Global survey highlights new phase of internationalisation: From a “market era” to a “managed era”

- Findings from a survey of university leaders in major Western destinations reflect the strain of the current international student recruiting environment

- From macroeconomic pressures to geo-political tensions and anti-immigrant sentiment, universities face a complex set of factors influencing their internationalisation efforts

Amidst more restrictive immigration policies, declining student visa approval rates, wars (e.g., Gaza, Ukraine), the “America First” orientation in the US under Trump, affordability crises, and underfunded higher education sectors, universities in the West are facing unprecedented challenges to their ability to recruit overseas.

The last time Western institutions faced such severe pressures was during the COVID-19 pandemic. Then, closed borders and quarantine requirements drastically reduced international student mobility. Now, shifting public opinion in the West concerning immigration levels is at the root of governmental efforts to curb foreign enrolments.

The dynamics of international education have once again become complicated. Both institutions and prospective students are thinking very carefully about which courses of action are prudent in the new context in 2025.

Findings from a September/October 2024 survey conducted by the Nous Group and Navitas among 200 senior operational and strategic leaders primarily employed by universities in Australia, the United Kingdom, and Canada illustrate the strain of the current policy and economic environment. For example, over 8 in 10 respondents (82%) said that their internationalisation goals are being increasingly affected by government policy decisions.

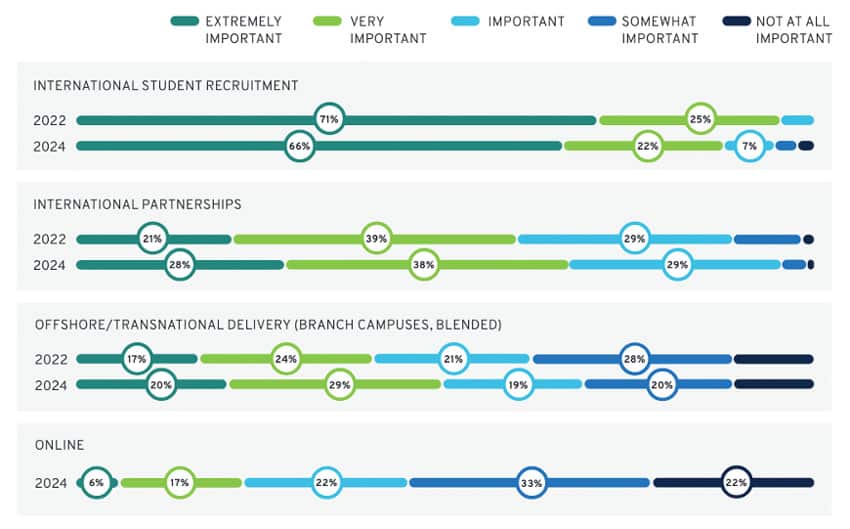

At the same time, respondents indicated a continued commitment to international student recruitment: almost 9 in 10 (88%) said that foreign student recruitment is very important (22%) or extremely important (66%) to their overall internationalisation strategy. This is down somewhat from 2022, the first iteration of the Nous/Navitas survey, but still much ahead of international partnerships, transnational education (TNE), and online education, as shown in the following screenshot from the survey report

Summing up the current recruitment context, the Nous/Navitas report calls the operating environment today a “managed era” – in contrast to the “market era” before and directly after the COVID-19 pandemic.

Intense competition expected due to interconnected factors

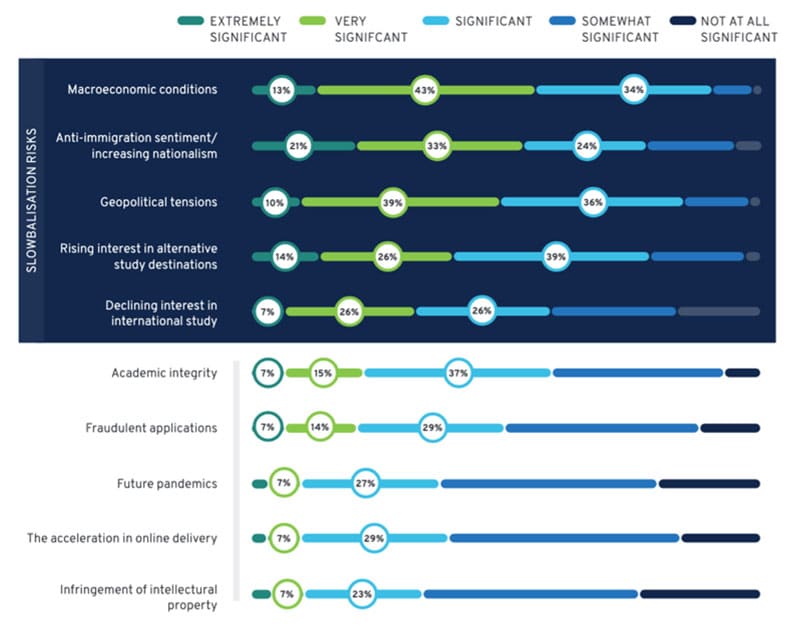

As shown in the following screenshot, surveyed respondents pointed to a range of challenges they are facing in 2025, including macroeconomic conditions, anti-immigrant sentiment, and geo-political tensions.

Nine in ten (89%) respondents to the survey said it will be “very” or “extremely” competitive in the next couple of years to recruit students to programmes because of these pressures. Expectations of heightened competition are especially high in Canada and the UK, as shown in the following screenshot.

Nous Principal Matt Durnin said:

“Pressure to compete while reducing costs will lead to new approaches to internationalisation going forward. There will be a portion of the sector that reduces its dependence on international, while others will find opportunities within the constraints of this managed era.”

Interest in TNE rises, but barriers are high

Amidst greater barriers to recruiting students to foreign campuses, survey participants indicated increasing interest in transnational education (TNE) including bilateral exchange and academic partnerships, joint degrees, and branch campuses. At the same time, this interest exceeded university executives’ faith that they could currently execute TNE as well as they might like to. Mr Durnin said:

“There is a lot of focus on transnational education; however, the findings show that leaders are uncertain about their ability to execute successfully. It won’t be a quick fix for revenue.”

Transnational education arrangements often take months – or years – to solidify and are subject to a host of regulatory issues. They entail a substantial investment, and they take a long time to generate ROI. Writing in the Koala News in June 2024, veteran international education consultant Tracy Harris made these points about TNE:

“From my experience, untapped potential [in TNE markets] simply doesn’t exist in any kind of volume, and even fewer opportunities can provide the return on investment that make the effort involved in establishing and delivering TNE worthwhile.

Therefore, if the intention of the government is for education and training providers to replace lost revenue from onshore international students, then TNE is not the solution. However, it does provide an opportunity for Australian education and training providers to enhance their brand reputation and recognition internationally.”

Long-term thinking is great, but short-term needs are acute

Given the long timeframe needed for successful TNE partnerships – and the acute revenue challenges many universities have right now – universities are looking for ways to survive the current climate and constraints. Many are facing both increased regulatory pressures/visa processing issues as well as low levels of state funding.

Not surprisingly, the survey findings show a natural focus on revenue generation and cost-cutting where possible. Increasing international student revenue rose as a “very important” priority from 50% in 2022 to 66% in 2024. In contrast, increasing international student volumes moved from 29% “very important” in 2022 to 17% in 2024.

Increased fees, reduced scholarships are common predictions

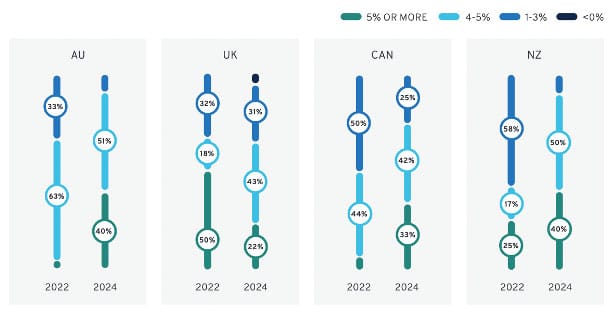

More than half of those surveyed expect their universities to increase international student tuition fees over the next 12 to 24 months by 4–5%. An expectation of significant fee increases was clearly evident in Canada and Australia. The reverse was true in the UK, as shown in the screenshot below.

Many universities will also be reducing their scholarship offerings. This trend intensifies among the top 100 universities, where 40% of respondents anticipated reducing their scholarship programmes for international students. Only 20% expected to be more generous.

Looking ahead

The current international education landscape is difficult, but as some respondents noted, opportunities remain. “Despite the recent negative policy changes, there is an immense amount of opportunity in our international portfolio.” Another noted: “[Higher] education is a stalwart endeavour, and there will always be a need to offer courses and degree programs to a global audience.”

That said, the shift from the “market era” to the “managed era” may not be short-lived. Navitas Chief Insights Officer, Jon Chew, said:

“Beyond the financial pressures in the immediate term, university leaders must contend with the possibility that the shift from the market era to the managed era will continue to deliver greater levels of government intervention and control, which will in turn have important implications for strategic planning.”