Latin American institutions increasingly prepared to compete for international students

- International student mobility is increasing in Latin America – both in terms of outbound student flows and increasingly, inbound students and researchers

- Over the course of the pandemic, Latin American universities increased international partnership activities and dramatically improved online learning platforms

In the landscape of international education, there are sometimes stories and trends that show just how much this industry can do to better the world – to make it more cooperative, to improve the lives of students (not to mention their kids and parents), to move people from places of violence and corruption to places of safety, and to help developing countries to transition into more prosperous, stable nations that can compete and collaborate with advanced economies.

One such trend is to be found in Latin America right now.

Many Latin American countries have been sending increasing numbers of students abroad – but many are also home to important and sophisticated institutions that are competing ever more strongly for students from all over the world.

Latin American outbound

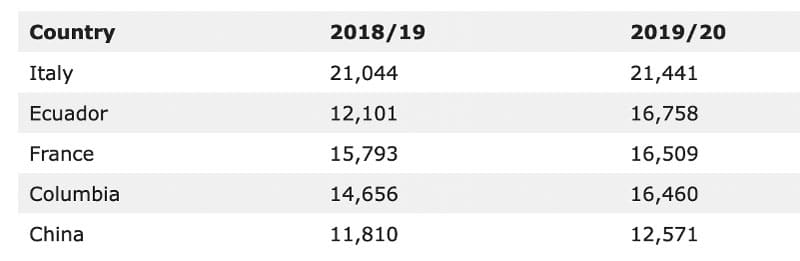

Spain is a highly popular country for Latin American students. Spanish institutions have been receiving increasing numbers of Latin American students for several years: Ecuador is the #2 market and Colombia is #4. Both are growing much faster than the remaining countries in Spain’s top 5 list.

In Portugal, where the number of international students in higher education has more than doubled in the past decade, 41% of the nearly 50,000 international students enrolled in Portuguese universities were from Brazil.

Latin America is also an increasingly important region for Canada. Canadian institutions hosted 81% more Mexican students in 2021 than 2020, while Bolivia, Chile, and Peru sent 153%, 133%, and 113% more students, respectively. In the US, Brazil, Colombia, Mexico, and Venezuela are in the top 25 markets.

Moving to Australia, the fastest growing source region for students is Latin America. Between 2013–17, the number of Latin American students in Australian institutions almost doubled, and the vocational and English-language sectors are responsible for a lot of that growth. In 2018, 40,000 Brazilian students were in Australia, making them the fourth-largest international student group. Colombia is also now in Australia’s top 10 source markets.

That’s a lot of outbound. But it’s only part of the story of Latin American internationalisation right now.

International collaborations are a top priority

In 2019, QS conducted a survey that found that fully 90% of participating Latin American universities had an international strategy in place. The strategies’ goals included:

- Comprehensive internationalisation (49%)

- Expansion and improvement of international mobility (41%)

- Development and promotion of new international partnerships (31%)

- Encouragement of international academic collaboration (26%)

- Improvement of international activities management and processes (17%)

By “comprehensive internationalisation,” respondents meant that they were committed to developing their “programmes, staff, and activities that will ultimately help to attract international talent and develop academic staff to become experts in their field of research.”

The level of development was high enough already in 2019 that Latin American countries were receiving almost as many students (137,000) as they were sending students abroad (195,400), according to UNESCO data.

Institutions responding to the QS survey painted a picture of collaboration and global-mindedness: “Most universities in the region [had] between 50 to 400 official international agreements (65%) and up to 100 unofficial collaborations (54%) with global partner institutions.”

In 2022 – despite the pandemic – Latin American universities have only upped their game. University World News reports that at the 2022 NAFSA conference,

“Dr Rodrigo Cintra, chief international officer of Escola Superior de Propaganda e Marketing (ESPM or Higher School of Advertising and Marketing) in São Paulo, Brazil, put the American and European universities that have dominated international education on notice, saying: ‘We are here to play with you.’”

Underpinning the confidence is the fact that Latin American universities invested heavily in technology and online platforms during the pandemic. Dr Brigitte Baptiste, rector of the Universidad Ean in Bogotá, Colombia, told the NAFSA audience,

“We invested lots of money in our technological capacities. But also, in creating new languages or making virtual interaction less boring, less heavy, much more attractive for learners.”

Encouraging intra-regional mobility has been a heavier priority for Latin American countries of late. In 2019, we reported that 23 Latin American countries had signed on to a new Convention for the Recognition of Studies, Diplomas and Higher Education Diplomas in Latin America and the Caribbean. The agreement was born out of concern that too many Latin American students were going overseas to study rather than staying within the region. The hope attached to the agreement was that encouraging intra-regional mobility would concentrate graduate talent in Latin America rather than see too much of it migrate overseas.

The growing niche Latin American universities are carving out for high-quality online platforms and teaching is complemented by their investment in the kind of programmes the world needs most right now. Focuses include trauma-informed pedagogy, racial literacy and critical thinking (Universidad Veritas in Costa Rica) as well as sustainability, pollution, and climate change. University World News reports that Ms Baptiste “challenged her audience to re-imagine “tourism, agricultural, food and entrepreneurship programmes from a sustainable point of view.”

A greater focus on intra-regional?

It will be interesting and exciting to see if Latin America follows a similar internationalisation trajectory as Asia has over the past few years. As we reported in 2019, Asian students have had more and more reason to stay within their region rather than study in the West. Reasons for that, we noted in 2019, included:

- “A dozen of the world’s 100 top ranked universities are now in Asia – in China, Hong Kong, Japan, Singapore, and South Korea. (Editor’s update: In the QS 2022 rankings, the number of Asian institutions in the top 100 is now 26, meaning that a quarter of the world’s best-ranked universities are now in Asia.)

- Asia is the world’s fastest-growing regional economy; China, India, Indonesia, Japan, and South Korea are driving the most expansion. Students realise that Asian universities can help them to access industry internships and jobs in the region.

- China, the continent’s powerhouse, invests heavily in its massive, multifaceted soft-power initiative known as One Belt, One Road, which stretches through more than a hundred countries and through South and East Asia. China is creating thousands of scholarships to attract Asian as well as African students. It is increasing higher education capacity and tempting Asian students from within the region to choose China rather than go overseas. (Editor’s update: China has closed its borders for more than two years now as a result of COVID. It will be interesting to see whether, once China opens up, international students return to the country in the same massive volumes as before the pandemic.)

- Students everywhere are gravitating towards programmes with strong and immediate employment outcomes. Asian universities are performing very well in this regard. QS’s 2019 Graduate Employability Rankings include four Asian universities – Tsinghua, Peking, Hong Kong and Tokyo – among the top 20 institutions. QS notes that “Asian universities are among the world’s best at enhancing their alumni’s job market prospects.” (Editor’s update: In QS’s 2022 Graduate Employability Rankings, 23 Asian institutions were in the top 100).

- More than half a dozen Asian countries have national strategies aimed at making them major destinations, with several setting international student targets. China is now the world’s fourth most popular study destination after the US, Australia, and Canada. (Editor’s update: This is no longer the case given that no international students have been able to enter China for more than two years. Again, it will be interesting to see what happens when China lifts its travel restrictions).”

As it stands, six Latin American universities are in the 2022 QS World University Rankings.

For additional background, please see: