2019 Agent Barometer: Optimism for year ahead and insights on destination preferences

The 13th annual ICEF i-graduate Agent Barometer, results of which were released at ICEF Berlin this week, elicited a record number of responses (2,065) from agencies in 119 countries, the widest geographical distribution ever for the survey. The 2019 survey was administered over August and September this year and represents an unusually large sample size for a qualified agent survey.

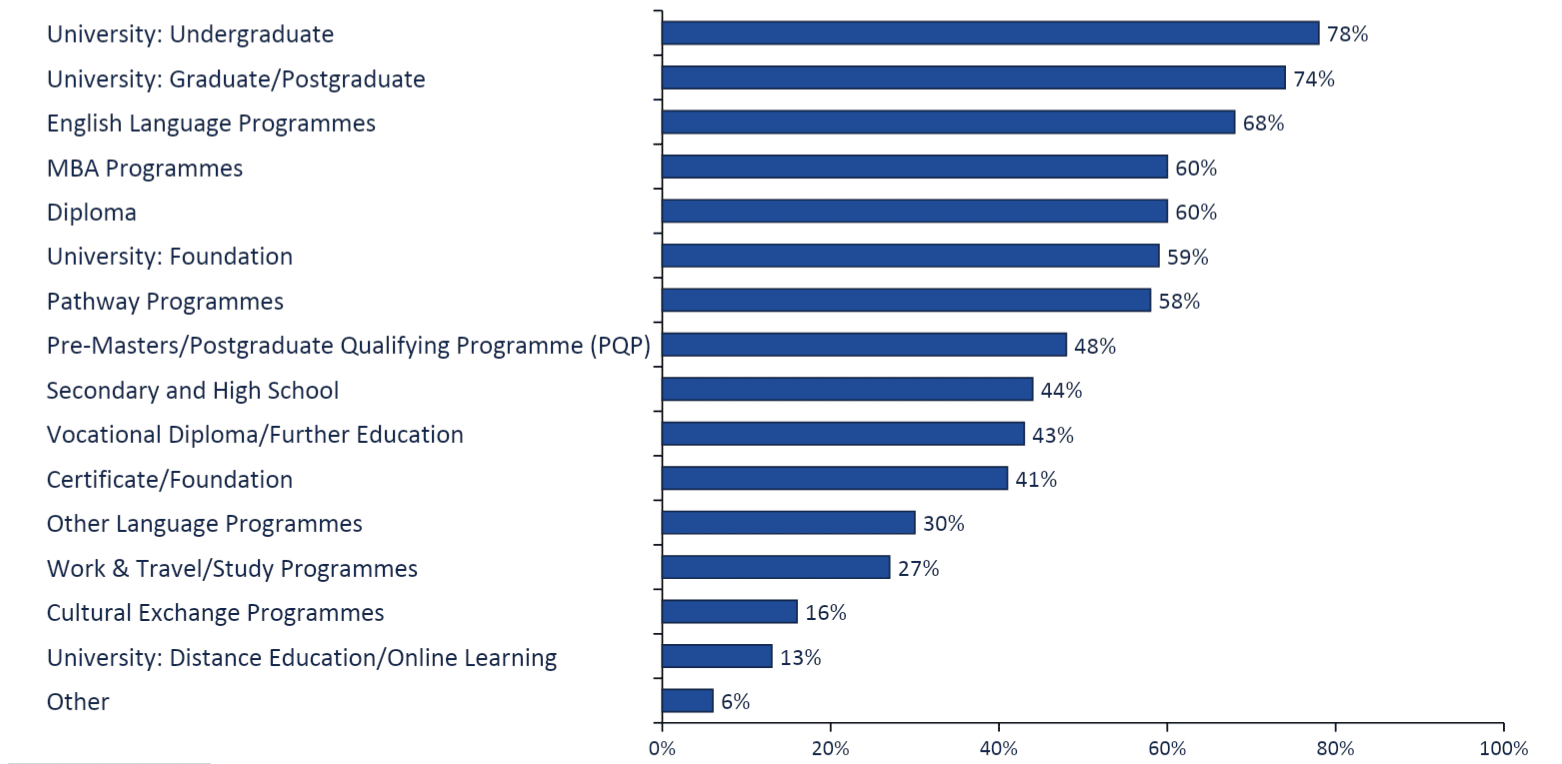

The most popular programmes that agents are referring students to are undergraduate and postgraduate programmes (78% and 74%, respectively), followed by English-language programmes (68%); MBA and diploma programmes (60% each); and university foundation and pathway programmes (59% and 58%, respectively). As in previous years, business, computer science, and engineering are the programmes to which most agents are referring students.

Optimism abounds

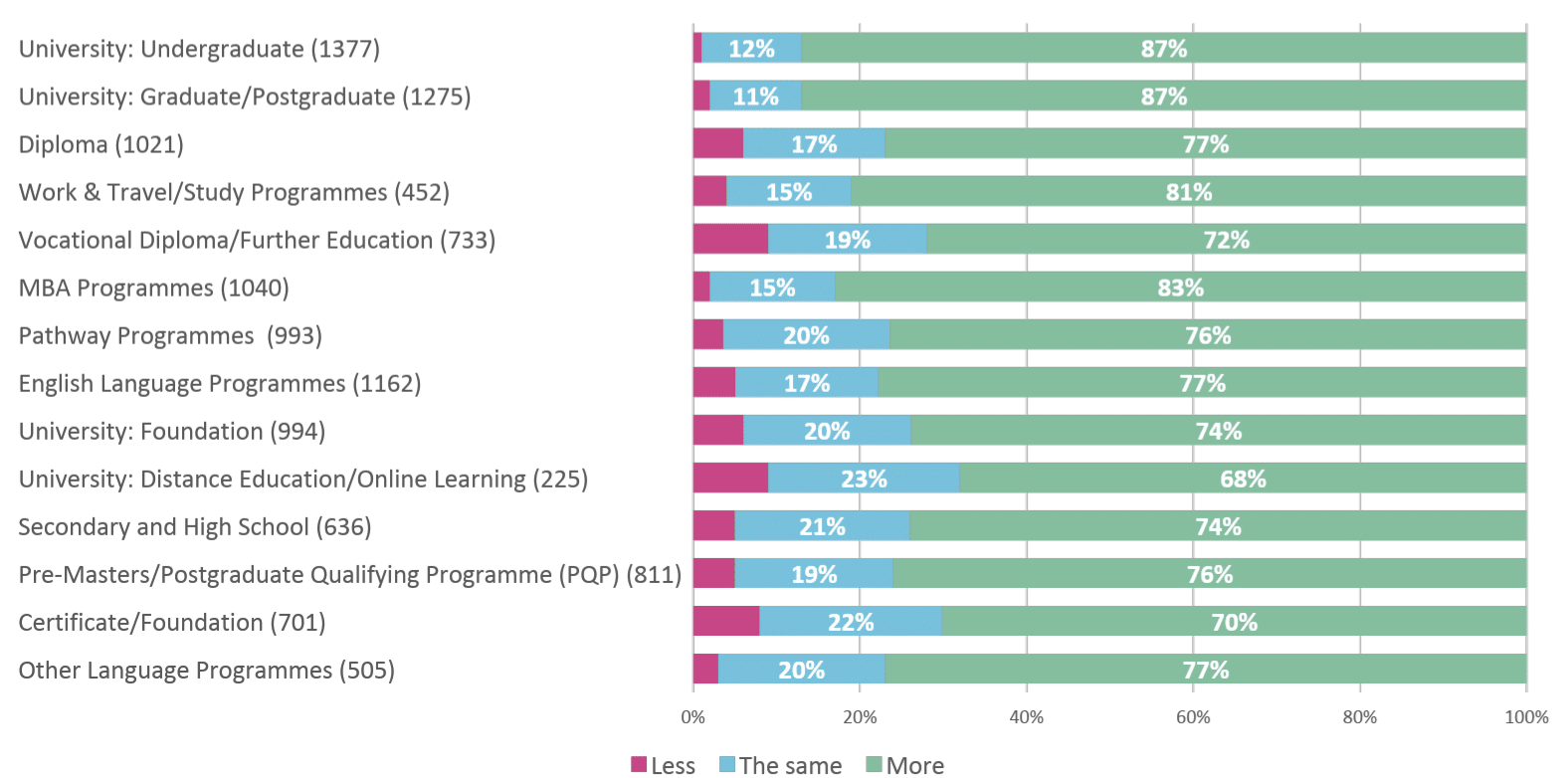

The vast majority of agents said they expect to send more students abroad in the next 12 months. More than 80% felt this way regarding undergraduate, postgraduate, work & travel, and MBA programmes.

Where agents are sending students

In 2019, the 2,065 agents surveyed placed 548,610 students into programmes, compared with 352,975 students placed by 1,025 agents in 2018.

In terms of the countries where agents are sending students, notable trends are that:

- Canada has become much more popular since last year, with 55% of agents sending students there compared with 45% in 2018;

- Australia is stable, with 42% sending students there;

- The US has bounced back from a low of 40% in 2018 to 48% now, and the UK has also seen a boost (from 37% last year to 44% now);

- Ireland has become more popular in 2019 (17% versus 10% in 2018).

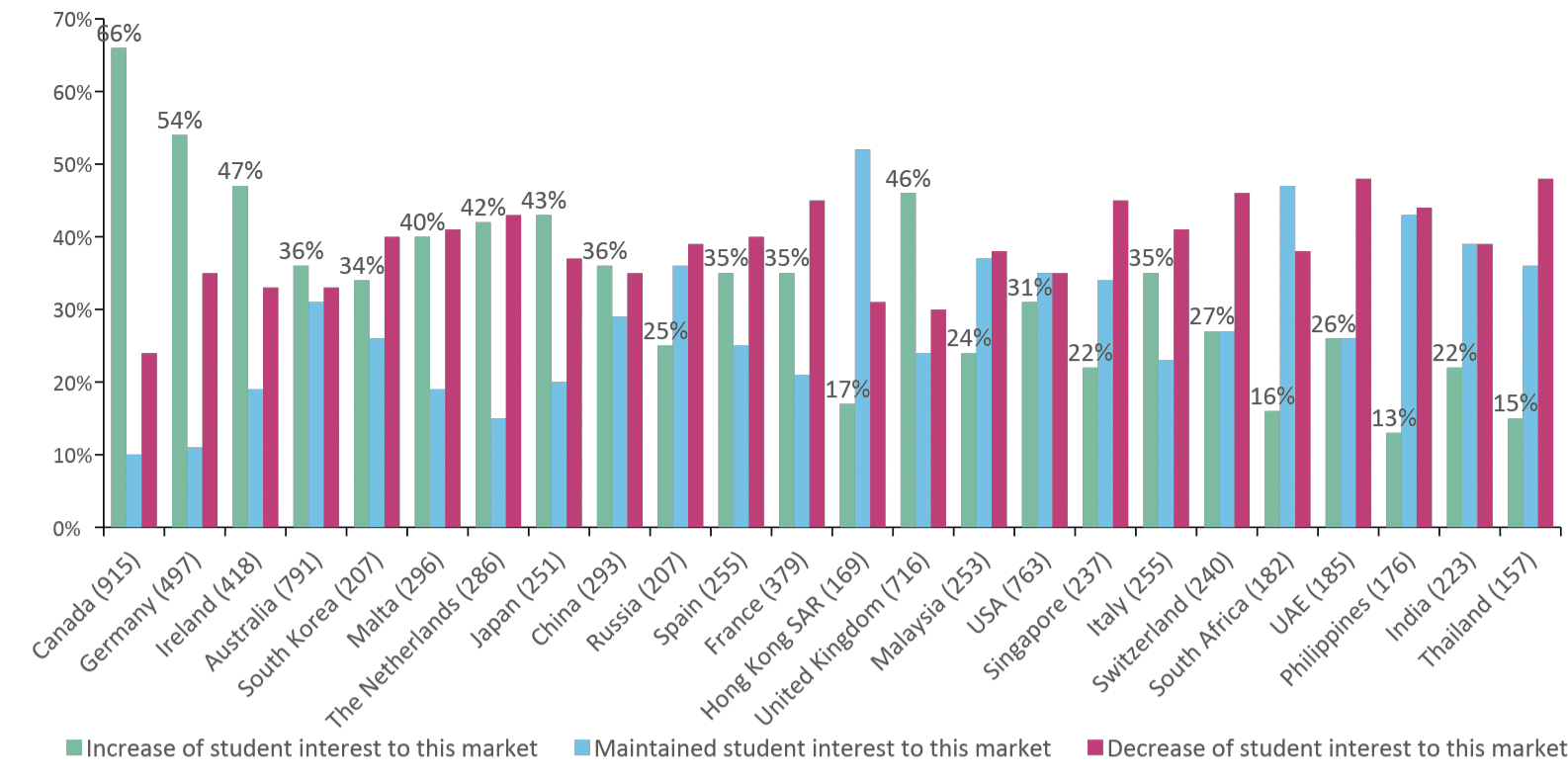

Agents also indicated the markets that are becoming more interesting to their students over the past 12 months. Two-thirds (66%) said Canada has become more interesting, and over half (54%) said the same about Germany. At least four in ten mentioned Ireland, the UK, Malta, the Netherlands, and Japan as becoming more interesting.

Agent-reported shifts in destination popularity are more broadly reflected in the following chart, which maps agent perceptions of increasing or declining popularity for individual destinations over the past year.

Student concerns

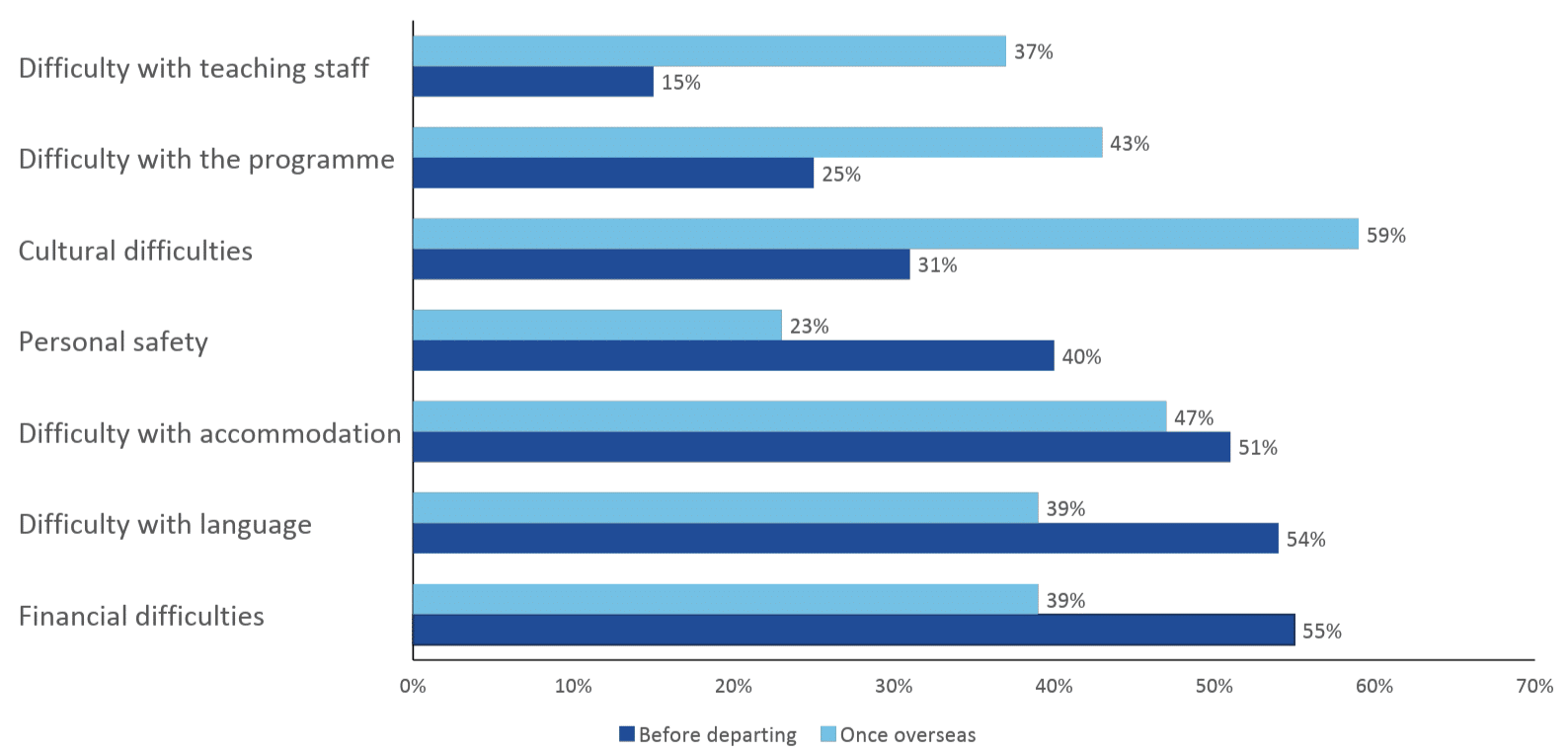

Before departing, agents say that the major concerns for students and parents are financial difficulties and worries about language proficiency, accommodation, and personal safety. After arriving, students become more concerned about adjusting to the new culture and they experience greater problems with programmes and teaching staff. Accommodation is the one area where concerns are similarly high both before and after students arrive. And interestingly, students become much less worried about personal safety after they arrive at their host institution.

