Three international education trends for 2025: Revenue optimisation, marketing personalisation, and on-the-ground local intelligence

- It has been a challenging year for many in our industry, but the new context offers the chance for much-needed innovation

- Data-informed, precision-targeted strategies can help to ensure that budgets are used well and for maximum results

- Superior service for prospective and current students is a must, as is local representation in key target markets

TREND #1

DEMAND AND REVENUE OPTIMISATION

“Half the money I spend on advertising is wasted; the trouble is I don’t know which half,” observed businessman and political figure John Wanamaker (1838–1922). This famous truism is relevant to the international education sector, where many institutions still do a lot of guessing about what is going right or wrong with regards to recruitment, marketing, on-campus student services, and admissions management.

The time for guessing is over. Demand for study abroad is volatile and fast-changing; students are considering an ever-wider range of destinations and institutions. Committing to data-backed strategies is the only way to remain competitive and to maximise return-on-investment (ROI).

It’s tempting to believe that intuition – perhaps based on years of experience and success – is enough, especially when margins are tight and data collection and analysis seems like a big investment. But consider this scenario:

Your institution ran a campaign or scholarship initiative that yielded some good results in a key market. But, could those initiatives have performed even better? Did the scholarship need to be that large or would demand have remained strong if it had been smaller or more targeted? Or vice versa: would a bigger scholarship have filled the seats you couldn’t fill in an undersold programme?

There is no way of knowing without data, because there are no comparison points or analytics. And so, the answers to whether your ROI was as strong as it could have been will always be at least slightly vague.

For many institutions faced with a less certain marketplace, answers to questions like these would be extremely important to know:

- How do we increase demand/revenue for certain programmes? For example, in Canada, business courses are no longer linked to the Post-Graduation Work Program (PGWP). Study fields that are linked are agriculture and agri-food, healthcare, STEM, skilled trades, and transportation. Educators are trying to find out how to price programmes in those fields given that they are now the only ones tied to the PGWP. Would demand fall if the price went up? Which programme features could be emphasised to keep demand high (e.g., internships, on-campus housing, the ability to study at home for the first two years, etc.)?

- If demand appears to be low, could it increase if we decreased tuition fees? How much of a price cut would make a difference?

- Which programme/campus features are game-changers for prospective students? The answer would help inform marketing messaging and future investments in different services.

- And for all these questions: how do the answers differ by international student market and segment?

At the 2024 CBIE conference in Ottawa earlier in November, attendees learned more about the benefits of optimising price, features, demand, and revenue in target markets.

Oliver Fortescue, a partner in the education consultancy firm Edified, presented about the firm’s capability to determine the relationship between demand and pricing, and between demand and programme features, in key overseas markets. The model allows institutions to see how students’ “willingness to pay” changes according to different scenarios.

Mr Fortescue used a travel industry example to illustrate that most people will trade off certain features of a journey to arrive at a fare they are comfortable with – e.g., departure and arrival times, number of connections, allowed baggage, or carrier. If a traveller must arrive at their destination as quickly as possible, they might be willing to pay more. If they have more flexibility, they might be more likely to choose a less optimal departure time for a lower fare.

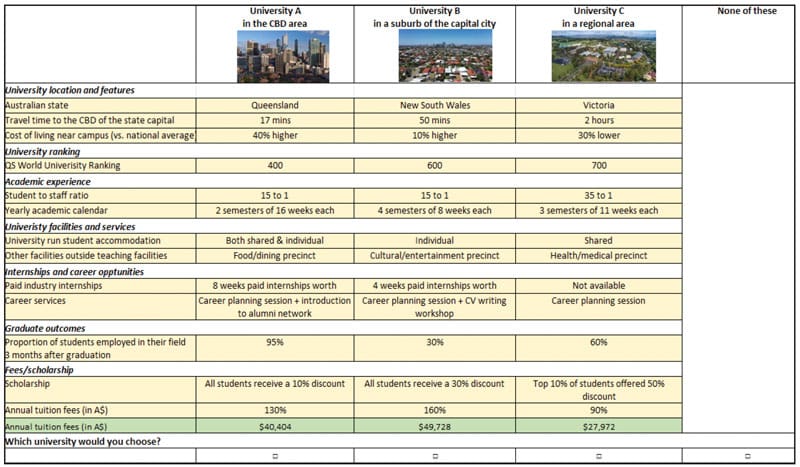

Prospective international students also make trade-offs when deciding where to study. They consider such variables as campus location, cost of living, ease of transportation, length of course, graduate outcomes, rankings, and scholarships.

The Edified team works with institutions to determine their top goals (usually regarding revenue, demand, yield, or all three) and then designs a project accordingly. A partner company secures a custom survey sample of ideal students/parents in key markets (at least 1,000 per market, often more). A choice modelling framework determines how students would respond to different scenarios (e.g., this tuition fee with this course length, this tuition fee with this course length plus a scholarship, this tuition fee/course length/scholarship plus on-campus housing).

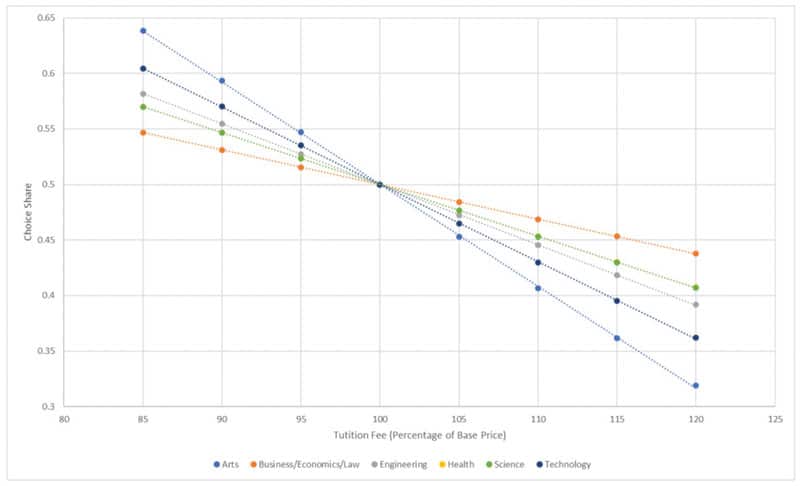

Among other results, the model can show the exact points at which demand begins to increase or decrease depending on the scenario. The following slide shows that demand for arts programmes is the most sensitive to a tuition fee increase or decrease of all the programmes in this illustrative choice set.

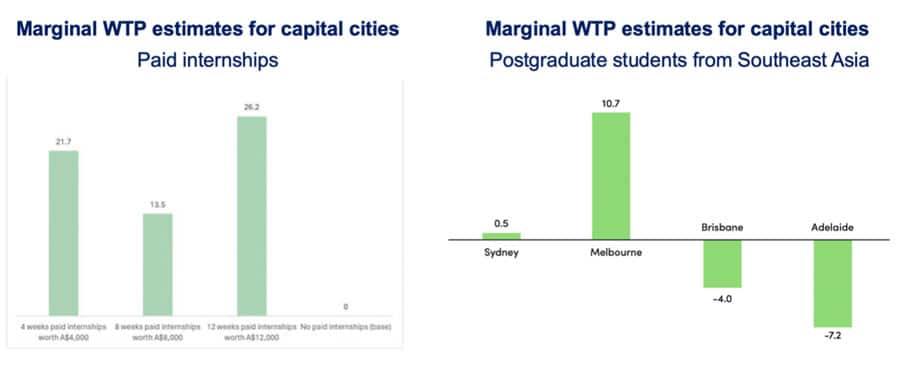

Institutions can also discover how willing students would be to pay for different features. For example, in the slide below, you can see that a 12-week internship is the most valuable of the possible durations, and that Southeast Asian postgraduate students would be willing to pay significantly more if they were able to study in Melbourne.

This kind of research is not inexpensive, but it adds much greater certainty to recruitment decisions, eliminating the likelihood of costly mistakes such as offering:

- A large scholarship where a smaller, more targeted one would have been just as effective;

- A campaign aimed at a city where there is no intrinsic demand;

- A programme priced so high that it is impossible to sell;

- Additional campus services or a facility expansion that students don’t care about.

Mark Pettitt, founder and CEO of Edified, observes that a more challenging recruiting context can also be viewed as an opportunity:

“I've been in this industry for a long time, and the policy environment we are seeing now in some destinations is just another example of a crisis–recovery pattern that has played out for years and that will continue to play out. There will always be changes in government policies, global viruses, geo-political tensions, currencies bottoming out, etc. – followed by a new normal once the crisis has passed. A devotion to students’ well-being and career outcomes; personalised, timely communications with prospective students; strong leadership with a long-term perspective; and an investment in data-informed decision-making will allow some institutions to survive – and even thrive – where others cannot.”

