UK ELT shows real gains through second quarter of 2022

- ELT enrolments in the UK grew by nearly 200% in the second quarter of 2022, compared to the same quarter in 2021

- The average business volume per reporting ELT centre has now reached 70% of pre-pandemic levels

- The composition of that enrolment, however, remains very different with a much greater reliance on individual, adult bookings than was the case before the onset of COVID-19

Compared to the same period a year before, there were many more students enrolled in English Language Teaching (ELT) centres in the UK in Q2 2022. Those students were mostly enrolled as individual bookings, as opposed to groups, and the vast majority were adults, as opposed to juniors. This is a very different composition for the country's ELT enrolment than was the case in the years before COVID, but there is no doubt the industry has taken an important step towards recovery through the first half of this year.

The Q2 2022 edition of English UK's Quarterly Intelligence Cohort (QUIC) report, prepared by industry research specialists Bonard, reports a total of 105,658 student weeks for the quarter. This represents a 181% increase over the 37,608 student weeks for the same quarter in 2021.

Other key findings include:

- The pace of recovery is uneven by student segment. An accompanying statement from English UK highlights that, "Whilst the average volume of student weeks [per reporting centre] has reached 70% of the 2019 figure, for juniors it stood at 37%."

- Even so, junior bookings grew to account for 10% of all student weeks in Q2. "This is a considerable jump from the proportion of junior student weeks recorded during the same period last year (0.4%)," adds the report.

- Individual bookings accounted for 86% of all enrolments for the quarter, but again the proportion of group bookings doubled this year (representing 14% of all bookings for Q2 2022, as compared to 7% for the same period last year).

- Most ELT students were recruited through agents, with roughly three in four student weeks being accounted for by agency referrals.

Where are students coming from?

In line with the growing proportions of group and junior bookings, the Q2 report notes some changes in the table of top sending markets.

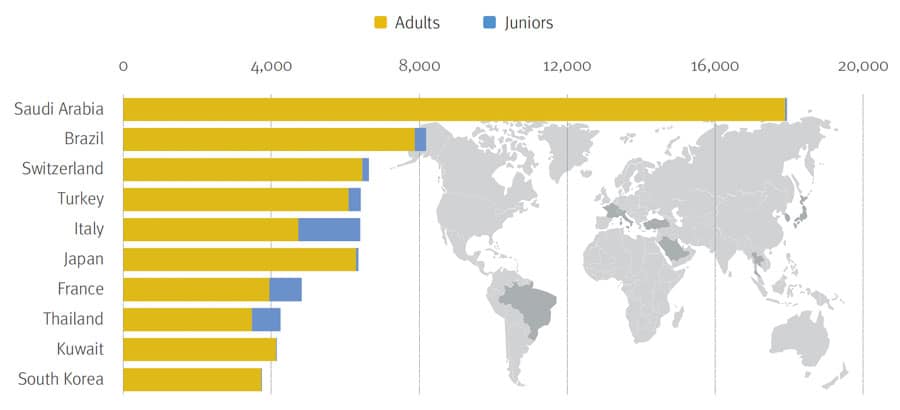

"Saudi Arabia kept its usual top position in the overall ranking, dwarfing all other source countries with 17,941 student weeks. It was followed by Brazil (8,179 student

weeks), Switzerland (6,455) and Turkey (6,420), all strong adult source markets," explains the report.

"Climbing from eighth in Q2 2021 to fifth position in the ranking, Italy, a traditionally strong source market (ranked second in Q2 2019), accounted for 6,406 student weeks in total, 1,680 of which were spent by junior students.

The second most significant junior market in Q2 2022 after Italy was Spain, with 1,348 junior student weeks (a 12% increase from Q2 2021)."

The top ten sending markets for the quarter are summarised in the chart below.

For additional background, please see: