UK: Post-study work rights worth billions but current policies leading to weaker enrolments this year

- Post-study work policies enacted in 2021 helped to add more than 600,000 additional international enrolments and over €60 billion to the UK economy between 2019/20 and 2023/24

- But new policies introduced this year are seriously dampening international student demand for study in the UK

- Institutions, peak bodies, and other stakeholders are now sounding the alarm

- Among other indicators, a recent survey of 70 UK institutions finds that international post-graduate enrolment was down 40% at the January 2024 intake

A new analysis released by Universities UK indicates that the UK’s 2019 announcement of extended post-study work rights for non-EU students – and subsequent launch of those rights in July 2021 – created the conditions for a massive injection of additional revenue into the UK economy.

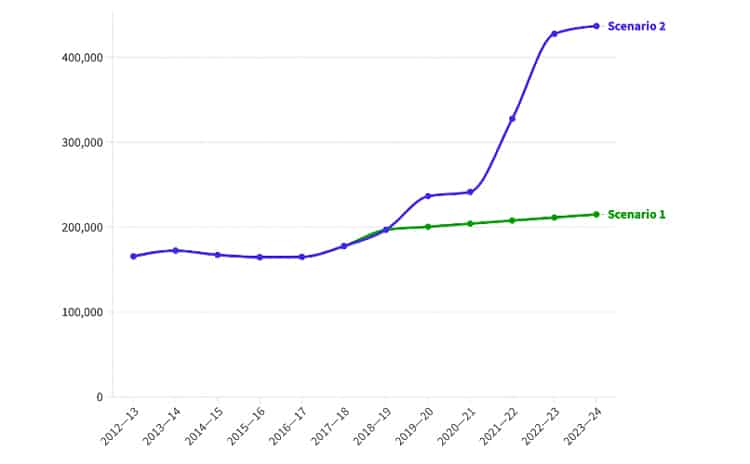

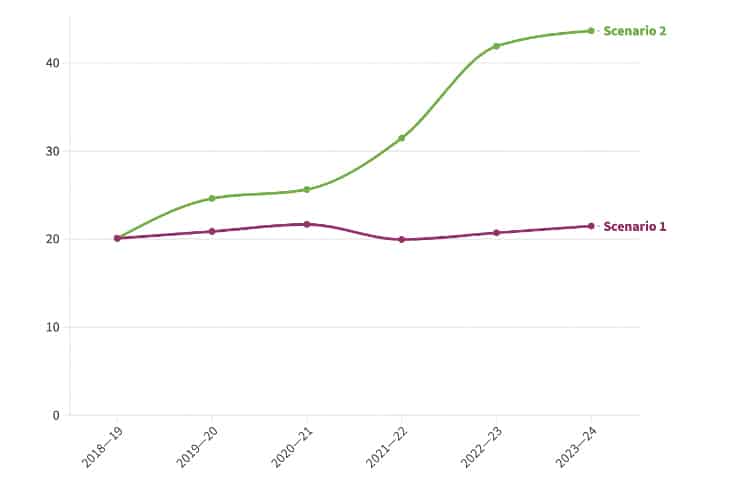

From 2019/20 to 2023/24, the Graduate Route programme (which provides international students with 2–3 years of work rights after the completion of their studies) along with the support of the UK’s International Education Strategy (IES):

- directly contributed to 632,000 additional international first-year enrolments;

- provided a net economic contribution of £62.6 billion to the UK economy over the duration of students’ programmes.

The analysis was based on “the most recently available HESA data for the academic year 2021-22, the London Economics analysis of the benefits and costs of international students, and Home Office visa data for the year ending September 2023.”

An injection of over £60 billion to the country’s economy should be front-page news, yet Universities UK notes that a new survey from Censuswide found that only 3% of 2,000 British adults surveyed “realise[d] the scale of the economic contribution made by international students, or the size of the contribution to the NHS via the Immigration Health Surcharge.”

The following two charts illustrate the difference between a baseline scenario stripped of the effects of the Graduate Route and IES (Scenario 1) and what actually happened in terms of enrolments and revenue thanks to those policy instruments (Scenario 2).

New policies are affecting demand – and quickly

The impact of government policy is made crystal-clear by the London Economics analysis linking the Graduate Route to the huge injection of revenue to the UK economy. The influence of policy is being underlined again – this time unfortunately – by the removal of most international students’ right to bring dependants with them to the UK. That policy took effect in January 2024.

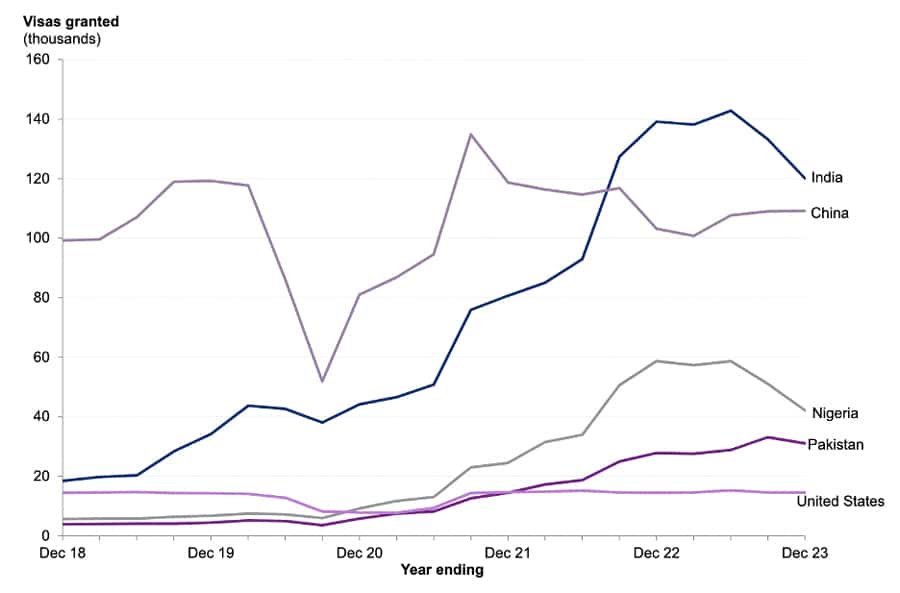

Enroly – an application platform used by about 60 UK universities – has since recorded significant drops in demand for study in the UK, especially from two of the largest non-EU source markets, India and Nigeria. UK government data confirms the trend reflected in the Enroly data, as shown in the following chart:

Further concerning news comes in the form of a survey of more than 70 universities reporting on postgraduate taught enrolments: those enrolments fell by more than 40% in January 2024, a drop coinciding with the dependants ban. Only international students in research-oriented (as opposed to taught) postgraduate programmes are exempted from the ban.

The Guardian notes:

“More than 320,000 international students account for nearly half of enrolments on taught courses at UK universities, paying tuition fees averaging about £17,000 a year. A sudden fall in enrolments would make a wide range of courses uneconomic and cause severe financial dislocation at many institutions.”

Separate data from 60 universities show that study visa grants were down 33% this year compared with the same time last year.

Review of Graduate Route adds more uncertainty

The government has also announced that its Migration Observatory Committee is reviewing the Graduate Route this year. An IDP survey conducted in January 2024 found that more than a third of surveyed students (37%) – out of a total sample of 2,500 – said this review has prompted them to either rethink their study abroad plans or to choose another country to study in.

The chief executive of Universities UK (UUK), Vivienne Stern, commented:

“The UK is extremely fortunate to be a popular destination for international students. The whole country benefits from their decision to spend a few formative years with us. I regret the fact the government appears to want to diminish our success in this area. Our new data shows that if they wanted to see a reduction in numbers, they have already achieved that through policy changes introduced earlier this year. If they go further, they will damage the economies of towns and cities throughout the UK, as well as many universities. Given we should be doing everything we can to promote economic growth, this seems to be getting the priorities wrong.

The number of international students coming to the UK is already falling, but there is now a real danger of an over-correction.

We call on all political parties in the run up to a general election to reassure prospective international students that the UK remains open, and the Graduate visa here to stay. Any further knee-jerk reforms could have serious consequences for jobs across the country, economic growth, and UK higher education institutions.”

John Foster, chief policy and campaigns officer for the Confederation of Business Industry (CBI), the UK’s premier business organisation, pointed out that even the prospect of more restricted work rights is already having an impact on demand: “Uncertainty surrounding whether the Government will change or withdraw the graduate visa [is] already damaging UK universities' competitiveness.”

For additional background, please see:

- “Demand for study abroad already affected by new international education policies”

- “Notable government policy shifts affecting international students going into 2024”

- “New analysis highlights UK universities reliance on international enrolments”

- "UK to block dependants from accompanying international students as of January 2024"