

Amber underscores the point by noting that roughly two in ten students (21%) globally are accommodated in university accommodations. The report adds that, "As the PBSA sector continues to expand, the supply crunch has caused 53% of the global student population to opt for private accommodations in major education markets."

With the real growth in PBSA beds lagging behind demand, large percentages of students are in privately owned housing, sometimes referred to as the HMO segment. The term refers to "a house in multiple occupation", typically with three or more tenants sharing communal areas such as a kitchen, bathroom, or other living space. As a result, the HMO space dwarfs the PBSA sector in some destinations. For example, Amber sizes the HMO market at US$225 billion in the US and roughly US$32 billion in the UK. This compares to a PBSA sector valued at US$65 billion in in the US and US$73 billion in the UK.

The report notes as well that private housing providers that target student segments are increasingly aligning their offerings with those of PBSA providers: "Globally, HMOs are revamping their offerings to provide higher-quality accommodations. As students have become accustomed to the modern amenities offered by PBSAs, they are increasingly seeking housing options near universities that offer similar features and amenities."

Based on its 40,000 student bookings in 2022/23, Amber reports that the vast majority of students arranging accommodation in the US, UK, and Australia prefer a private bedroom with private bathroom, with the most in-demand amenities including high-speed WiFi, 24-hour security, on-site laundry, and fitness centre.

For additional background, please see: