The other side of a “V-shaped” recovery: 2024 and the transition to steadier growth in international enrolment

- A new analysis frames 2024 as a transitional period between the post-pandemic surge in international student mobility and a return to more stable, sustainable growth rates for the sector

- A number of major study destinations, including Canada, Australia, and the UK, are expected to see declining student numbers this year before returning to longer-term growth patterns

- The report anticipates as well a shift in recruiting perspective, away from focus on student numbers and more toward qualitative factors of student fit and the student experience

"The year ahead will likely be a transitional one, marking both the end of the post-COVID era and the beginning of what is to come afterwards. Expect turbulence ahead."

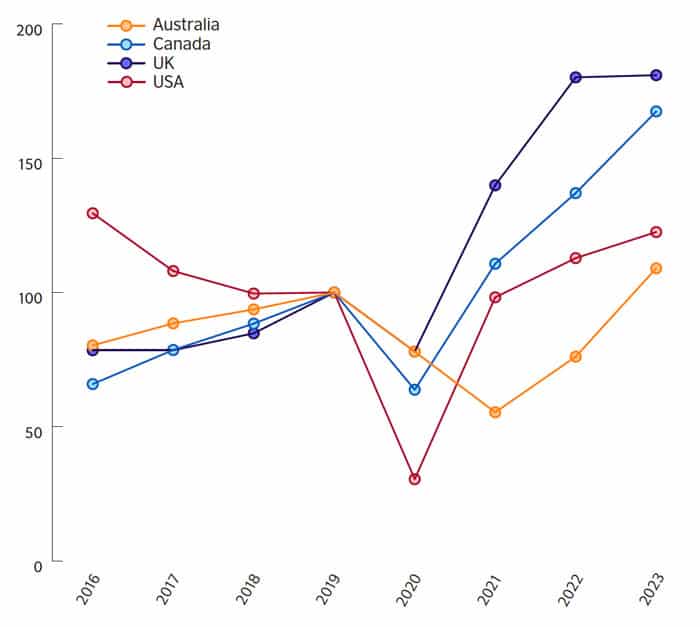

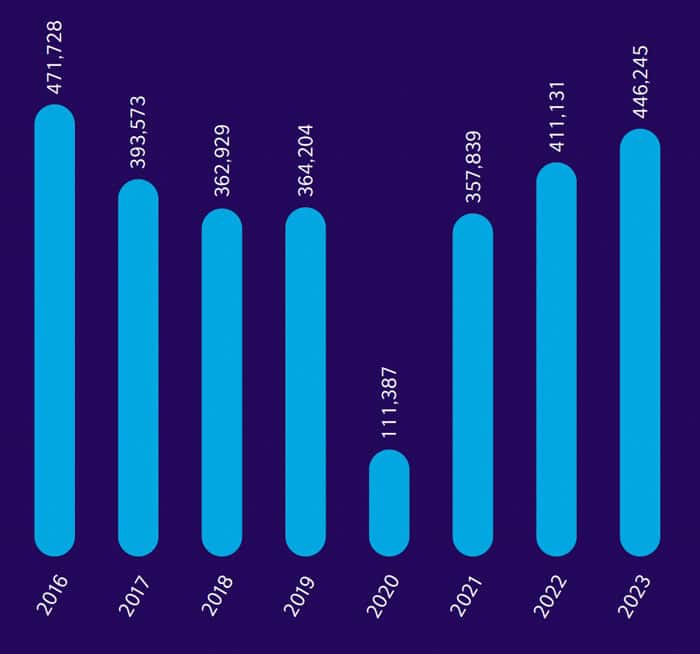

That cautionary note opens an interesting new analysis from British Council. It describes an end to the post-pandemic surge in international mobility and projects a slowing of growth in 2024, adding that, "Growth in new enrolments of international students will slow across major host destination markets in 2024, as the effects of the V-shaped recovery from the pandemic fade. In all four major host markets – Australia, Canada, the UK and US – the number of international student enrolments has already surpassed pre-pandemic levels. This means new enrolments will likely increase more slowly in 2024 (and beyond) as these markets revert to the steady…long-term growth rates that preceded the pandemic."

The paper, "5 Trends to Watch in 2024", relies in part on recent data on visa issuances for some of the world's leading study destinations. It notes that, "Growth in issuance of UK study visas essentially ground to a halt by the third quarter of 2023 and will likely go into reverse in 2024 given rising domestic pressures to restrict migration."

This contrasts with the situation in the United States, where visa issuances reached a new high point last year for the period 2016–2023. The authors expect that the US will gain a greater share of the international student market this year, in part because, "The US will present a more welcoming face to international students than the UK, Australia or Canada, where student migration flows will come under greater scrutiny from policymakers in 2024."

In general, the report projects a renewed area of increased recruitment activity and competitiveness for US educators, dampened only by the looming US presidential election in November 2024.

Overall, the "turbulence" noted above is expected to result in a decline in international student numbers this year for the first time since the start of the pandemic, and particularly so for destinations such as Australia, Canada, and the UK where more restrictive migration policies are now taking hold. The British Council analysis, however, frames this as a "natural correction" that will effectively put destinations on a more sustainable, long-term growth trajectory.

"Fewer inbound international students means [higher education institutions] can invest more time and energy in ensuring that they recruit the best international students possible," concludes the paper. "HEIs will also need to focus less on the number of students and more on ensuring that they provide students with the most attractive post-graduate employment opportunities possible."

The longer-term outlook offered is of a shift in focus from quantitative metrics for student recruitment to "quality-based" indicators. The complete insights report is available for download from the British Council.

For additional background, please see: