Australia: Higher education showing strong growth through early 2018; ELICOS flat

The latest data from Australia shows strong growth through the first quarter of 2018 with overall enrolment growth of 12.6% for year-to-date February 2018, and nearly 9% growth in commencements for the same period. A closer look at the numbers reveals that much of this increase is being driven by the higher education sector, which is up just over 14% year-over-year. The vocational education and training (VET) and school sectors are also tracking ahead of 2017, with growth of 7.8% and 5.8% respectively through February of this year. In contrast, total ELICOS enrolments (English Language Intensive Courses for Overseas Students) are up only marginally over the same period (1.4% year-over-year) while commencements through February 2018 declined by just over 1%. An accompanying statement from English Australia cites this as a worrying trend where overall enrolment growth is expected to remain soft this year based on the decline in commencements between July 2017 and February 2018. Indeed, the broader trend reaching back to February 2016 is that overall ELICOS enrolments in Australia have been essentially flat over the last two years. An important caveat here is that while total ELICOS head counts have shown little growth over this period, we have seen greater increases in overall student weeks booked in the recent past due in part to some notable shifts in sending markets for Australian providers.

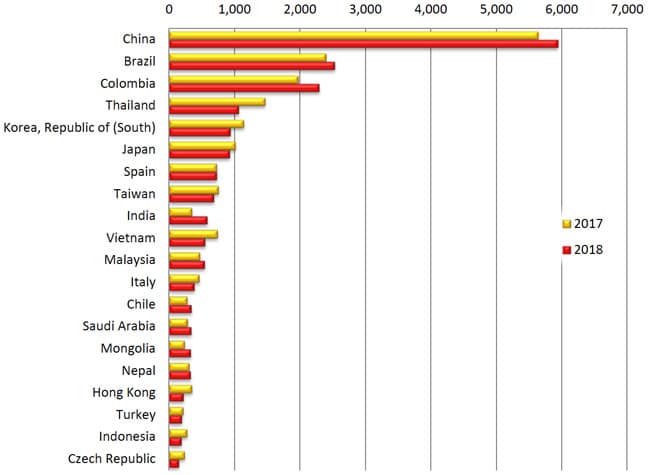

Sending markets for ELICOS

As the following chart reflects, China is far and away the largest sending market for ELICOS providers and it continues to demonstrate relatively strong commencement growth through February 2018. The same can be said of the increasingly important Brazilian and Colombian markets, which are also up through the early months of this year.

However, most of the remaining top 20 source markets are showing a decline in commencements this year, notably Thailand (-27.4%), Vietnam (-25.6%), Japan (-8.4%), South Korea (-17.8%), and Taiwan (-9.5%).

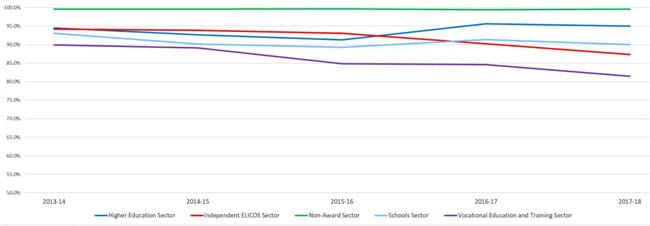

Falling visa grant rates

A corresponding data release from the Australian Department of Home Affairs (DHA) suggests that visa processing for prospective ELICOS students could be playing a part in these overall enrolment trends. The data shows that rejection rates are rising over the last two years for “ELICOS only” applicants (that is, those intending – at least at point of application – to study only in ELICOS courses).

As the following chart illustrates, the ELICOS and VET sectors have both seen declining visa grant rates over the past five years, and from 2015/16 in particular.