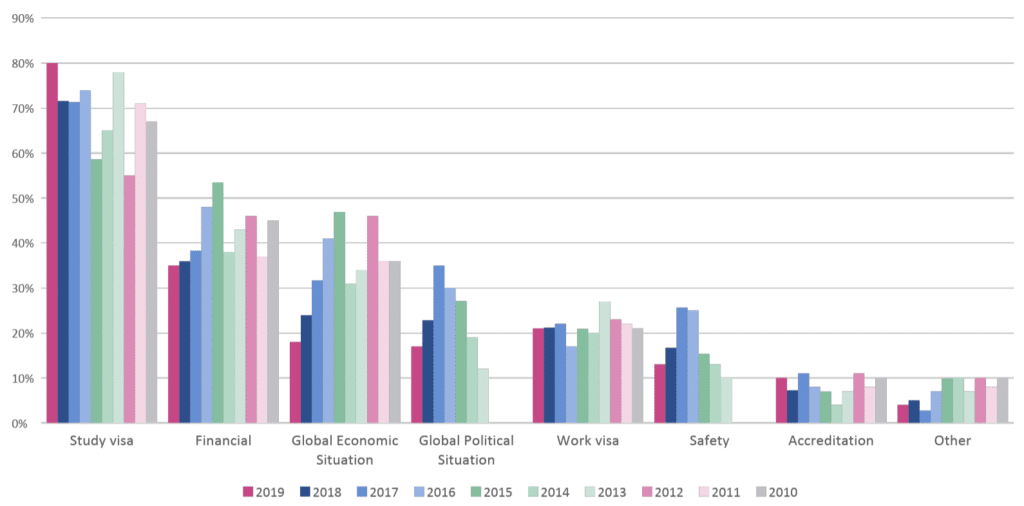

Looking at trend data, barriers around study visas became more pressing in 2019 than in any other year going back to 2010, while financial issues fell in terms of posing a problem to study abroad. Canada emerges as the country where study visa issues are the most problematic, followed by the US; agents perceive Australia, the UK, and New Zealand as relatively less difficult in this regard. The US and Canada are also seen as countries where work visas are considered to be harder to obtain than in the other three major English-speaking destinations.

In 2019, agents are less troubled than at any other point in the past decade by the global economic and political environment in terms of their ability to refer student to foreign institutions.

Most effective marketing strategies

Agents say that the most effective promotional initiatives institutions can take are to go to education exhibitions in source countries, market to and visit local schools and colleges, create brochures in English and local languages, and to have information available for inclusion in agencies’ own brochures. All of these were rated “very important” by at least four in ten agents.

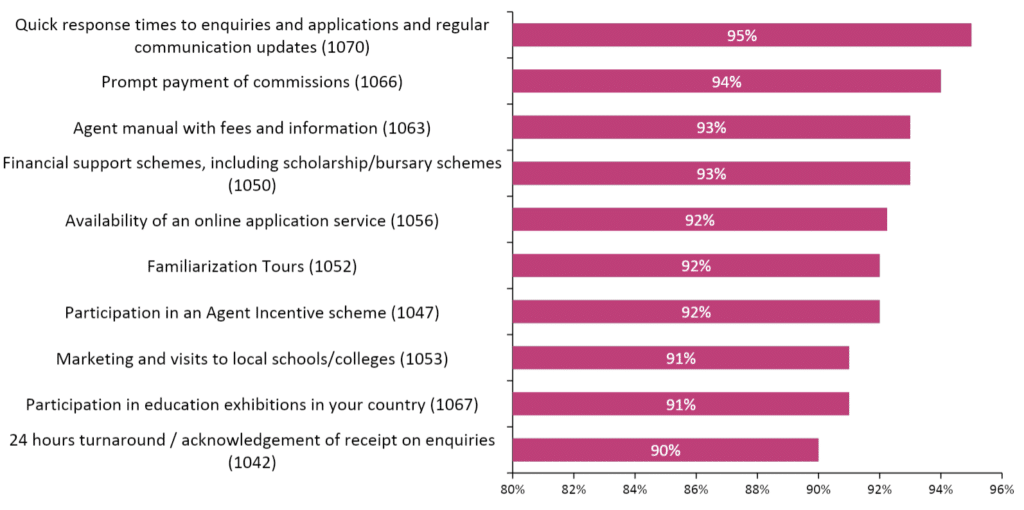

Making financial aid offers as well as responding within 24 hours to enquiries are considered “very important” by more than half of agents, as were familiarisation tours, prompt payment of commissions, providing an agent training manual with fees and information, providing an online application service, and offering an agent incentive scheme.

Agents consider Facebook to be the most important social media platform for reaching out to students and to market programmes in general. Interestingly, 40% said that Twitter is the platform “to not use,” compared to 25% for Linked In, 22% for YouTube, and 4% for Facebook.

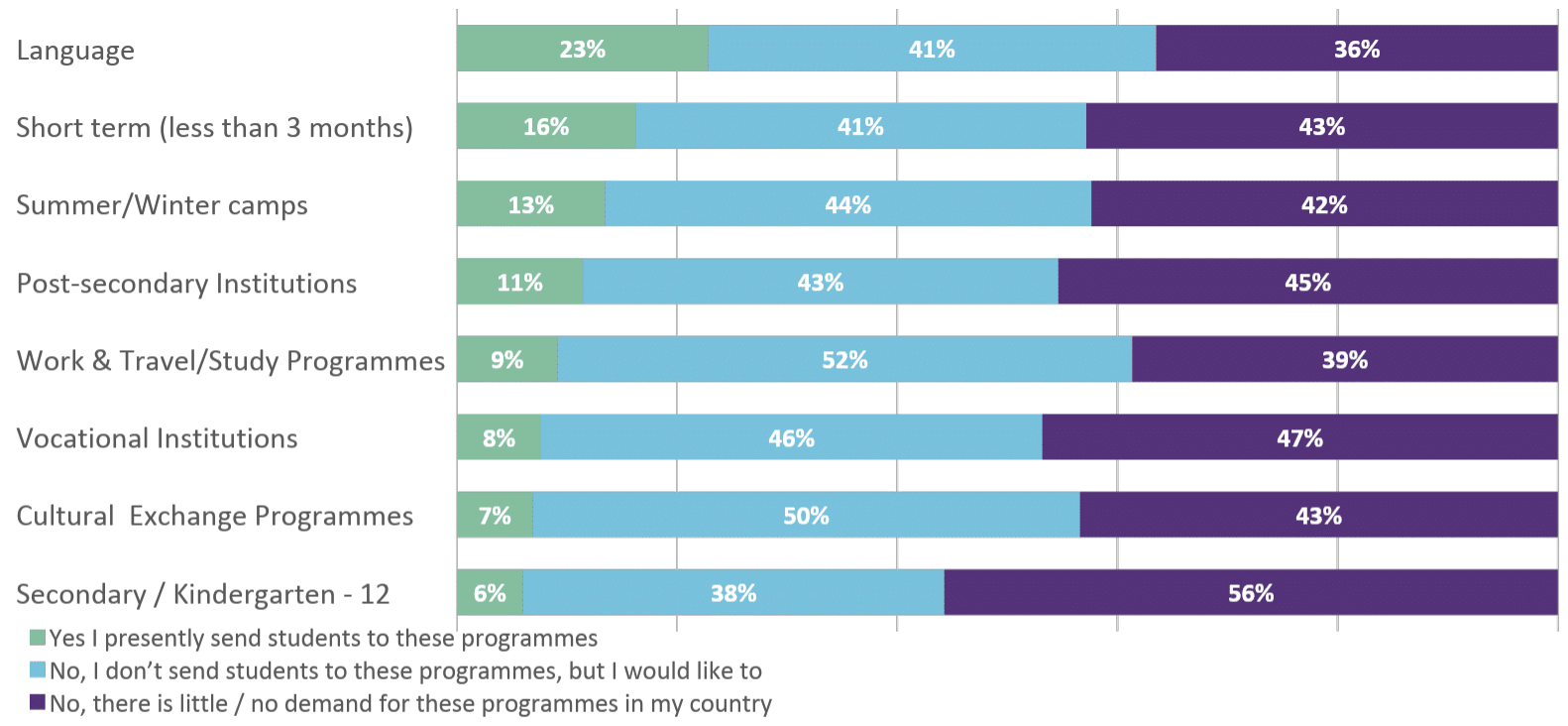

French-language recruitment

New in 2019, Agent Barometer asked agents if they are recruiting from French-speaking countries. There was significant interest among many agents who aren’t yet recruiting for French programmes to begin doing so.

Secondary school recruitment

Agent representation for the secondary school sector is of the fairly niche variety – almost half of agents (48%) said they did not recruit for secondary schools. The next largest proportion (38%) said they represented between 1 and 10 secondary schools. Fewer than 1 in 10 represented more schools than that.

Those that do represent this sector primarily appreciate the benefits of their work in this area diversifying their business portfolio (38%) and raising awareness and prestige of their agency (32%).

The main areas of demand in this sector are International Baccalaureate (IB) programmes, public schools with homestay/guardianship, and private schools with boarding accommodations.

For additional background, please see:

- “2018 Agent Barometer survey tracks agent perspectives on destinations, online learning, alumni, and student experience”

- “New surveys highlight key elements of agent-educator relationships”

- “Survey finds high degree of student satisfaction with education agents”

- “Education agents refer 75% of Australia’s international students”