Mr Pettitt adds that data can help to maintain a diversification effort even when visa refusal rates are going up:

“An example of short-term thinking is, ‘I need to cut back in the risky markets because there’s less chance of students being approved … and everyone else is doing that as well.’ What a shame if you have been developing those markets for years – and what a shame for the bright students in those countries who would be perfect for your institution.

What you could do instead is use targeted scholarships to top students from highly reputable schools in the markets everyone else seems to be leaving. Over time, your mix of students can shift dramatically — to high-quality, low-risk students from a range of target countries. Well-considered scholarship programmes can align with diversity goals and boost your competitive position in some of the most promising markets for years to come. Especially during periods when competitors are dropping out of these markets.”

TREND #2

PERSONALISING COMMUNICATIONS

As with understanding demand, precision is key when it comes to communicating with prospective international students. Generic emails are just not going to cut it anymore – students are used to personalisation in their shopping, and they expect it from the schools and universities they are checking out.

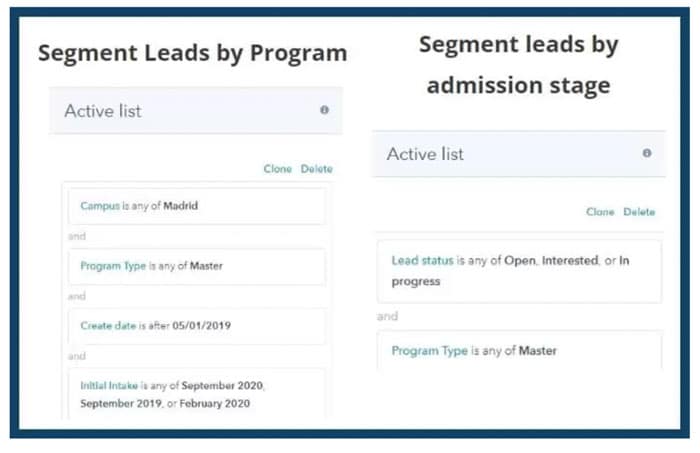

A well-configured customer relationship management system (CRM) offers a foundation for the ability to personalise. On the CRM, you can enter information on leads, segment them, and track every contact and result. The information in your CRM enables the creation of custom emails based on individual students’ programme preferences and that skip past general content.

Website data analytics allow you to personalise further. As per HEM:

“Create landing pages tailored to different segments of your audience. These pages should highlight the most relevant information to the visitor, increasing the likelihood of engagement and conversion. For instance, a landing page for international students could feature visa information, housing options, and success stories from other international students.

Implement dynamic content on your website that changes based on the visitor’s profile. A prospective student from a particular region might see testimonials from alumni in their area, while another visitor might see information on scholarships they’re eligible for.”

The Amazon.com main storefront offers a masterclass in personalising content. For example, data-informed recommendations such as “Based on your browsing history,” “Other items you might like,” “Inspired by your shopping trends …”. Amazon is explicit in personalising content – but effective personalisation can simply consist of creating and sending custom content to each of your leads

TREND #3

ON-THE-GROUND REPRESENTATION

Data can show you that in a certain week (or even day), students in target markets:

- Lost interest in one destination and began to consider another;

- Warmed up to a programme they hadn’t considered before;

- Finally accepted an offer of admission because a scholarship was offered;

- Spent a great deal of time on the accommodation section of your website;

- And all sort of other essential insights.

However, data insights do not replace human insights. A student’s ultimate decision about where to study may be decided by such things as:

- An agent who sits down face-to-face with parents and dispels the myth that no one is being approved for visas;

- A returning student who sets up a successful start-up company, signalling to the local market that their study at a particular institution paid off;

- An alumnus who speaks with local school leaders about pathway programme options that will guarantee admission to an institution with high admission standards;

- An in-country representative who sets up a fancy event with great food and successful alumni speakers, and shares video testimonials of happy current students.

Partnering with trusted agents and in-country reps is even more essential when travel budgets are tight and when an institution is trying to keep diversifying despite cost-cutting measures.

Prediction: More sophisticated recruitment strategies in 2025

In times like these, institutions will either lean into or back away from investments in international student recruiting. If the former, the obvious approach is to become more surgical in recruiting, in order to zone in on ideal students who have a good chance of being approved for a visa. Enrolling best-fit students begins a chain reaction of greater student satisfaction, better graduate outcomes, and positive word-of-mouth about your institution.

For additional background, please see: